Powell signals caution as trade deal optimism picks up

USD: JPY weakens on trade deal optimism

The US dollar weakened into the close of trading yesterday but has rebounded helped in part by optimism over the pace in which the US might be willing to reach deals with key trading partners. The comments made by Fed Chair Powell at the Economic Club in Chicago certainly indicated the difficulty central banks find themselves in in trying to manage upside inflation risks and downside growth risks. Our sense was that Powell clearly leaned in favour of focusing on inflation and ensuring price stability arguing that that was the basis for stronger economic growth. Powell stated that it was the Fed’s obligation to “make certain” that a one-time increase in prices did not turn into an “ongoing inflation problem”. That to us does not sound like a central bank that will be rushing to cut rates and there remains an increasing risk that the Fed could delay for longer than the markets expect to cut rates. The OIS market has currently 18bps of easing priced for June, down two basis points from before Powell’s speech. Still, UST bond yields remained lower in part due to the S&P 500 declining by 2.2%.

The lower UST bond yields weighed on the US dollar and it was the comments from Japan’s Economic Revitalisation Minister Ryosei Akazawa that helped prompt the rebound of the dollar. President Trump had earlier posted on Truth Social that “Big Progress” had been made in initial trade talks with Japan and Akazawa echoed the optimism stating that the US wanted a deal within the 90-day tariff postponement period. He added that there was no discussions related to FX.

The length of time of these meetings make it difficult for us to believe that anything of substance would have been agreed and for Japan this meeting was about “building trust”. Nonetheless, another meeting is scheduled and the comments made have understandably lifted optimism. We perhaps should not be surprised. If there are countries that the US would be eager to reach deals with it would be the countries in Asia that have notable trading relations with China. We are also not surprised that FX was not raised as an issue. It is reported that Scott Bessent sees BoJ monetary policy as a cause of FX misalignment in Japan but given the BoJ is one of the only major central banks still signalling possible rate hikes (again by Governor Ueda today) and given the notable drop in USD/JPY, reason for complaint by the US is currently weak.

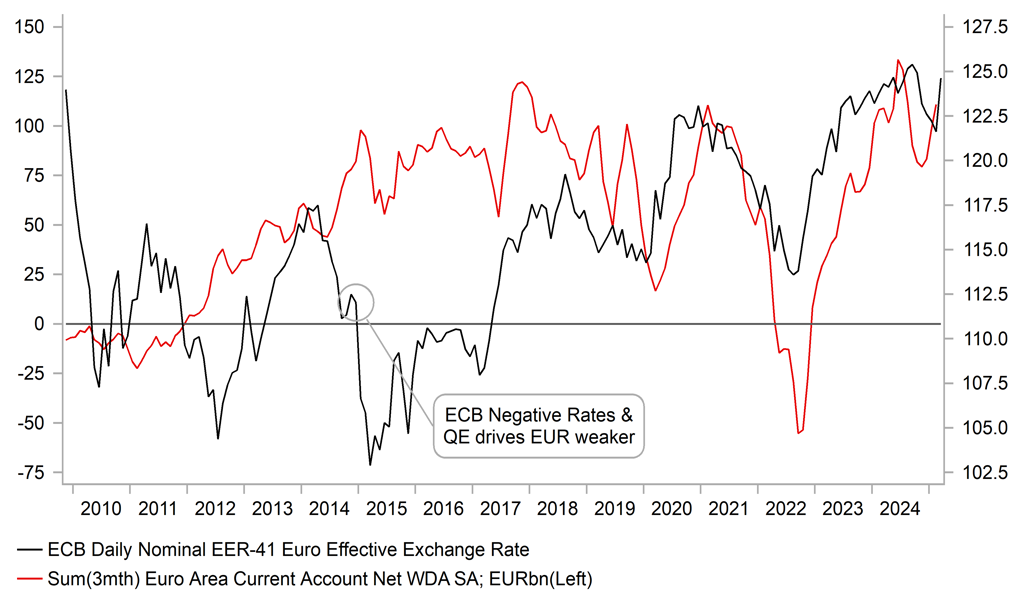

We expect the ECB to cut by 25bps today and the ECB should signal the scope to cut further given the downside growth risks will likely be viewed as greater than the upside inflation risks. The EUR EER-41 is 5.5% stronger than assumed in March forecasts that will add to downside inflation risks relative to those forecasts. Still, like Powell last night and BoC Governor Macklem, we shouldn’t expect any strong conviction in policy guidance given the elevated uncertainty. That should limit post-press conference moves in EUR/USD and rates.

EURO-ZONE’S SUBSTANTIAL CURRENT ACCOUNT SURPLUS HELPING PROVIDE EUR WITH SAFE-HAVEN APPEAL

Source: Bloomberg, Macrobond & MUFG GMR

CAD: On hold with little guidance possible

On a day in which the US dollar sold off across G10, the Canadian dollar advanced by 0.7% yesterday helped in part by the decision of the Bank of Canada to hold off from cutting rates again – the first pause from the BoC since the beginning of the easing cycle in June last year. The OIS market was partially priced for a 25bp cut (at about a 35%-40% probability) so the hold helped push USD/CAD lower. Nonetheless the move lower was relatively modest given the dollar was weaker more broadly given that BoC Governor Macklem was very clear that the BoC was willing to respond “decisively” if required on any new information that justified action. The statement itself was a little more nuanced and not as explicit with the BoC unwilling to provide clear guidance. The Governing Council would “proceed carefully, with particular risks and uncertainties facing the Canadian economy”. The BoC also published its Monetary Policy Report and given the difficulty in forecasting the outlook presented two scenarios – Scenario 1 was the more benign with trade tariffs “negotiated away” but under a difficult and uncertain process that lasts through to the end of 2026. Scenario 2 assumed the current tariffs are added to by the US and a “long-lasting trade war unfolds.”

Scenario 1 sees global and Canadian growth slow temporarily and inflation declines to 1.5% for one year and then returns to the 2.0% target. Scenario 2 there is a sharper downturn in global growth and inflation picks up but in Canada a “significant recession” unfolds with a temporary pick-up in inflation to 3.0% by mid-2026 before then returning to the 2.0% target.

Based on these scenarios and the comment from Governor Macklem to act “decisively” if required, this pause probably won’t last and a rate cut in June is likely assuming by then we have more clarity in US trade policy. 50bps of cuts are priced in the OIS market which we believe reflects Scenario 1 laid out by the BoC – the more benign one. Anything more aggressive, and the BoC will cut by more than priced. With little in the way of guidance from the BoC, rates in Canada have not moved much since the meeting and whether the BoC needs to act more aggressively will only be determined once we get tariff policy clarity. Rate spreads are also less influential at the moment on USD/CAD moves but current levels of USD/CAD are also more aligned with Scenario 1 from the BoC and any signs of Scenario 2 emerging would likely put renewed downward pressure on CAD.

USD/CAD TRADING AT LEVELS REFLECTING MORE OPTIMISTIC SCENARIO

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

BOE Credit Conditions Survey |

-- |

-- |

-- |

!! |

|

EC |

13:15 |

Deposit Facility Rate |

Apr |

2.25% |

2.50% |

!!!! |

|

EC |

13:15 |

ECB Marginal Lending Facility |

-- |

-- |

2.90% |

!! |

|

EC |

13:15 |

ECB Monetary Policy Statement |

-- |

-- |

-- |

!! |

|

EC |

13:15 |

ECB Interest Rate Decision |

Apr |

2.40% |

2.65% |

!!!! |

|

US |

13:30 |

Building Permits |

Mar |

1.450M |

1.459M |

!! |

|

US |

13:30 |

Building Permits (MoM) |

Mar |

-- |

-1.0% |

! |

|

US |

13:30 |

Housing Starts |

Mar |

1.420M |

1.501M |

!! |

|

US |

13:30 |

Housing Starts (MoM) |

Mar |

-- |

11.2% |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

225K |

223K |

!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Apr |

2.8 |

12.5 |

!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!!!! |

|

US |

16:45 |

Fed Governor Barr speaks |

!! |

Source: Bloomberg