Strong US data boosts carry – will it last?

JPY: Big US yield jump spurts renewed yen selling

The retracement of USD/JPY continues and we have now seen roughly a seven big rebound from the low point after the 20-big figure drop from the high in July. The intra-day high yesterday (149.32) fell just short of the 38.2% retracement (149.44) of that 20-big figure lower but a breach of that level could well further impetus to the rebound over the short-term.

The continued rebound was helped by the much stronger than expected retail sales data from the US that has further reduced the prospect of a 50bp rate cut at the next FOMC meeting in September. We have now seen market expectations shift from a near 50-50 probability pricing for an inter-meeting cut from the FOMC to 50bps in September back to now close to just 25bps. Clearly the US rates market was skewed toward a big reaction to any data that comes in stronger than expected and the July gain in control group retail sales of 0.3% MoM after a 0.9% gain in June has set third quarter consumption off to a good start. The initial claims data also fell more than expected, helping ease investor concerns over the labour market.

The 13bp jump in the 2-year yield was the largest one-day jump since the 7th June when the non-farm payrolls reading was over 100k stronger than expected. In that context it is unusual for retail sales to trigger such a reaction and is really more a reflection of the overshoot in yields to the downside and the extent of rate cuts priced into the market.

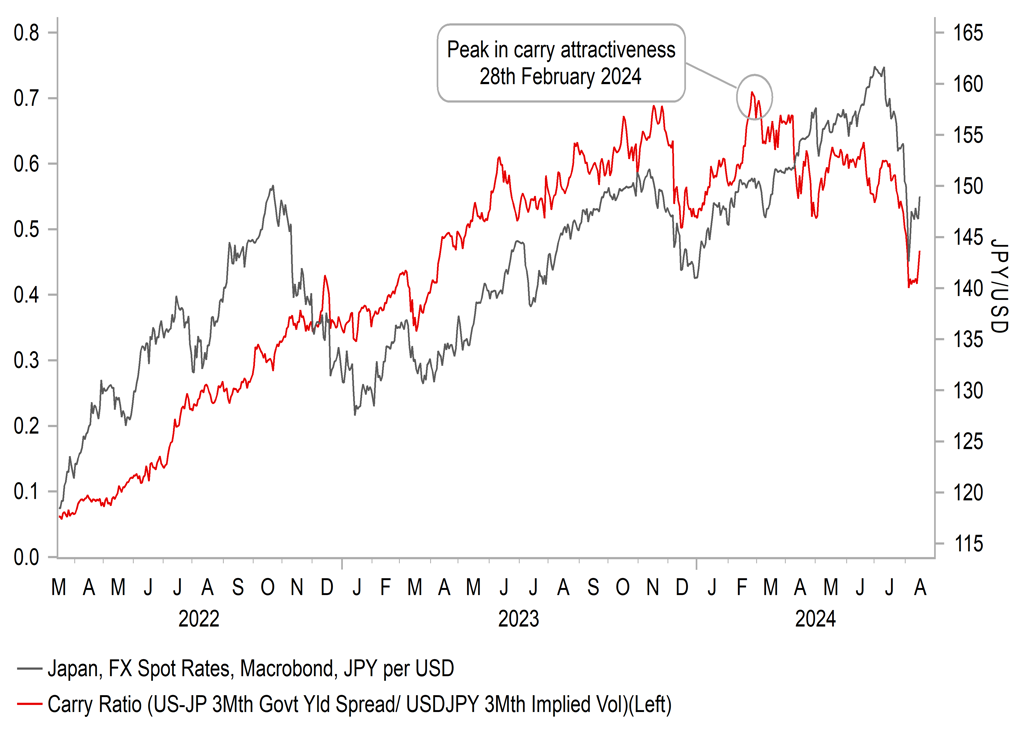

What tends to be standard going into an economic downturn is the mixed signals in the economic data on the scale of the downturn. We suspect bigger swings in both directions are likely to become more common over the remainder of this year as investors switch back and forth between fears of a hard-landing and optimism of a soft-landing. That likely means increased volatility and that will discourage renewed appetite for carry at weaker yen levels. The scale of the drop in USD/JPY will certainly compel certain market players with yen upside exposure to buy yen at weaker levels and at least partially cover exposures. Still, we do also acknowledge that hedging costs remain elevated at the very front of the curve given the limit declines in 3mth rates relative to 2yr yields and until actual cheaper hedging costs are realised certain Japan investors will remain disincentivised to increase yen buying related hedging.

Data released from Japan yesterday will also encourage the BoJ that the route to better GDP growth is through lowering inflation pressures. The GDP deflator YoY was still elevated in Q2 at 3.0% but has eased and subsiding inflation is helping lift consumer spending. Household consumption was up 1.0% in Q2 after a 0.6% drop in Q1. If conditions in the financial markets continue to improve, the BoJ rhetoric will likely also shift given the authorities would prefer to see USD/JPY settle at lower levels rather than see a rapid retracement back toward the levels where intervention took place.

CARRY CONDITIONS IMPROVE BUT VOLATILITY RISKS REMAIN

Source: Macrobond & Bloomberg

GBP: More solid data helps pound to top G10 performer

It’s been in general a good week of economic data from the UK and that continued this morning with the retail sales data for July revealing a slightly stronger than expected reading when the upward revision to the June data is incorporated. The ex-auto fuel gain in sales of 0.7% MoM was 0.1ppt more than expected and there was a 0.2ppt upward revision to -1.3% to the June reading. Bad weather impacted the June reading but better weather in July along with sporting events and discounting helped boost the overall volume of sales. The data followed a solid Q2 GDP growth reading of 0.6% Q/Q after a 0.7% gain in Q1 – the best run of growth over two quarters since the two quarters to Q1 2022 before the inflation shock undermined economic activity.

Keeping inflation in check will therefore be the best avenue to more sustained economic growth going forward and certainly highlights the potential risk of the BoE failing to meet the expectations of market pricing on rate cuts. We expect the BoE to cut the key policy rate once more this year – at the November meeting when we get the next updated Monetary Policy Report. The market is currently priced for more than that – over 40bps and if we are correct we see potential for this to adjust which should help provide support for the pound.

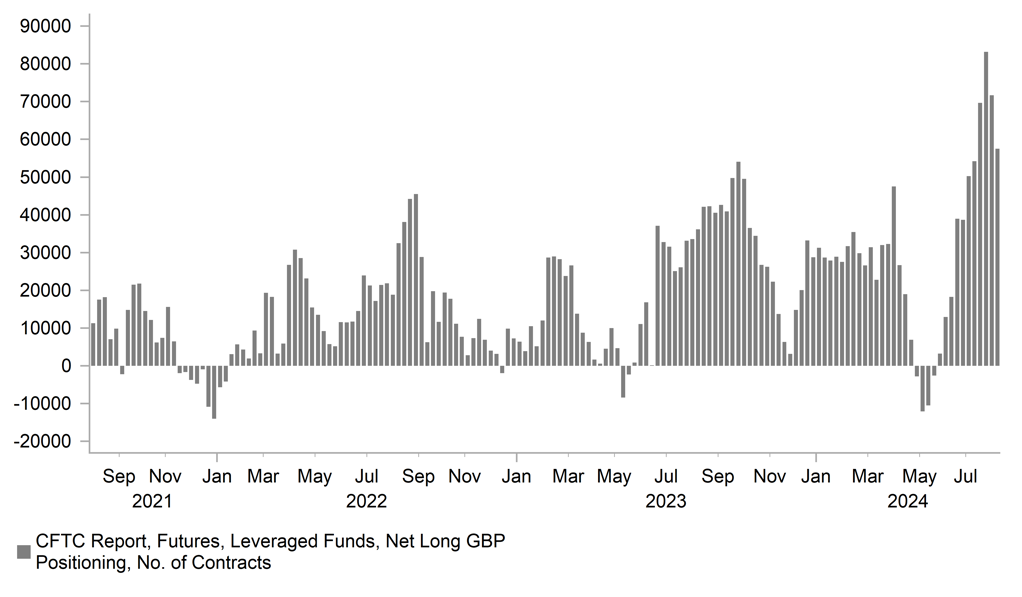

This week MPC member Catherine Mann spoke of an “upward ratchet” to the wage setting process that could be structural. Admittedly, Catherine Mann is a known hawk but her comment will have gained credibility after the government agreed to recent large wage deals in the public sector for doctors and this week for train drivers. Wage growth did slow in the jobs data this week so this confirms the disinflation process and the scope for rate cuts but the BoE is more likely to fall short of market expectations in circumstances of economic growth picking up and wage growth risks remaining elevated. After long GBP positioning amongst Leveraged Funds hit the highest level since 2014 a few weeks ago, the risk-off period saw some positioning paring that has resulted in GBP being the worst performing G10 currency in August to-date. However, it’s the best performing this week as risk appetite and we see scope for that outperformance to persist.

GBP HAS UNDERPERFORMANED DURING RISK-OFF PERIOD OF LATE AS LONG POSITIONS WERE CUT BUT SCOPE TO BOUNCE BACK INCREASING

Source: Macrobond, Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (MoM) |

Jul |

-- |

0.5% |

! |

|

IT |

09:00 |

Italian CPI (YoY) |

Jul |

-- |

1.3% |

! |

|

IT |

09:00 |

Italian CPI Ex Tobacco (YoY) |

Jul |

-- |

0.8% |

! |

|

IT |

09:00 |

Italian HICP (MoM) |

Jul |

-- |

-0.8% |

! |

|

IT |

09:00 |

Italian HICP (YoY) |

Jul |

-- |

1.7% |

! |

|

EC |

10:00 |

Trade Balance |

Jun |

13.3B |

13.9B |

!! |

|

CA |

13:15 |

Housing Starts |

Jul |

246.0K |

241.7K |

!! |

|

US |

13:30 |

Building Permits |

Jul |

1.430M |

1.454M |

!! |

|

US |

13:30 |

Housing Starts |

Jul |

1.340M |

1.353M |

!! |

|

CA |

13:30 |

Foreign Securities Purchases |

Jun |

15.90B |

20.89B |

!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Jun |

-2.3% |

0.4% |

! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Aug |

-- |

2.9% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Aug |

-- |

3.0% |

!!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Aug |

-- |

68.8 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Aug |

66.7 |

66.4 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Aug |

-- |

62.7 |

! |

|

US |

15:30 |

Atlanta Fed GDPNow |

Q3 |

2.4% |

2.4% |

!! |

|

US |

18:25 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg