USD sell-off extends further after US CPI report provides some relief

USD/JPY: US CPI reports provides some relief weighing on USD/JPY

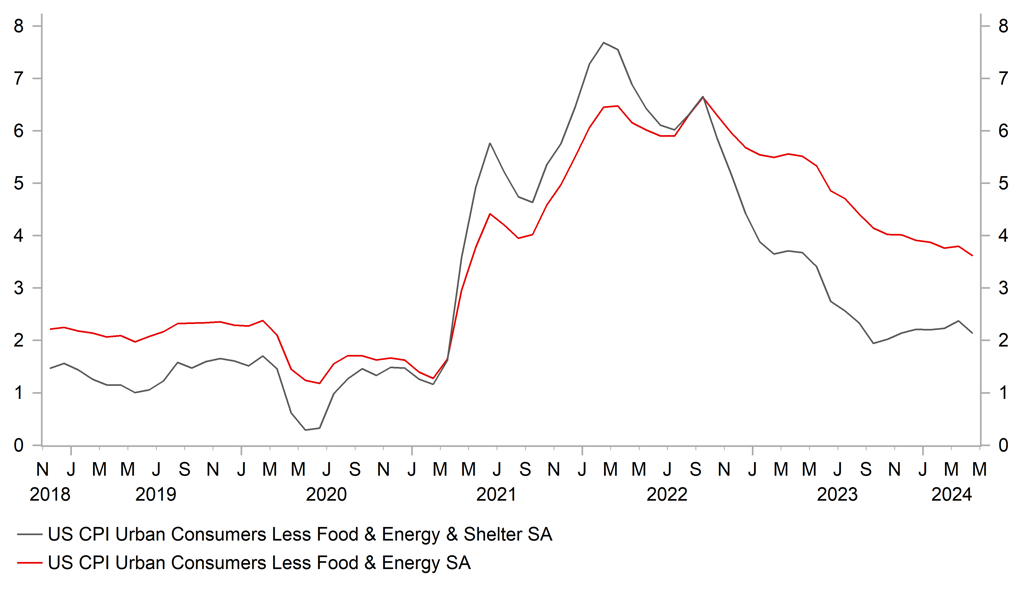

The US dollar has continued to correct lower following the release of the latest US CPI report yesterday. It has resulted in the dollar index falling back towards the 104.00-level and extending its decline since the recent peak on 16th April to around 2.3% which is now similar in size to the previous correction lower for the US dollar between February and March. The US dollar has continued to correct lower after the release yesterday of the latest US CPI for April brought some relief for market participants and the Fed by bringing an end to the run of upside inflation surprises at the start of this year. While it was not a soft inflation report, it did reveal that both headline and core US inflation both slowed by 0.1ppt to increases of 0.3%M/M in April. It followed three consecutive monthly prints of 0.4%M/M at the start of this year for core inflation. Together with the release of the PPI report for April earlier this week, the CPI report has reinforced expectations that the core PCE deflator for April released at the end of this month will also increase by similarly by around 0.2%-0.3%M/M. A welcome development for the Fed after recent stronger inflation readings when the core PCE deflator picked up to an annualized rate of 4.4% in Q1.

The breakdown of the CPI report revealed that core goods prices fell by -0.1%M/M driven by lower used and new vehicle prices. Core services inflation excluding housing stepped down to an increase of 0.4%M/M in April following an increase of 0.7%M/M in March driven by payback in car insurance inflation and weaker rents. Overall, the report has provided some much needed reassurance to back up our view that inflation will slow further through the rest of this year and open the door for the Fed to begin cutting rates. The US rate market has since moved to fully price back in two Fed rate cuts by the end of this year. The developments support our long EUR/USD trade recommendation outlined in our latest FX Weekly report (click here). The pair has broken above resistance from the 200-day moving average at around 1.0790 in recent days and we expect it to move closer to the year to date highs above the 1.1000-level.

The yen has been the main beneficiary from the lower US dollar and US yields which have resulted in USD/JPY falling back to a low overnight of 153.60. The yen has continued to strengthen overnight even as the release of the latest GDP report from Japan revealed that the economy contracted more than expected in Q1. Japan’s economy declined by an annualized rate of -2.0% in Q1 following flat growth in Q4. Japan’s economy has not grown now since Q2 of last year following the downward revision to growth in Q4. The breakdown revealed broad-based weakness although one off factors exacerbated the decline in GDP in Q1. The result reflects the negative impact of the New Year’s Day earthquake northwest of Tokyo and disruptions to auto production and sales after a certification scandal blew up at Daihatsu Motor Company. Economic growth is still expected to begin recovering from Q2 onwards. While weaker than expected growth at the start of this year is an unfavourable development, we do not believe it will alter the BoJ’s building optimism over the inflation outlook encouraged by recent stronger wage agreements. As a result, we still expect the BoJ to hike rates again sooner in July. If yen remains a concern, it will keep pressure on the BoJ to hike rates sooner as well.

US CORE INFLATION CONTINUES TO SLOW GRADUALLY (%Y/Y)

Source: Macrobond, Bloomberg & MUFG Research

AUD: Labour market helps to ease pressure on RBA to hike further

The broad-based US dollar sell-off helped to lift the AUD/USD rate briefly above 0.6700-level but the pair has since lost upward momentum after the release overnight of the latest labour market report from Australia. The report revealed encouraging evidence that labour market slack is increasing which should help to ease the RBA’s concerns over upside inflation risks. While employment increased by a further 38.5k in April, it was not sufficient to prevent the unemployment rate from rising by 0.2ppt to 4.1%. The unemployment rate has been drifting gradually higher since the 2H of last year. Labour supply has been boosted by migrant flows. Over the past year the working-age population has increased strongly by 2.9%Y/Y in April. Strong labour supply growth is helping to dampen wage growth. The wage price index increased by 0.8%Q/Q in Q1 down from 0.9% in Q4 2024. The RBA had been forecasting an increase of 4.3% for Q1. Recent labour market developments will help to ease pressure on the RBA to hike rates further.

At the same time, the performance of the Australian dollar this week has been impacted by market sentiment related to China. On the plus side for the Aussie, Bloomberg reported yesterday that China is considering further steps to support their domestic housing market which remains a headwind for growth. China is reportedly considering a proposal to have local governments buy unsold homes from property developers funded by state banks in an attempt to clear excess housing inventory. However, there are no details over the size of the stimulus program making it difficult to assess the impact at this stage. It has provided an offset to investor concerns over the risk of further disruption from another China-US trade war that would weigh on the Aussie. The immediate impact of this week’s new tariffs from President Biden covering just USD18 billion of imports from China is expected to be limited (4% of exports to US).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

BoE Financial Stability Report |

-- |

-- |

-- |

!! |

|

IT |

09:00 |

Italian CPI (YoY) |

Apr |

0.9% |

1.2% |

! |

|

EC |

09:00 |

ECB Financial Stability Review |

-- |

-- |

-- |

!! |

|

GE |

12:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Housing Starts |

Apr |

1.420M |

1.321M |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

219K |

231K |

!!! |

|

US |

13:30 |

Philly Fed Business Conditions |

May |

-- |

34.3 |

! |

|

US |

14:15 |

Industrial Production (MoM) |

Apr |

0.1% |

0.4% |

!! |

|

US |

15:30 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

US |

16:30 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

|

US |

20:50 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg