Relief for global bond markets but limited spill-overs into G10 FX

JPY: BoJ sends stronger signal it is planning to hike rates next week

The yen has continued to strengthen overnight resulting in USD/JPY falling to an intra-day low of 155.21 as the pair moves further below the high set at the end of last week following the release of the much stronger nonfarm payrolls report at 158.87. The main trigger for the stronger yen has been building expectations for the BoJ to hike rates again as soon as next week. Those expectations were reinforced further overnight by the release of a Bloomberg report stating that BoJ officials see a good chance of an interest rate hike next week as long as the arrival of Donald Trump at the White house doesn’t trigger too many negative surprises according to people familiar with the matter. The BoJ will reportedly will reach a final conclusion after examining economic data, markets and the implications of US economic policies. The officials reportedly see Japan’s economy and inflation continuing to move largely in line with their projections, raising their confidence that the bank’s economic outlook will materialize in support of their stable 2% inflation target. A likely upgrade to the BoJ’s forecasts for inflation excluding fresh food and energy for this fiscal year and next year are viewed as supportive for a rate increase at next week’s policy meeting. Furthermore, the officials have become more confident over wage increases particularly after the Branch managers’ meeting earlier this month. They expect the annual spring wage negotiations to produce a solid outcome similar to last year’s and noted that Japanese firms are increasingly taking raising wages as a given.

Overall, the report sends the strongest signal yet that the BoJ is preparing market participants for a rate hike next week. Another rate hike will only be derailed if President-elect Donald Trump’s initial policy implementation plans prove disruptive for financial markets and/or raise downside risks over the outlook for the US economy. It follows on from similar hawkish policy messages delivered by Governor Ueda and Deputy Governor Himino in recent days that gives the Bloomberg report more credibility. The Japanese rate market has moved accordingly to more fully price in another rate hike as soon as next week. According to Bloomberg, there are currently around 20bps of hikes priced in now for next week and around 50bps of hikes in total by the end of this year.

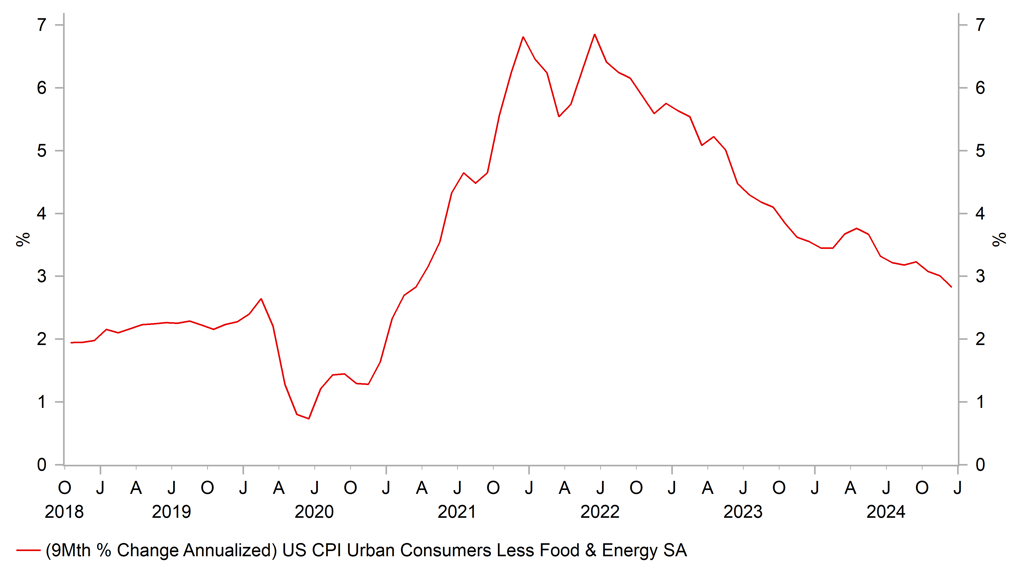

SLOWING US INFLATION SUPPORTS FED’S PLANS FOR RATE CUTS

Source: Bloomberg, Macrobond & MUFG GMR

USD: US inflation continues to slow ahead of Trump’s second term

The correction lower for USD/JPY has been driven as well by yesterday’s sharp drop in global bond yields which has helped to narrow yield spreads with Japan. After the heavy sell-off for global bond markets at the start of this year, the releases yesterday of softer inflation data both from the UK and US have provided some relief highlighting that market participants concerns over higher inflation may have gone too far in the near-term. The latest CPI reports from the UK and US provided a timely reminder that underlying trends for inflation are still slowing providing encouragement for the BoE and Fed to keep cutting rates this year. The UK rate market has moved to more fully price in another BoE rate cut in February (around 20bps) and is currently pricing in around 58bps of cuts in total by the end of this year. The dovish shift in BoE rate cut expectations has been encouraged further by the release this morning of softer monthly GDP data from the UK as well. The report revealed that UK economy has been flatlining towards the end of last year in line with the BoE’s latest forecasts for no growth in Q4. The sharp decline yesterday in services inflation by 0.6 percentage points to 4.4 in December will be welcomed by the BoE although the drop was exaggerated by the volatile airfares component. The developments have triggered a relief rebound for Gilts but there has been limited positive spill-overs for the pound. More active BoE easing would put a dampener on pound performance going forward.

US bond yields also dropped sharply yesterday resulting in the 10-year US Treasury yield falling back to 4.65% from the high earlier this week set at 4.81%. The US rate market has moved to price back in a higher probability that the Fed will follow through with plans to deliver two further rate cuts this year after US core inflation slowed for the second consecutive month in December helping to further dampen concerns over the stronger inflation prints recorded in September and October. The US rate market still expects the Fed to wait until Q2 to deliver the next rate cut. The recent pick-up in employment growth if sustained and Trump’s initial policy plans are expected to provide a higher hurdle for the Fed to lower rates further at the start of this year. The Fed will be reassured though by further evidence that underlying inflation pressures continue to slow. Core inflation slowed to +0.23%M/M in December. The breakdown revealed that core goods inflation increased by +0.05%M/M and core services inflation by +0.27%M/M. The core services ex-housing measure that the Fed has emphasized in the past still came in weaker than expected at +0.21%M/M despite an acceleration in airfares. Together with the softer PPI report for December, it points to an increase in the core PCE deflator of just +0.19%M//M in December. The sharp correction lower for US yields did initially trigger a sell-off for the US dollar but weakness proved short-lived. It highlights that it will take more than one month of softer US inflation to significantly undermine current bullish market sentiment towards the US dollar.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (YoY) |

Dec |

1.3% |

1.3% |

! |

|

UK |

09:30 |

BOE Credit Conditions Survey |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Trade Balance |

Nov |

11.8B |

6.8B |

!! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

Dec |

-- |

0.0% |

!! |

|

CA |

13:15 |

Housing Starts |

Dec |

252.0K |

262.4K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

210K |

201K |

!!! |

|

US |

13:30 |

Philly Fed Business Conditions |

Jan |

-- |

30.7 |

! |

|

US |

13:30 |

Retail Control (MoM) |

Dec |

-- |

0.4% |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Jan |

45 |

46 |

! |

|

US |

16:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg