Pivotal week ahead for Fed policy and the USD

USD: Building confidence in 50bps Fed cut weighs on the US dollar

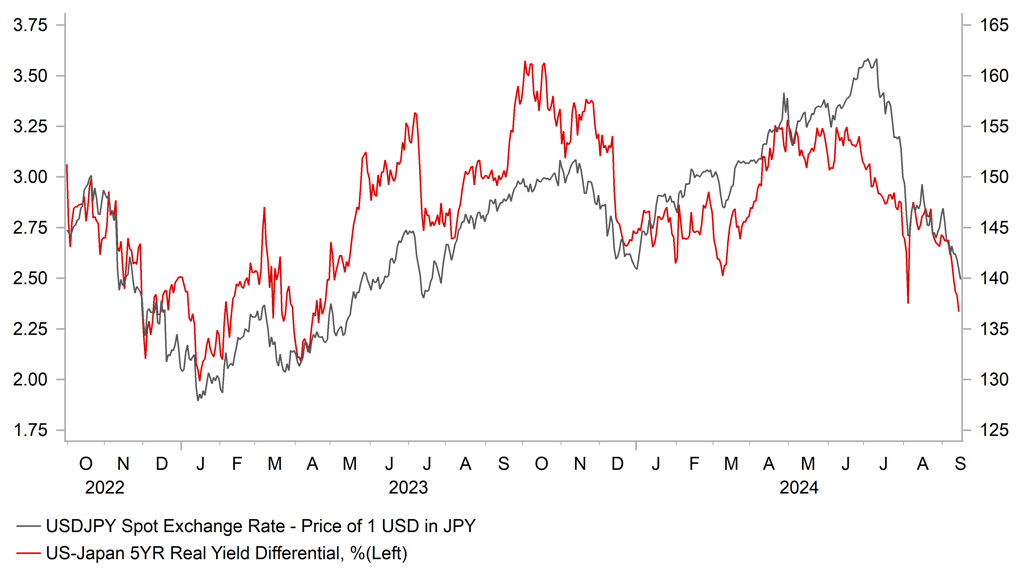

The US dollar has continued to weaken at the start of a pivotal week for the direction of Fed policy. It has resulted in USD/JPY falling back below the 140.00-level for the first time since the end of July of last year. The US dollar sell -off has been encouraged by building market expectations that the Fed could start their rate cut cycle this week by delivering a larger 50bp cut. The US rate market is currently pricing in around 40bps of cuts ahead of this week’s FOMC meeting indicating that market participants now judge it more likely than not that the Fed will deliver a larger 50bps cut. The dovish repricing of US rate market expectations was encouraged at the end of last week by the Wall Street Journal article by Nick Timiraos (“The Fed’s rate cut dilemma: Start big or small?”). The article has been interpreted by market participants as being an orchestrated move by the Fed given this journalist is known to have Fed links. The article also quotes Jon Faust who served as a senior advisory to Fed Chair Powell until earlier this year stating that the decision next week between 25/50bps is “a close call”.

Over the weekend there has been no pushback against market expectations for a larger Fed cut which has given market participants even more confidence. The WSJ’s Chief Economics commentator Greg Ip has even called for a 50bp cut from the Fed this week in an opinion piece. It fits with the view (click here) of our US rates strategist George Goncalves who has been calling a 50bps over the summer. Even if the Fed only delivers a smaller 25bps cut, we expect the accompanying guidance to be dovish and leave open the possibility of larger 50bps cuts if required especially if the US labour market continues to weaken heading into year end. For this reason even if only a 25bps cut is delivered this week, it will likely still be judged as more a matter of time before the Fed needs to speed up the pace of rate cuts.

In these circumstances, it is difficult to see US dollar staging a sustained rebound in the near-term. In our latest FX Weekly report (click here) we maintained our short USD/JPY trade recommendation ahead of this week’s FOMC and BoJ policy meetings. The BoJ policy meeting is likely to garner more market attention once the Fed policy meeting is out of the way even though it is likely to be just a holding operation. After raising rates for the second time at their last policy meeting at the end of July, and speeding up the pace of balance sheet reduction, the BoJ are expected to leave rates on hold this week as they continue to assess the impact of their previous policy actions. Importantly, we expect the BoJ to maintain hawkish policy guidance indicating that they will raise rates further if Japan’s economy performs in line with their outlook. The sharp strengthening of the yen and domestic equity market weakness since the July policy meeting is unlikely to prompt the BoJ to tone down their policy guidance at this stage. Market participants will be watching closely to assess if the BoJ could even raise rates again as soon as at the next policy meeting in October ahead of our own forecast for the next hike in December.

YIELD SPREADS CONTINUE TO MOVE IN FAVOUR OF STRONGER JPY

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Will BoE policy update cast more doubt on GBP carry trades?

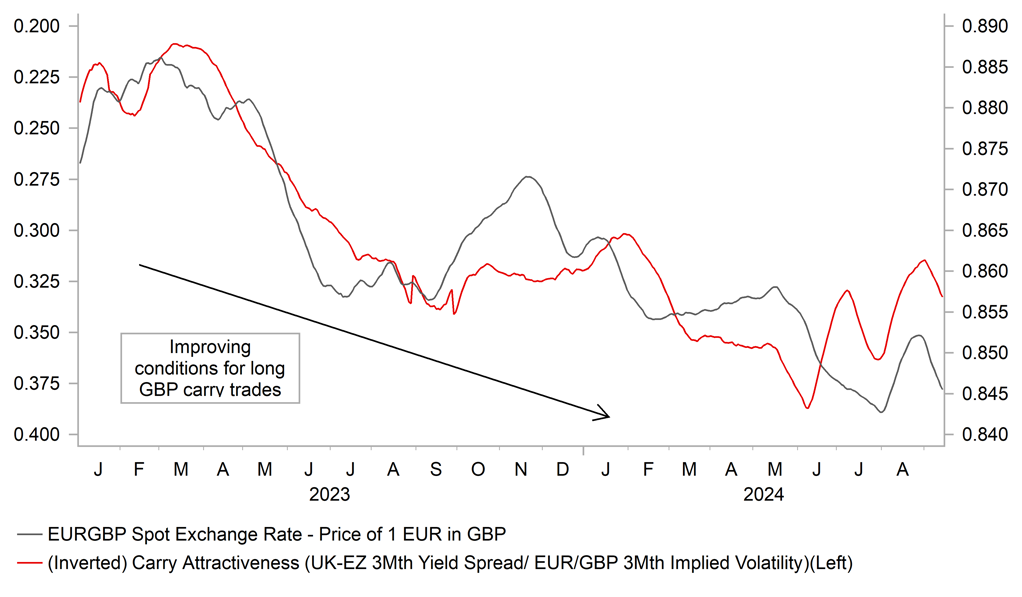

The other major central bank to hold their policy meeting in the week ahead will be the Bank of England. Cable has risen back towards recent highs that were recorded just above the 1.3200-level overnight driven by broad-based US dollar weakness. In contrast, EUR/GBP has been more stable as it continues to trade just below 0.8450. Recent price action suggests that short-term fundamental drivers for the GBP have not changed significantly beyond the pick-up in market volatility over the summer. The latest IMM report revealed that Leveraged Funds have been rebuilding long GBP positions over the last couple of weeks with longs moving back to multi-year highs. Market participants are still anticipating that yields will remain relatively higher in the UK in the year ahead than in other major economies. The UK rate market is pricing in around 150bps of BoE rate cuts by August of next year that would see the policy rate fall to 3.50%. In comparison the euro-zone and US rate markets are expecting the ECB and Fed policy rates to fall to around 2.25% and 2.80% respectively by next August.

However, the recent data flow from the UK has increased the likelihood that the BoE could deliver faster and deeper rate cuts which would take some of the shine off the GBP’s outperformance so far this year. Services inflation, wages and GDP growth have all recently been weaker than the BoE had been forecasting. While the weakness is unlikely to be sufficient to trigger a back-to-back rate cut this week after the decision to begin cutting rates in August was finely balanced. It should encourage the BoE to deliver a dovish policy signal that another rate cut is likely in November. If the BoE continues to become less concerned over persistent upside inflation risks there is room to price in deeper rate cuts in the year ahead. After adjusting for forecasted UK inflation, the BoE’s real policy rate is expected to remain much higher than for other major central banks implying that BoE rate cuts are relatively underpriced in our view. The UK rate market could be encouraged to price in more BoE easing after this week’s policy meeting if the decision to leave rates on hold is closer than expected. It will be the first MPC meeting for new member Alan Taylor who could lean the MPC in a more dovish direction. He replaced Jonathan Haskel who was one of the most hawkish MPC members and voted to leave rates on hold in August.

In these circumstances, we judge that risks are tilted to the downside for the GBP from this week’s MPC meeting. The GBP has tended to weaken following recent MPC meetings. Cable declined in the first six hours after 3 out of the last 4 MPC meetings by an average of -0.2%. The biggest sell-off was following the March MPC meeting when cable fell by -0.7%. For an even bigger negative GBP reaction, the BoE would have to deliver a surprise back-to-back rate cut this week which appears unlikely. We see a higher probability that back-to-back cuts could be delivered in November and December weighing more heavily on GBP performance later this year. Until then this week’s BoE meeting is unlikely to be sufficient on its own to significantly undermine the GBP’s carry appeal. With the BoE still expected to cut rates more slowly than the Fed in the coming months, any pullback for cable this week will be viewed as a short-term buying opportunity in anticipation that it can still rise further above the August high at 1.3266. Please see our latest FX Weekly report for more details (click here).

ARE THE BEST DAYS OVER FOR GBP CARRY TRADES?

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (YoY) |

Aug |

1.1% |

1.3% |

!! |

|

EC |

09:10 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Wages in euro zone (YoY) |

Q2 |

-- |

5.30% |

!! |

|

EC |

10:00 |

Labor Cost Index (YoY) |

Q2 |

-- |

5.10% |

!! |

|

EC |

10:00 |

Trade Balance |

Jul |

14.9B |

22.3B |

!! |

|

EC |

13:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Sep |

-4.10 |

-4.70 |

!! |

Source: Bloomberg