US inflation fears ebb taking USD lower as JPY outperforms

USD: PPI helps weaken the dollar & Ueda adds to selling

The headline PPI data yesterday helped to prompt some correction weaker in the US dollar and on a DXY basis, the dollar is now close to having fully retraced the move higher following the stronger than expected jobs report on Friday. Headline, core and core ex-trade PPI were all weaker than expected although the details were not as favourable with some of the components that feed into the PCE inflation data higher than expected. Airline Passenger Services leapt 7.2% m/m in December which was the largest increase since March 2022. The increase makes it more likely that we could see a 0.3% m/m increase in the core PCE inflation print which will keep the FOMC concerned over near-term inflation being stickier than anticipated.

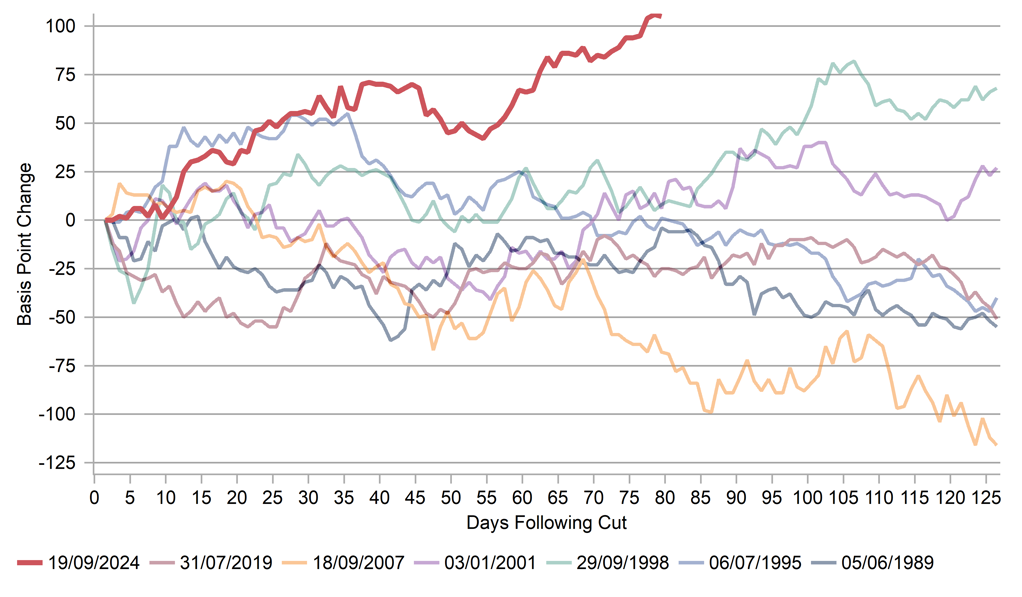

Those concerns are certainly valid for now given the fact that the FOMC began easing its monetary stance with core PCE inflation averaging 3.0% over the 12mth period prior to the first cut – that was the highest underlying inflation rate at the start of an easing cycle since the 4.4% level recorded ahead of Fed easing that started in 1989. Given that scenario the UST 10-year bond yield is behaving very differently to past Fed easing cycles. As can be seen above, the 10-year yield is now up over 100bps from the level when the FOMC began easing, well above the moves at this stage after the start of the last six Fed easing cycles. CPI data today in the US is still set to show headline CPI picking up due to food and energy price increases.

We highlighted in our FX Weekly on Friday (here) that a January BoJ was still possible and that some more explicit guidance from the BoJ would be required to set up the possibility of a move. That looks to have been forthcoming. Deputy Governor Himino, while not explicitly signalling a hike, yesterday in a speech certainly left the possibility on the table. Now today, in a speech that was only scheduled at the last minute, Governor Ueda today spoke at an event hosted by the Regional Banks Association of Japan and made similar comments to Himino’s the previous day, repeating that there would be a discussion on hiking rates next week and that the information on wages was pointing to another solid year of wage increases. The probability of a 25bp hike next week continues to creep higher and is now close to 75% - high enough to suggest the BoJ has done a good job in shaping expectations for a hike. We could still get further media reports, possibly in the period between inauguration and the BoJ decision on 24th January. A hike is now more likely than not in our view given these comments which should help prompt some renewed strengthening of the yen although moves will likely be contained ahead of Trump’s inauguration on Monday.

INFLATION CONCERNS SINCE THE FOMC CUT RATES IN SEPT HAS SEEN 10-YEAR YIELDS MOVE FAR HIGHER THAN IN PREVIOUS FED EASING CYCLES

Source: Bloomberg, Macrobond & MUFG GMR

EUR: PM Bayrou helps reduce near-term political instability risks

France prime minister, Francois Bayrou yesterday gave a key policy speech to parliament yesterday as the new government attempts to break the gridlock and get the 2025 budget passed. Based on the narrowing on the OAT/Bund spread it is clear that investors are less concerned over the medium term fiscal outlook and more concerned over the risk of further near-term political instability. Continued political instability would inevitably raise investor concerns over the position of President Macron and his ability or appetite to remain in office through to the end of his term in April 2027. So the initial response of the markets was positive with the budget proposal implying a less onerous reduction in the budget deficit than under the plans put forward by former PM Barnier. Instead of the 5.0% of GDP budget deficit target for this year PM Bayrou has proposed a reduction to 5.4%. The OAT/Bund spread narrowed by between 2-3bps and EUR was the top performing G10 currency suggesting the reduced near-term political risks helped fuel EUR buying.

The biggest news stemming from the speech was the announcement of opening renegotiations for a 3-month period on pension reform. This has been a cornerstone of President Macron’s presidency and this step is a departure from PM Barnier approach. This at the very least should give some longevity to the current government as negotiations should thwart attempts from the left to bring down the government. The only stipulation (but a rather important one!) is that any changes to pension reform plans must not impact state finances. That seems a difficult task.

There is also an issue of credibility. For now, bond investors are relieved that there has been a reduction in imminent political instability risks but we will need to see more details on the budget deficit projection of 5.4%. Growth for this year has been revised down making the achievement of budget consolidation more difficult and PM Bayrou cited “significant savings” as “exponential” tax increases would be avoided and there would be increased healthcare spending.

While this is potentially some good news in terms of possibly reducing near-term political instability risks, this risk wasn’t a particular driver of EUR performance of late and therefore we don’t see yesterday’s developments as having much bearing on FX direction. The OAT/Bund spread remains elevated and is unlikely to narrow notably given there is a high risk that the details lack credibility with the medium-term fiscal outlook remaining uncertain.

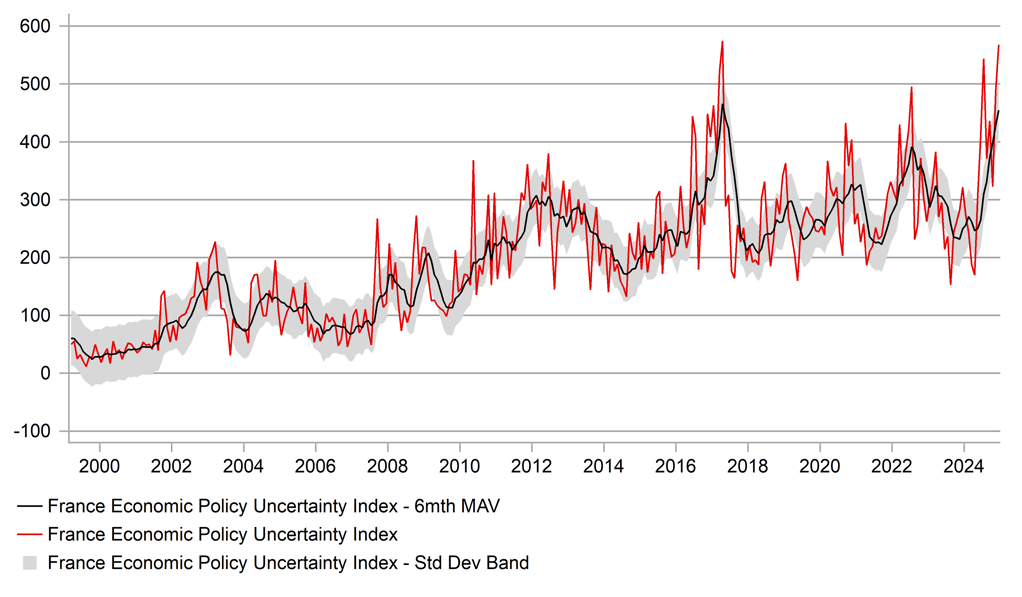

FRANCE ECONOMIC POLICY UNCERTAINTY HIT CLOSE TO A RECORD HIGH AT THE END OF 2024 – SOME DECLINE NOW POSSIBLE

Source: Macrobond

GBP: Respite for Reeves with softer CPI

Given the sustained political pressure Chancellor Reeves has been under as 10-year Gilt yields have moved higher, the CPI data this morning will come as some relief. We were somewhat sceptical of the move higher in Gilt yields becoming sustained and turning to a crisis given we believed the labour market was weakening and wage inflation would ease.

But the drop in services CPI in particular does point to easing underlying inflation with a drop from 5.0% to 4.4%, well below the expected 4.8% and the lowest since March 2022. This print is also well below the BoE’s projection of 4.7% and strengthens the case for a rate cut at the February meeting. We see the MPC cutting at the meeting which is now priced at about an 85% probability. For the pound, an increased chance of a rate cut would usually be pound negative but given the selling of Gilts had begun to weigh on the pound, we see scope for the pound to respond positively, over the short-term at least, to the weaker inflation data.

The data should allow for some reassessment of the views on a possible Gilt crisis emerging. The fundamentals don’t back that up. Chancellor Reeves has made clear that the government would act with spending cuts to keep to its self-imposed fiscal rules and inflation has now come in weaker than expected. The UST bond 10-year yield is up 103bps since the end of September when the Trump trade re-emerged. Gilt yields are up 95bps over the same period. This was predominantly an international driven move with inflation risks and the budget in October adding to investor concerns but those concerns should now ease and break the link between rising Gilt yields and a falling pound.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

US |

09:00 |

IEA Monthly Report |

-- |

-- |

-- |

! |

|

GE |

09:00 |

German GDP Annual |

-- |

-0.20% |

-0.30% |

! |

|

UK |

09:30 |

House Price Index (YoY) |

-- |

3.5% |

3.4% |

! |

|

UK |

10:00 |

10-Year Treasury Gilt Auction |

-- |

-- |

4.332% |

!!! |

|

EC |

10:00 |

Industrial Production (YoY) |

Nov |

-1.9% |

-1.2% |

! |

|

EC |

10:00 |

Industrial Production (MoM) |

Nov |

0.3% |

0.0% |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-3.7% |

! |

|

US |

13:30 |

Core CPI (MoM) |

Dec |

0.2% |

0.3% |

!!!!! |

|

US |

13:30 |

Core CPI (YoY) |

Dec |

3.3% |

3.3% |

!!! |

|

US |

13:30 |

CPI (MoM) |

Dec |

0.4% |

0.3% |

!!!! |

|

US |

13:30 |

CPI (YoY) |

Dec |

2.9% |

2.7% |

!! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Jan |

-0.30 |

0.20 |

!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Nov |

0.4% |

2.1% |

! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

Nov |

-0.6% |

1.0% |

!! |

|

US |

14:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

US |

16:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

|

US |

17:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

Source: Bloomberg