All eyes US Treasuries as risk aversion picks up again

USD: Risk aversion picks up again

After stabilising yesterday, the US dollar is weakening again with CHF, JPY and EUR outperforming in the G10 space as equities take a hit in Asia on the news from Nvidia that it has been barred from selling its H20 chip to China – a chip that had been designed specifically for China after President Biden had placed controls on exporting more powerful chips to China. Nvidia estimates the Trump control will cost around USD 5.5bn. Despite the dollar sell-off and renewed risk aversion, the UST bond market so far is trading as you’d expect with yields lower, although the 30-year yield is close to unchanged suggesting still fragile sentiment. Efforts have been made to shore up confidence in the bond market. Yesterday’s comments from US Treasury Secretary Scott Bessent may have helped. Bessent stated that the Treasury has “a big toolkit that we can roll out” such as restarting buyback programs buying up older less-liquid off the run bonds to help liquidity and improve market-making conditions. In addition, Deputy Treasury Secretary Michael Faulkender at an event in Washington yesterday confirmed that the Treasury are discussing the supplementary leverage ratio in regard to UST bond trading. The idea being discussed is whether a mechanism could be created that would provide flexibility so that on days of stress SLR requirements would be relaxed in order to increase appetite for holding a larger than usual quantity of bonds.

But the most notable factor for some restoration of some degree of stability to the financial markets prior to today’s renewed equity market sell-off had been the backtracking by the Trump administration first in regard to consumer electronics and then on auto parts. The shifts underline the potential reduced leverage the US in trade negotiations going forward that may result in trade deals being negotiated with more countries more quickly. Vice President Vance stated yesterday that President Trump “loves the UK” and the King and that the relationship was very important. Because of this Vance said the US was working very hard with the UK government on a trade deal. Japan’s Economic Revitalisation Minister Ryosei Akazawa is in Washington today until Friday for discussions with UST Secretary Bessent and US Trade Representative Jamieson Greer on reaching a new trade deal. Japan’s government spokesman stated that the trip was about “building trust” and while we don’t expect much from this initial meeting we should be aware of the risks from the US side of indicating that FX is part of negotiations.

However, it is hard to throw too much complaint at Japan given it openly and quite aggressively sold USD/JPY to halt yen depreciation and the BoJ is now the only major central bank that remains more likely to hike policy rates further. Now is unlikely the time for the US to signal a desire for trading partners like Japan to strengthen their currencies. That of course would imply a greater chance of Japan needing to sell its UST bond holdings to finance intervention, something that would only reinforce speculation about Japan and/or China selling down their UST bond holdings. So don’t expect too much focus on FX an issue from this initial US-Japan meeting.

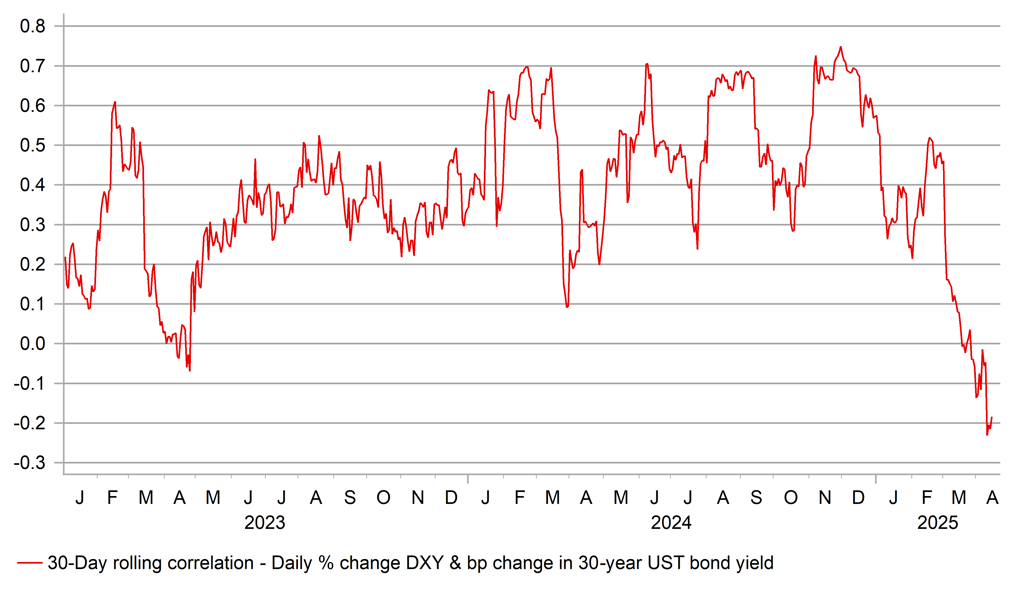

30-DAY ROLLING CORRELATION OF DAILY % CHANGE IN DXY AND BP CHANGE IN 30-YEAR YIELD PLUNGES INTO NEGATIVE TERRITORY

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Weaker CPI print paves way for BoE cut

The US dollar is selling off broadly on the Nvidia news and renewed risk-off in Asian equities but the buying of GBP has paused following the CPI data released this morning which highlighted weaker inflation pressures than expected. Headline CPI, services CPI and CPIH were all weaker than expected while core CPI was in line but down 0.1ppt from February at 3.4%. Services CPI slowed from 5.0% to 4.7% and will ease concerns within the BoE over the stickiness of underlying inflation. The biggest downward pressure in price came from recreation and culture (computer games), with the annual rate slowing from 2.5% in February to just 0.6% in March. That drop alone accounted for a drop of 0.14ppts in headline CPI. Motor Fuels was the next biggest component putting downward pressure on inflation with the annual rate dropping from -2.8% to -5.6%. The biggest component exerting upward pressure on the headline rate was Clothing & Footwear, with the annual rate jumping from -0.7% to +1.1% contributing +0.11ppt to the annual rate.

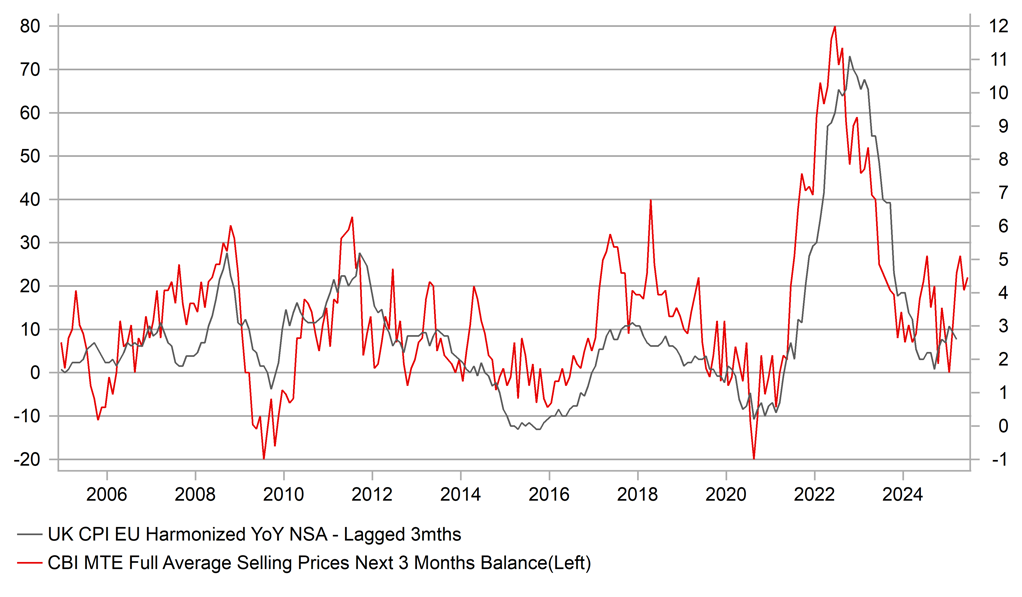

While this is good news for the BoE and makes a 25bp rate cut a near certainty on 8th May, inflation is set to pick up in Q2 given the NICs tax increase on employers, the minimum wage increase and the rise in the utility energy price cap. All of these will see the headline CPI advance potentially to levels around 4.0%. But this data at least confirms that heading into that period of an inflation pick-up, the starting point is a little weaker than expected. The BoE had forecast services CPI to be at 4.9% in today’s data. Given this data and the uncertainty over the impact of US trade tariffs on the economy and inflation, the current MPC guidance of easing the monetary stance in a “careful and gradual” manner seems justified. We expect GBP to continue to underperform EUR as the dollar weakens but quicker than expected progress on a US-UK trade deal would help to quickly reduce that underperformance.

UK CPI SET TO ACCELERATE IN Q2 SO BOE CAUTION TO CONTINUE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Bank Lending Survey |

-- |

-- |

-- |

!! |

|

UK |

10:00 |

10-Year Treasury Gilt Auction |

-- |

-- |

4.679% |

!!! |

|

GE |

10:00 |

German ZEW Current Conditions |

Apr |

-86.0 |

-87.6 |

!! |

|

GE |

10:00 |

German ZEW Economic Sentiment |

Apr |

10.6 |

51.6 |

!! |

|

EC |

10:00 |

Industrial Production (MoM) |

Feb |

0.1% |

0.8% |

!! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Apr |

14.2 |

39.8 |

!! |

|

CA |

13:15 |

Housing Starts |

Mar |

238.0K |

229.0K |

! |

|

US |

13:30 |

Export Price Index (MoM) |

Mar |

-- |

0.1% |

! |

|

US |

13:30 |

Import Price Index (MoM) |

Mar |

0.1% |

0.4% |

! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Apr |

-14.80 |

-20.00 |

!! |

|

CA |

13:30 |

Common CPI (YoY) |

Mar |

2.4% |

2.5% |

!!! |

|

CA |

13:30 |

Core CPI (MoM) |

Mar |

-- |

0.7% |

!!! |

|

CA |

13:30 |

Core CPI (YoY) |

Mar |

-- |

2.7% |

!!! |

|

CA |

13:30 |

CPI (YoY) |

Mar |

2.6% |

2.6% |

! |

|

CA |

13:30 |

CPI (MoM) |

Mar |

0.7% |

1.1% |

!! |

|

CA |

13:30 |

Median CPI (YoY) |

Mar |

2.9% |

2.9% |

! |

|

CA |

13:30 |

Trimmed CPI (YoY) |

Mar |

2.9% |

2.9% |

! |

|

US |

16:35 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

EC |

17:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg