USD supported by more evidence of firmer US inflation

USD: Disappointing US inflation data is encouraging a stronger USD

The US dollar has continued to trade at higher levels during the Asian trading session after strengthening yesterday in response to further evidence that US inflation has picked up at the start of this year. It leaves the dollar index on track to close higher this week which would bring an end to the run of three consecutive weekly declines. The main trigger for the US dollar rally yesterday was the release of the US PPI report for February which surprised to the upside, and closely followed the upside surprise from the US CPI report for February released earlier this week. The report revealed that the headline rate of producer price inflation increased by 0.6%M/M in February which was well above consensus expectations for an increase of 0.3%M/M. The headline reading was boosted by a 1.0%M/M jump in food prices while energy prices also rose sharply. Even after excluding the more volatile items of energy and food, the core rate of producer price inflation came in firmer than expected when it rose by 0.3%M/M in February compared to the consensus forecast for an increase of 0.2%M/M. The PPI print makes it more likely now that the PCE deflator report for February released at the end of this month will remain at a faster rate than the Fed would likely to see after the upside surprise in January. The core PCE deflator is expected to increase by 0.3%M/M in February after an increase of 0.4%M/M in January.

While we don’t think the developments will be sufficient at this stage to prompt the Fed to adjust their plans for three rate hikes this year at next week’s FOMC meeting, it is likely that the Fed will display more caution over the inflation outlook in the near-term. In response to the recent run of disappointing US inflation data, the US rate market has been paring back expectations over how early and deeply the Fed is likely to cut rates this year. There are currently around -17bps of cuts priced in by the June FOMC meeting and a cumulative total of around -77bps of cuts by the end of this year. The recent shift in pricing highlights that market participants are becoming more wary of the risk that the Fed could delay starting to cut rates until the 2H of this year. It has resulted in the 2-year US Treasury bond yield rising sharply by around 28bps from the recent low which is encouraging a stronger US dollar. However, not all of the economic developments were US dollar supportive yesterday. It was also revealed that US retail sales remained weak for the second consecutive month in February. After contracting by -0.3%M/M in January, control retail sales growth failed to grow again in February (0.0%M/M). It points to a sharp slowdown in consumption growth in Q1 after robust growth averaging just over 3.0% in the 2H of last year. It has increased downside risks to the Bloomberg consensus forecast for GDP growth of 1.9% in Q1, and supports our view that the robust pace of growth recorded in the 2H of last year was unsustainable.

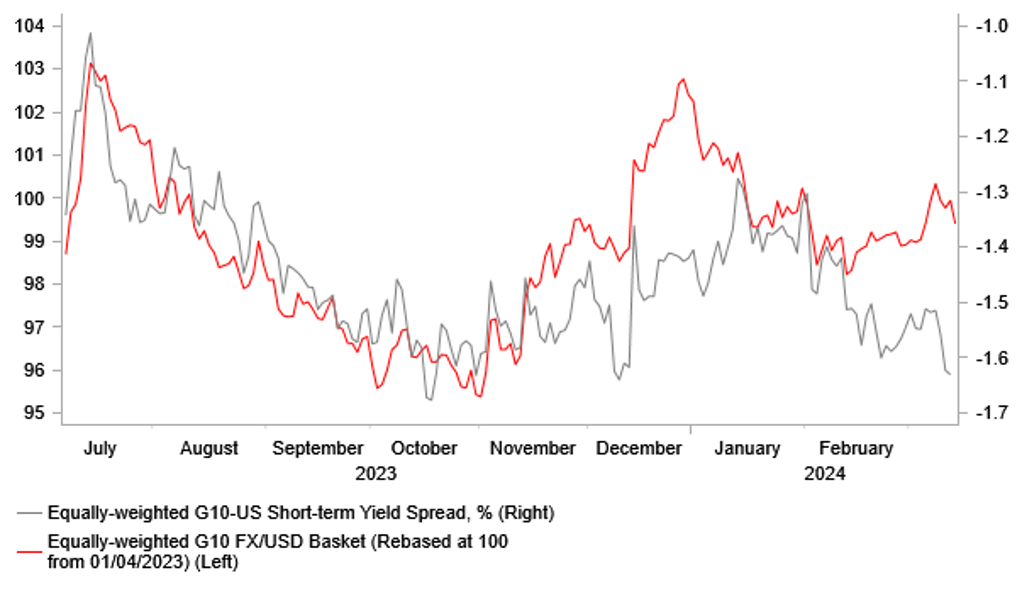

YIELD SPREADS CONTINUE TO MOVE IN FAVOUR OF STRONGER USD

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Rengo wage agreement results to encourage BoJ to tighten policy

The main development overnight from Japan was the eagerly awaited announcement of the preliminary wage agreement results from Japan’s largest labour union federation. The Japanese Trade Union Confederation (Rengo) revealed that 771 unions secured a 5.28% total pay hike which is well above the corresponding increase secured at the same stage last year of 3.8%. The break down revealed that 654 unions achieved an average increase of 3.7% in monthly base wages which was also higher than at the same stage last year of 2.33%. While the final wage agreements could be somewhat softer than the preliminary results, the large uplift compared to the same stage of last year should clearly give the BoJ more confidence that stronger wage growth will be sustained in the upcoming fiscal year. The size of last year’s total pay hike came in somewhat lower in the final report in June at 3.58% down from the preliminary announcement of 3.8%.

The BoJ had clearly signalled that they were focusing closely on today’s wage announcement when setting the outlook for monetary policy in Japan. The much stronger Rengo wage agreement results support our view that the BoJ should finally be sufficiently confident to tighten monetary policy at next week’s meeting. The report has been quickly followed by a JiJi press headline stating that the BoJ is making final arrangements to end its negative rate policy next week. The yen initially strengthened modestly resulting in USD/JPY falling back to the 148.00-level after the stronger Rengo wage agreement results were released, but it has proven short-lived. The failure of the yen to strengthen further this week alongside stronger wage growth from Japan suggests that market participants are comfortable that the BoJ’s policy announcement next week is unlikely to provide a significant hawkish policy surprise. The Japanese rate market is already pricing in the BoJ’s policy rate rising to 0.25% by year end, and the BoJ’s forward rate guidance is expected to remain cautious when they exit negative rates.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (YoY) |

Feb |

0.8% |

0.8% |

! |

|

GE |

10:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

12:30 |

Import Price Index (MoM) |

Feb |

0.3% |

0.8% |

!! |

|

US |

12:30 |

NY Empire State Manufacturing Index |

Mar |

-7.00 |

-2.40 |

!! |

|

US |

13:15 |

Industrial Production (MoM) |

Feb |

0.0% |

-0.1% |

!! |

|

US |

14:00 |

Michigan Consumer Sentiment |

Mar |

77.1 |

76.9 |

!! |

|

EC |

14:30 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg