Strong US data but lower yields suggest limits to the upside

USD: Strong retail sales but can that last?

The US retail sales data for July added to the list of US data that has indicated continued resilience of the US economy, suggesting the Fed’s tightening action to date is having limited impact on curtailing consumer demand. The only speaker this week – Minneapolis Fed President Kashkari – spoke following the release of the data stating that he saw no evidence of a recession around the corner and added that the Fed “was a long way from cutting rates” given inflation remains too high. Kashkari, who is a voter this year, also admitted that he was surprised by the resilience of the economy. For sure, the retail sales data was strong. The Control Group (that plugs into GDP) 3mth annualised increase in July was 8.6%. So Kashkari understandably makes reference to the resilience of the economy and to not seeing any sign of recession.

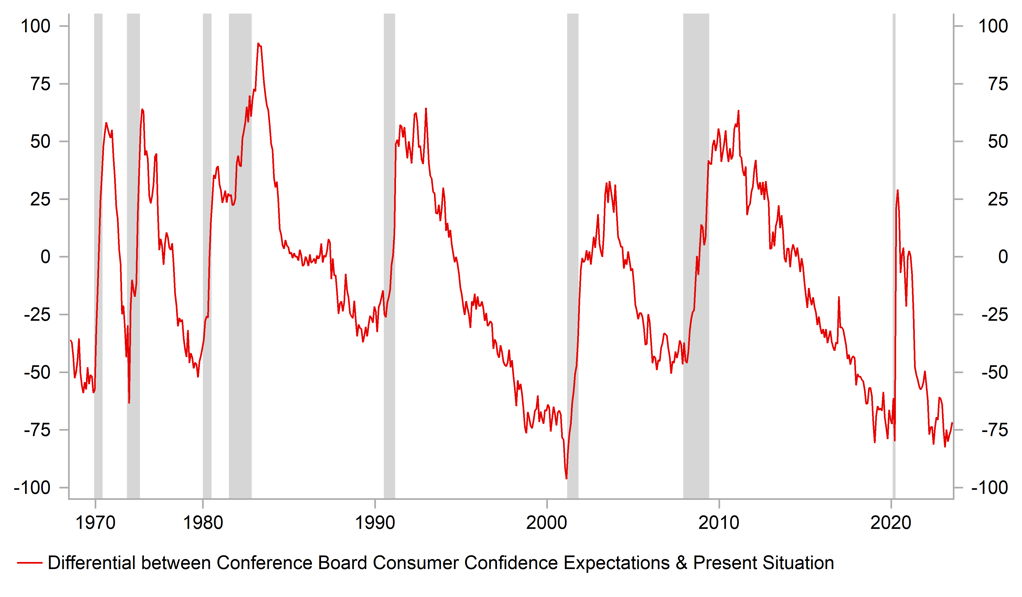

That said, it is important to remember the turn of an economy from resilience to recession can be quite abrupt and quick. Looking back at the Control Group 3mth annualised rate you can see for example that there was growth of 6% in November 2007, the month before the NBER-determined recession began in the US. The chart above highlights the current differential between the Conference Board indices for Current Conditions and Expectations with consumer expectations relative to current conditions at levels always consistent with recession. So current conditions for US consumer are pretty good but expectations relative to this remain extremely low underlining the angst that could result in quite a sudden change. So while the data remains resilient we could see that change quite suddenly.

What was interesting yesterday was the reaction to this strong retail sales report – yields fell along with the equity market. It may be the first sign of a near-term limit to the upside for yields and a period of consolidation rather than further advances from here seems plausible. Similar price action in bond yields were evident in Europe and for the UK the yield increase was modest despite the very strong wage data in the jobs report. Considering the strength of the wage increases, the 2yr Gilt yield advanced just 6bps. While we have a bias favouring the US dollar at the moment, the move in yields certainly makes it likely that FX moves remain within recent ranges.

Based on Kashkari’s comments and comments from most Fed officials, we would expect to see the minutes from the FOMC this evening to reveal confidence in the ‘soft landing’ for the economy view. We will be looking to see what levels of conviction there are on the topic of pausing rate hikes versus needing to hike further.

US CONSUMER EXPECTATIONS RELATIVE TO CURRENT CONDITIONS

Source: Bloomberg, Macrobond & MUFG GMR

NZD: RBNZ leaves key policy rate unchanged

As expected, the RBNZ today announced an unchanged monetary policy stance with the policy rate (OCR) left at 5.50%. There was a hawkish tone to the communication with the RBNZ stressing that inflation risks persist. The updated forecasts from the RBNZ included a path for the OCR that was slightly higher than previously with the OCR rising to 5.59% in mid-2024 before falling back to 5.50% by the end of the year and further into 2025. The implied first cut was therefore pushed back into 2025 while there 2024 levels implied a slightly higher probability of another rate increase. RBNZ Governor Orr did then play down the OCR projected path as not a form of guidance adding that ultimately the RBNZ was in “watch, worry, and wait” mode adding that the RBNZ also needed to be mindful of doing too much. We still believe the RBNZ has completed its tightening cycle and the data flow underlines the weakening economy that should allow the RBNZ to remain on the side-lines. Weaker China growth, weak growth in New Zealand and global growth risks in general will keep the performance of NZD toward the bottom of the G10 performance table going forward and we see downside risks for NZD versus the dollar over the short-term and into 2024.

GBP: Inflation surprises modestly to the upside also

The ONS has just released the July CPI data and we have had a modest upside surprise release following on from the stronger wage data yesterday. The only relief today is that the scale of the upside surprise is much more modest than yesterday. The OFGEM utility price cap reduction of 17% meant a big drop was always likely today. The m/m fall was 0.4% (0.5% expected) mainly due to the OFGEM factor. The m/m gas price dropped 25.2%, the largest recorded drop since the series began in 1988.

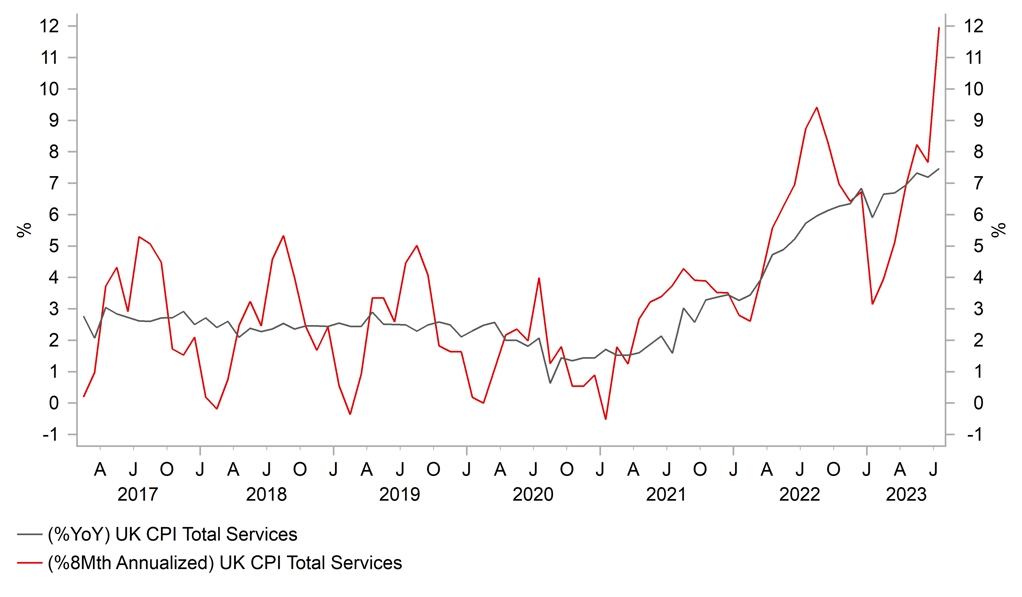

However, other details highlighted the fact that the drop overall in inflation was a little less than expected. The core CPI rate remained unchanged at 6.9% with services CPI YoY accelerating from 7.2% to 7.4%. The data will clearly add to the pricing probability of the BoE going by 50bps rather than 25bps in September but we doubt there will be a substantial shift in pricing at this juncture. US Treasury yields are lower today with shadow banking concerns in China increasing by the day and equity markets are all weaker in Asia following the drop in the US. That backdrop will help contain yields in the UK as will the fact that there will be another month of data before the BoE meets on 21st September. Given we believe there are upside risks for the dollar at the moment, we would play long GBP views versus the euro for now, although like yields we doubt GBP will see notable gains following this CPI release.

UK Y/Y SERVICES CPI HITS A NEW HIGH WITH 6MTH ANNUALISED SURGING

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

08:30 |

Consumer Confidence |

Q3 |

-- |

-34.40 |

! |

|

EC |

10:00 |

Employment Change (YoY) |

-- |

1.4% |

1.6% |

! |

|

EC |

10:00 |

Employment Change (QoQ) |

-- |

0.2% |

0.6% |

! |

|

EC |

10:00 |

GDP (QoQ) |

-- |

0.3% |

0.0% |

!! |

|

EC |

10:00 |

GDP (YoY) |

Q2 |

0.6% |

1.1% |

!! |

|

EC |

10:00 |

Industrial Production (YoY) |

Jun |

-4.2% |

-2.2% |

! |

|

EC |

10:00 |

Industrial Production (MoM) |

Jun |

-0.1% |

0.2% |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-3.1% |

! |

|

CA |

13:15 |

Housing Starts |

Jul |

240.0K |

281.4K |

!! |

|

US |

13:30 |

Building Permits |

Jul |

1.463M |

1.441M |

!! |

|

US |

13:30 |

Building Permits (MoM) |

Jul |

-1.7% |

-3.7% |

!! |

|

US |

13:30 |

Housing Starts (MoM) |

Jul |

2.7% |

-8.0% |

!! |

|

US |

13:30 |

Housing Starts |

Jul |

1.448M |

1.434M |

!! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

Jun |

-4.2% |

3.5% |

!! |

|

US |

14:15 |

Capacity Utilization Rate |

Jul |

79.1% |

78.9% |

! |

|

US |

14:15 |

Industrial Production (YoY) |

Jul |

-0.10% |

-0.43% |

!! |

|

US |

14:15 |

Industrial Production (MoM) |

Jul |

0.3% |

-0.5% |

!! |

|

US |

14:15 |

Manufacturing Production (MoM) |

Jul |

0.0% |

-0.3% |

! |

|

US |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

-- |

!!!! |

Source: Bloomberg