GBP near-term outlook clouded by weak inflation & GDP data

GBP: Inflation data no game-changer for the BoE

The US dollar is generally weaker across G10 and in EM markets with yields in the US correcting lower after the large jump on Tuesday following the strong US CPI data. The drop in US yields was helped by the comments from Fed President Goolsbee who stated that inflation being a little higher for a few months wouldn’t necessarily would be less important than broader evidence of the disinflation trend being intact and confidence in getting there is maintained. He added that the PCE gauge of inflation is what the Fed focuses on and sometimes can diverge notably from the CPI data. Waiting until 2% is actually achieved would not be appropriate. So some two-way balance has returned to the market allowing US yields and the dollar to correct. The one currency that failed to advance versus the weaker dollar was the pound after the UK inflation data came in weaker than expected yesterday. The data miss to the downside has helped reinforce the prospect of the headline inflation rate falling below the 2.0% target in April data and the undershoot helped offset the stronger than expected wage data on Tuesday.

Governor Bailey, in testimony to the House of Lords Economic Affairs Committee yesterday afternoon welcomed the data but put in context by stating the downside surprise offset the previous month’s upside surprise, implying being broadly in line with BoE expectations. Hence, we remain on a path implied by the BoE that should warrant rate cuts as implied by the BoE projections earlier this month. As Governor Bailey stated yesterday, the issue now for the BoE is “how long to keep policy restrictive”.

The OIS market yesterday added about 9bps of cuts to the June meeting which we see a reasonable shift in expectations. June certainly remains very much in play for the first rate cut given headline CPI could well be below the 2% target by then and given more compelling evidence of slower wage growth should be evident by then. Our current view is that the first cut comes in Q2, probably in June rather than May. While the inflation data was positive, services inflation ticked higher from 6.4% to 6.5%. Two MPC members continue to vote for a hike (Catherine Mann speaks today at 13:50 GMT) and the Fed’s start to cutting rates could be further back – all factors suggesting a later BoE start too.

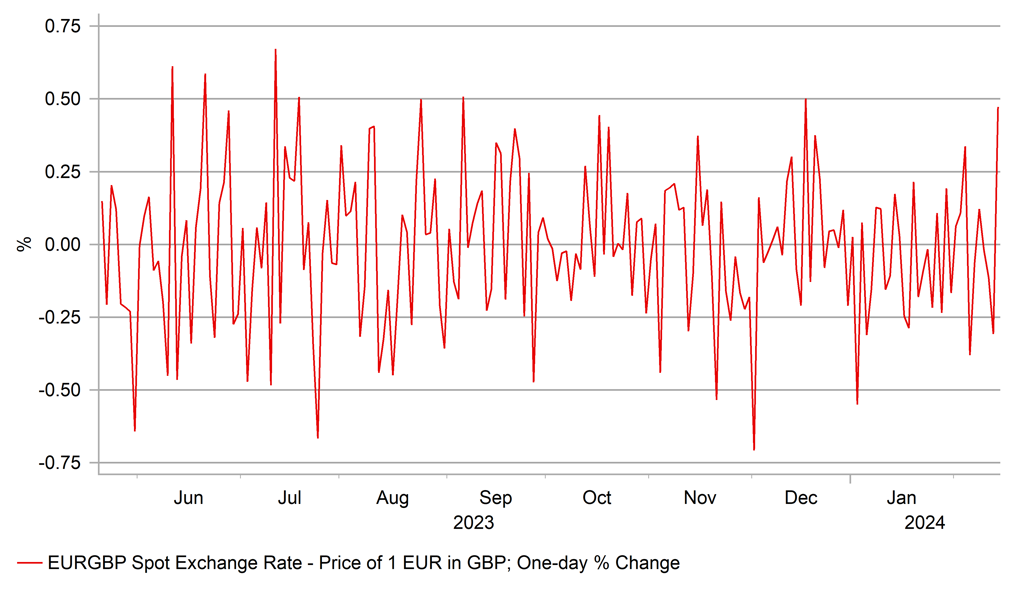

The 3mth SONIA futures strip rallied by 16-17bps yesterday which could be argued was a little excessive although that move needs to be taken in the context of a 50bp sell-off in February. The Dec-24 contract implies close to 100bps of cuts which is reasonable. We have been running a EUR/GBP short trade view based on the BoE reluctance to cut and lagging the Fed and the ECB and with some survey data pointing to some pick-up in growth. The near 0.5% rally in EUR/GBP does point to solid support at 0.8500 with the 2023 low of 0.8493 remaining intact. The gain yesterday was in fact the largest one-day jump since December. It looks like light EUR/GBP shorts had been built up on the potential for a break of the 2023 low so positioning could see GBP weakness extend over the short-term.

LARGEST ONE-DAY JUMP IN EUR/GBP SINCE DECEMBER

Source: Bloomberg, Macrobond & MUFG GMR

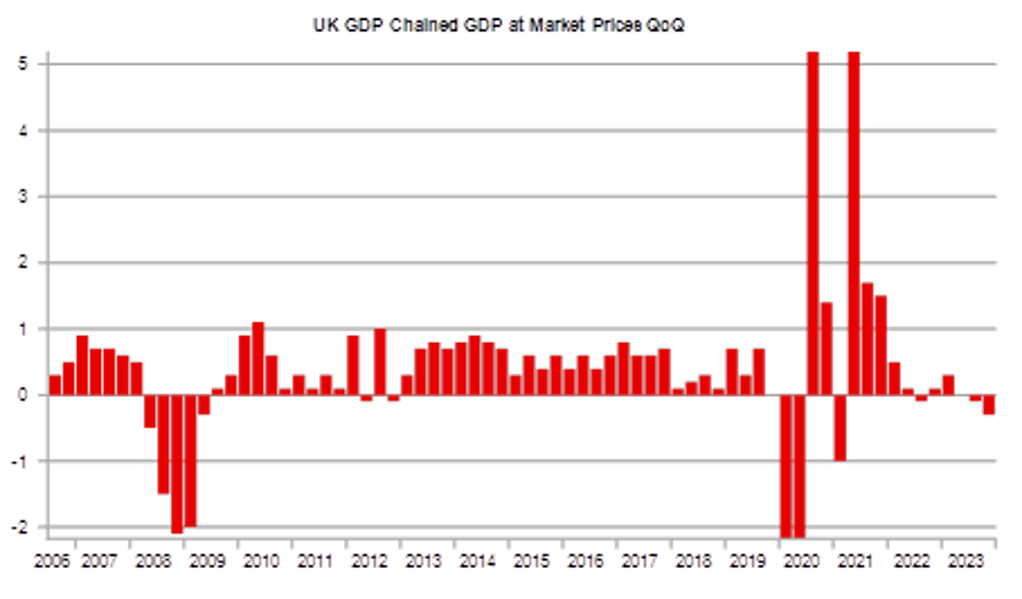

GBP: UK in technical recession but better momentum ahead

UK Q4 real GDP data has just been released this morning and the -0.3% Q/Q print was weaker than market expectations (-0.1%) and weaker than the BoE’s own estimate of unchanged. For 2023 as a whole, GDP grew just 0.1% compared to 2022. Given the weaker than expected inflation print yesterday it will add to the negative GBP momentum over the short-term. Still, BoE Governor Bailey did emphasise that the focus is on the forward looking data and as stated above has been highlighted by the evidence in the survey data indicating that the economy was beginning to accelerate. Momentum will be key in determining the outlook going forward.

In that regard, the December data released today pointed to better momentum for the economy going into the end of the final quarter of last year. Industrial production was expected to decline MoM but in fact increased 0.6%. the manufacturing sector alone gained 0.8%, matching the November increase and well above the market consensus (-0.1%). The ONS release this morning also emphasised the lower response rate meaning the data is prone to revisions going forward. A downward revision to services activity in November also helped explain the weaker than expected services contribution despite the December reading falling by less than expected. Exports were very weak, shaving 0.9ppt of GDP and can be volatile quarter to quarter. Business investment came in stronger than expected.

So while this may initially add to the negative GBP momentum prompted by the weaker CPI data, Governor Bailey’s comments yesterday do indicate the focus of policymakers is on the forward-looking indicators and the December data alone does point to a brighter outlook that should limit the negative rates and FX reaction.

MILD TECHNICAL RECESSION CONFIRMED IN THE UK

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

09:00 |

IEA Monthly Report |

-- |

-- |

-- |

! |

|

EC |

10:00 |

Trade Balance |

Dec |

21.5B |

20.3B |

!! |

|

EC |

12:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

-- |

0.0% |

0.0% |

! |

|

CA |

13:15 |

Housing Starts |

Jan |

236.0K |

249.3K |

!! |

|

US |

13:30 |

Export Price Index (MoM) |

Jan |

-0.1% |

-0.9% |

! |

|

US |

13:30 |

Import Price Index (MoM) |

Jan |

0.0% |

0.0% |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

219K |

218K |

!!! |

|

US |

13:30 |

Jobless Claims 4-Week Avg. |

-- |

-- |

212.25K |

! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Feb |

-13.70 |

-43.70 |

!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Feb |

-8.0 |

-10.6 |

!!! |

|

US |

13:30 |

Retail Sales Control (MoM) |

Jan |

-- |

0.8% |

!!! |

|

US |

13:30 |

Retail Sales (YoY) |

Jan |

-- |

5.59% |

! |

|

US |

13:30 |

Retail Sales (MoM) |

Jan |

-0.2% |

0.6% |

!!! |

|

US |

13:30 |

Retail Sales Ex Gas/Autos (MoM) |

Jan |

-- |

0.6% |

!!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Dec |

-0.5% |

1.2% |

! |

|

UK |

13:50 |

BoE MPC Member Mann |

-- |

-- |

-- |

!!! |

|

US |

14:15 |

Capacity Utilization Rate |

Jan |

78.8% |

78.6% |

! |

|

US |

14:15 |

Industrial Production (MoM) |

Jan |

0.2% |

0.1% |

!! |

|

US |

14:15 |

Manufacturing Production (MoM) |

Jan |

0.0% |

0.1% |

!! |

|

US |

15:00 |

Business Inventories (MoM) |

Dec |

0.4% |

-0.1% |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Feb |

46 |

44 |

! |

|

US |

15:00 |

Retail Inventories Ex Auto |

Dec |

0.6% |

-0.9% |

! |

|

GE |

18:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

18:15 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg