ECB less willing than Fed to send policy easing signals

EUR: Sharp jump but is the ECB being credible?

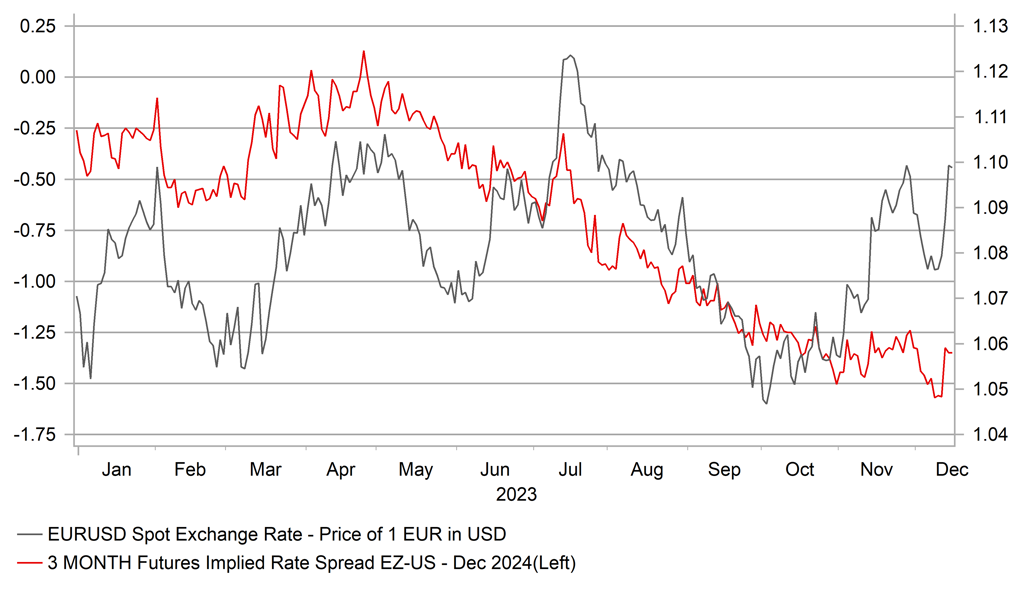

The sharp further gain for EUR/USD yesterday is on shaky ground in our view and there is limited logic in the ECB maintaining a more hawkish stance than the Federal Reserve – in essence the conclusion of market participants of the last two days that has resulted in such a big FX move. The detailed information from the ECB points to a central bank not yet convinced with the evidence before them – that inflation is falling sharply. Please see our FX Focus publications from yesterday on the ECB and the BoE decisions here and here. While it was inevitable to see the ECB’s 2024 inflation projection cut sharply (2.7% from 3.2%) the core forecast was cut by just 0.2ppt to 2.7% while the 2025 core CPI projection was actually raised 0.1ppt to 2.3%. This makes little sense to us and is a pretty incredible forecast when you consider how wrong the ECB has been over just the last three months. In essence these forecasts provided the justification for Lagarde to communicate a much more cautious message over the outlook for monetary policy. Unlike Fed Chair Powell, who on Wednesday admitted the timing of rate cuts next year was discussed at the FOMC meeting, President Lagarde confirmed there was no discussions at all about rate cuts. The justification it appears was that there was no evidence of a “sustainable slowdown” in inflation. That suggests to us the scope for a shift in the new year if there was further evidence by then of a continued slowdown in inflation.

The ECB did also announce the tiering of PEPP reinvestments in H2 2024 which may have added to the market’s interpretation of this being much less dovish than expected. Still, that plan being six months away is one that could of course change depending on circumstances. It does though potentially pave the way for earlier rate cuts in 2024 and that is an outcome of this meeting that could get greater focus over the coming weeks, especially if the inflation data continues to show an easing.

But for now the move in relative yields has been pronounced. The 10-year US-EZ spread has dropped nearly 20bps in two trading days while the 2-year swap spread has move by 20bps as well. We think this move will be hard to sustain and suspect that year-end position adjustment could be reinforcing this move. The ECB Governing Council is made up of 26 individuals and hence pivots like what we saw from the FOMC on Wednesday is less likely from the ECB. So while we believe the inflation data in the euro-zone justified a greater pivot than what we got the FOMC, time over the coming months will see a clearer shift take place.

The euro-zone backdrop and indeed the global backdrop does not seem to us conducive to a further sustained rally in EUR/USD. Fundamentals as a driver over the next few weeks through the Christmas and New Year period is never reliable but if this rally is sustained over that period, we’d expect a reversal as we advance through Q1 next year – which from a seasonal perspective covers a six-week period that is the worst of the year for EUR/USD.

SHARP EUR/USD REBOUND AS 2024 RATE EXPECTATIONS SHIFT AFTER ECB CAUTION RELATIVE TO THE FED

Source: Macrobond

CHF: SNB able to convey much more confidence over inflation outlook

In contrast to the ECB and the BoE, the SNB at its monetary policy meeting yesterday was in a position to be much clearer in its communication on inflation. President Jordan stated after the meeting that “monetary conditions are adequate and we do not have to hint at any change of monetary policy in the future”. This confidence was evident in the update forecasts from the SNB. Given actual inflation at the start of the forecast horizon is 0.4ppt lower than the 2.0% forecast just three months ago, the entire forecast profile was notably lower in many of the quarters out to Q3 2026 – from Q2 2025 onwards the updated forecasts yesterday were 0.3ppt lower at 1.6% and the calendar year averages for 2024 and 2025 were 0.3ppt lower at 1.9% and 1.6%.

Another period of stronger disinflation in Switzerland would quickly see the concerns within the SNB shift from inflation concerns back to the concerns of too low inflation or deflation that prevailed prior to the pandemic hitting in 2020. That risk was acknowledged with the SNB now seeing the inflation risks as balanced and also confirming that the SNB was no longer focused on foreign currency sales as part of its monetary policy strategy. Jordan also stated that the SNB would adjust policy if needed in order to achieve price stability implying given the current direction of travel, that the SNB could shift back to a strategy of fighting downside inflation or deflation risks.

That suggests to us increased risks first of a shift back to the buying of foreign currency for Swiss francs as a first step prior to actual rate cuts. SNB FX reserve holdings have dropped just over CHF 300bn since the start of 2022 and has been an important feature of fighting inflation that is now coming to an end. About 75bps of rate cuts are priced, much less than from the ECB, even after the more hawkish communications from the ECB yesterday. That will curtail upside potential for EUR/CHF for now especially given our view that the EUR/USD gains now are starting to look excessive.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:30 |

German Composite PMI |

Dec |

48.2 |

47.8 |

!!! |

|

GE |

08:30 |

German Manufacturing PMI |

Dec |

43.2 |

42.6 |

!! |

|

GE |

08:30 |

German Services PMI |

Dec |

49.8 |

49.6 |

!! |

|

IT |

09:00 |

Italian HICP (YoY) |

Nov |

0.7% |

1.8% |

! |

|

IT |

09:00 |

Italian HICP (MoM) |

Nov |

-0.4% |

0.1% |

! |

|

EC |

09:00 |

Manufacturing PMI |

Dec |

44.6 |

44.2 |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Dec |

48.0 |

47.6 |

!!! |

|

EC |

09:00 |

Services PMI |

Dec |

49.0 |

48.7 |

!! |

|

UK |

09:30 |

Composite PMI |

-- |

50.9 |

50.7 |

!!! |

|

UK |

09:30 |

Manufacturing PMI |

-- |

47.5 |

47.2 |

!!! |

|

UK |

09:30 |

Services PMI |

-- |

51.0 |

50.9 |

!!! |

|

UK |

10:00 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Wages in euro zone (YoY) |

Q3 |

-- |

4.60% |

!! |

|

CA |

13:15 |

Housing Starts |

Nov |

257.1K |

274.7K |

!! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Dec |

2.00 |

9.10 |

!! |

|

US |

14:15 |

Capacity Utilization Rate |

Nov |

79.1% |

78.9% |

! |

|

US |

14:15 |

Industrial Production (MoM) |

Nov |

0.3% |

-0.6% |

!! |

|

US |

14:15 |

Manufacturing Production (MoM) |

Nov |

0.4% |

-0.7% |

! |

|

US |

14:45 |

Manufacturing PMI |

Dec |

49.3 |

49.4 |

!! |

|

US |

14:45 |

S&P Global Composite PMI |

Dec |

-- |

50.7 |

!! |

|

US |

14:45 |

Services PMI |

Dec |

50.6 |

50.8 |

!!! |

|

CA |

17:40 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!!! |

|

US |

21:00 |

TIC Net Long-Term Transactions |

-- |

45.8B |

-1.7B |

!! |

Source: Bloomberg