USD’s upward trend remains firmly in place after US CPI report

USD: Powell signals greater caution ahead

The 2-year UST bond yield jumped 8bps and was up 12bps yesterday from the intra-day low in response to the speech last night from Fed Chair Powell that pointed to a possible early indication of an intention of the FOMC to pause its easing cycle. The scale of the move in front-end rates was notable in that it had limited impact on lifting the US dollar and indeed the DXY index is now already below the level that was trading just prior to when Powell began to speak. This is perhaps not a surprise and it does point to the potential for the dollar to enter a consolidation phase given the sharp move stronger since Trump’s election victory. We suspect the positive momentum we have seen since and before the election may now start to fade.

Powell was very clear with his message that the economy “is not sending any signals that we need to be in a hurry to lower rates” adding that the strength of the economy means the Fed has the ability to “approach our decisions carefully”. The decision to cut even in December is now more finely balanced and the OIS market is now pricing a little less than a 50% probability of cut at that meeting. The FOMC meeting is on 17th- 18th December so there will be a payrolls report and another CPI report before that meeting. Two strong reports and you would have to conclude the FOMC would feasibly move to a pause at that meeting. If the data is more mixed then a January pause makes more sense. The January FOMC meeting is on 29th – nine days following inauguration and there is a good chance we will have had an early indication of tariffs, tax policies and deportations. Crucially Powell did offer a hint on Fed thinking on tariffs by stating the situation today is very different to 2018-19 when tariffs were first introduced. Back then inflation was lower (12mth avg YoY CPI to the 2016 election was 0.9% and now the 12mth average if 3.1%) and consumers had little experience of being asked to accept a notable price increase. This time of course is very different.

That suggests the Fed will be quite anxious of the dangers of implementing trade tariffs into an economy with low levels of spare capacity in the labour market and inflation expectations much less anchored than prior to the pandemic. The 10-year breakeven today is around 75bps higher than when Trump won in 2016 (again 12mth averages). The S&P 500 closed down 0.6% yesterday, the biggest drop since the election and again suggests along with the easing positive dollar momentum that the Trump trade may have run its course for now.

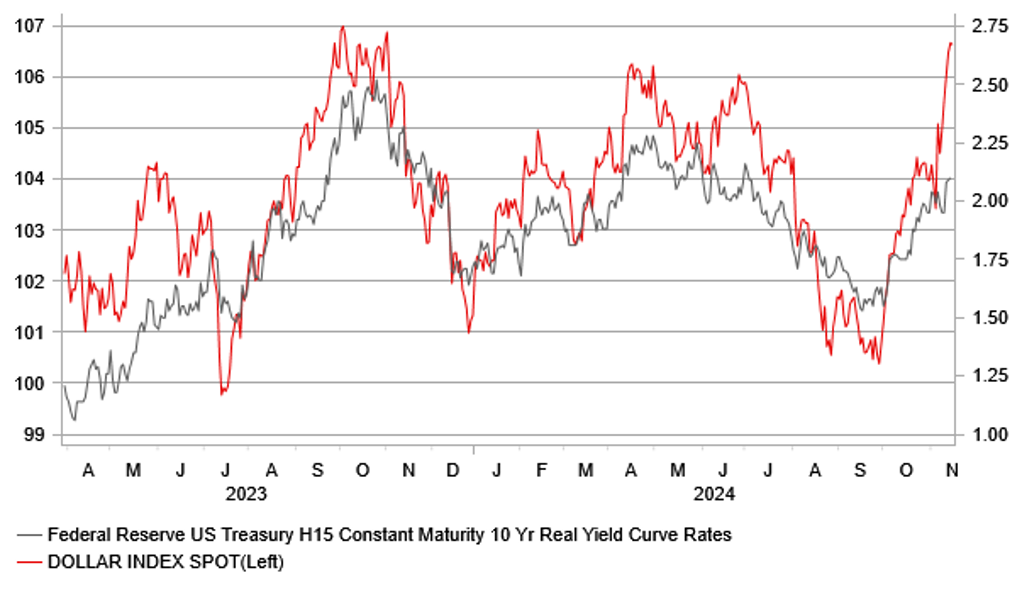

THE DOLLAR HAS NOW OVER-EXTENDED RELATIVE TO REAL YIELDS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB minutes signal a cut but 2025 pricing overdone

EUR/USD broke below the 1.0500-level yesterday for the first time since October 2023 as the dollar positive momentum continued to drive the dollar stronger against most currencies. But that break below 1.0500 was very brief and prompted a turnaround that lasted throughout the remainder of yesterday and into today. EUR/USD has now dropped 7-big figures in a little over a month and we may be reaching a point when the positive momentum fades and better two-way flow begins to emerge into the market. From speaking to clients our sense is that levels around or certainly below 1.0500 would be viewed as attractive buying levels for those who have EUR buying requirements. Given the speed in which this level has been hit, we may now start to see some better EUR demand.

The minutes from the ECB meeting in October did not offer any big surprises relative to the outcome of the meeting and the communications from ECB President Lagarde. The October meeting marked the first back-to-back cut and that was down to the better than expected progress on inflation which was clearly outlined in the minutes yesterday. There was also a reference to an inflation undershoot which given the scale of the recent decline of inflation ahead of the meeting is not a surprise.

The minutes also noted that the inflation undershoot could be assessed in more detail when the staff economic projections would be released in December. But of course these minutes are from a meeting that took place ahead of the US election and therefore the details of the minutes need to be caveated as being somewhat dated. A rate cut is still likely in December and is fully priced by the markets but the communications on future moves will be likely more balanced. The new projections will not be able to take account of future possible policies as we will only know them next year but inflation risks are already higher. EUR/USD was trading close to the 1.1200 level when the meeting took place in October and the projections were based on a spot rate around that level too. EUR/USD since then is between 6-7% lower which alone will have a small bearing on inflation projections. Retaliatory tariffs in 2025 while won’t be forecasted in the projections in December will be a risk-factor that will make the ECB much more cautious on forward guidance.

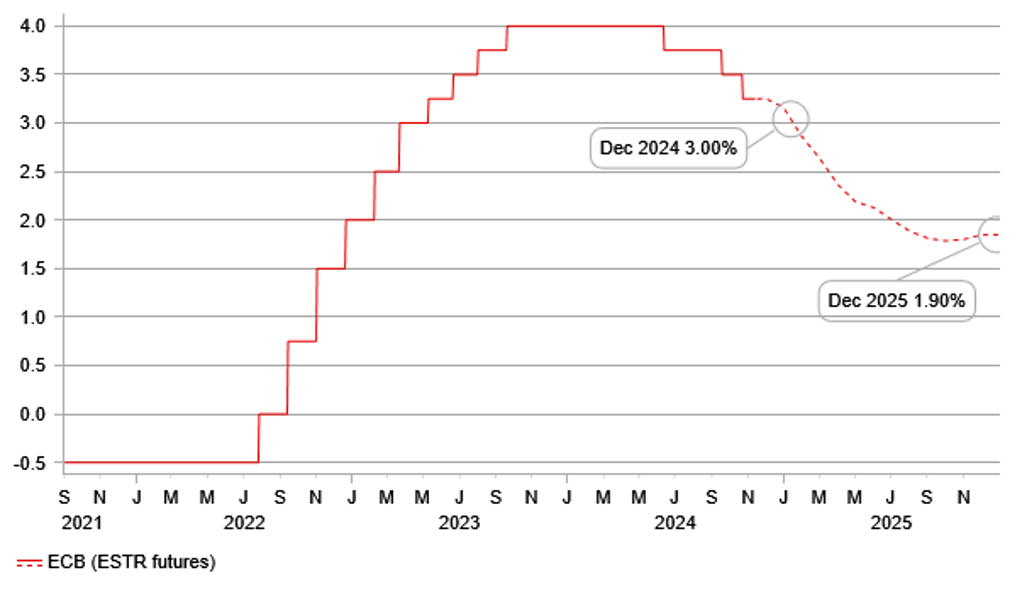

Certainly, the current divergence in rate cutting expectations between the Fed and the ECB over the next 12mths looks excessive to us. The Fed is priced to cut by nearly 65bps by next October but the ECB will cut by double that – nearly 150bps. We see risks of the ECB delivering less than priced. Weak growth didn’t get much focus when the ECB was hiking in 2022-23 and weak growth in 2025 will equally take a back-seat in circumstances of increased inflation risks related to Trump’s trade policies and Europe’s inevitable retaliation.

ECB IMPLIED TERMINAL RATE COULD BE LOWER

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (MoM) |

Oct |

0.0% |

-0.2% |

! |

|

IT |

09:00 |

Italian CPI (YoY) |

Oct |

0.9% |

0.7% |

! |

|

UK |

11:30 |

NIESR Monthly GDP Tracker |

Oct |

-- |

0.2% |

!! |

|

EC |

11:30 |

ECB McCaul Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Core Retail Sales (MoM) |

Oct |

0.3% |

0.5% |

!!!! |

|

US |

13:30 |

Retail Control (MoM) |

Oct |

-- |

0.7% |

!!!! |

|

US |

13:30 |

Retail Sales (MoM) |

Oct |

0.3% |

0.4% |

!!! |

|

US |

13:30 |

Retail Sales (YoY) |

Oct |

-- |

1.74% |

! |

|

US |

13:30 |

Retail Sales Ex Gas/Autos (MoM) |

Oct |

-- |

0.7% |

!! |

|

US |

13:30 |

Export Price Index (MoM) |

Oct |

-0.1% |

-0.7% |

! |

|

US |

13:30 |

Import Price Index (MoM) |

Oct |

-0.1% |

-0.4% |

! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Nov |

-0.30 |

-11.90 |

!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Oct |

-0.8% |

-1.3% |

! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

Oct |

0.9% |

-0.6% |

!! |

|

US |

14:15 |

Capacity Utilization Rate |

Oct |

77.4% |

77.5% |

! |

|

US |

14:15 |

Industrial Production (MoM) |

Oct |

-0.3% |

-0.3% |

!! |

|

US |

14:15 |

Manufacturing Production (MoM) |

Oct |

-0.5% |

-0.4% |

!! |

|

US |

15:00 |

Business Inventories (MoM) |

Sep |

0.2% |

0.3% |

! |

|

US |

15:00 |

Retail Inventories Ex Auto |

Sep |

0.1% |

0.5% |

! |

|

EC |

15:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

US |

18:15 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg