FOMC minutes and poor JGB auction lift yields further & helps dollar

USD: FOMC minutes highlight inflation concerns persist

The contents of the minutes from the FOMC meeting in July were largely as expected in that there was still plenty of evidence that concerns continue over upside risks to inflation with clearly a greater emphasis on the “significant” upside risks to inflation. There were references to “several” FOMC members being more mindful of overtightening but with the Fed staff scrapping its call on a mild recession and with the data coming in stronger than expected, it was understandable that the markets conclusion was to take yields higher still. The 10-year UST bond yield is now just 3bps from the cyclical high recorded in October of last year. The US dollar took another leg stronger. The higher momentum for long-term yields was further reinforced today by the poor JGB auction in Japan. The yield on the 20-year JGB auction generated from the lowest price was 6bps higher than the average (longest tail since 1987) with a bid-to-cover of 2.8 – the lowest since September last year.

The upward momentum for yields is strong indicated further today by the move higher in 10-year Australia bond yields despite much weaker than expected employment data. The 10-year yield is still 12bps higher today.

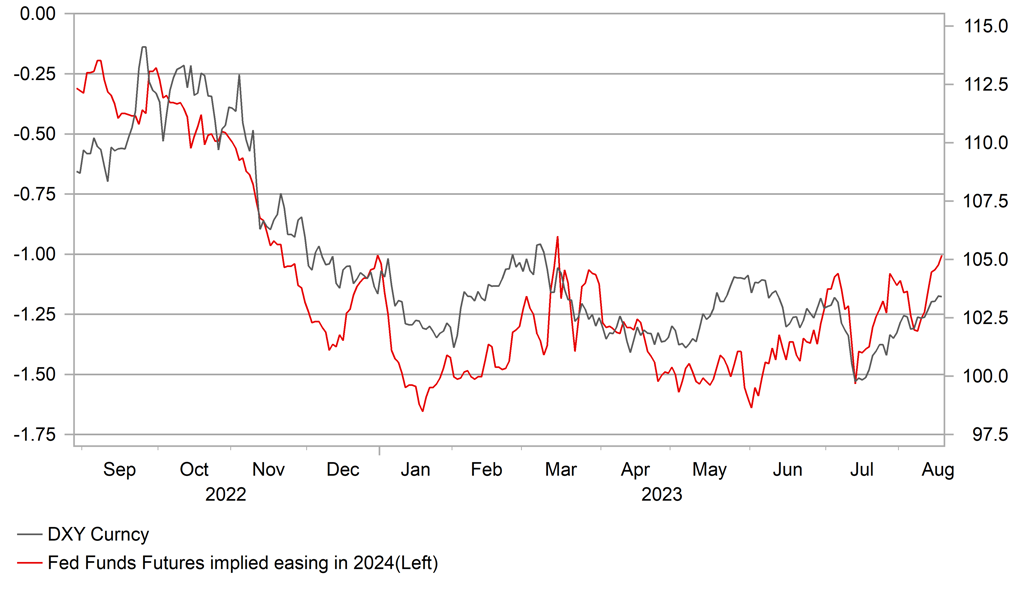

The move in US yields comes in the aftermath of more stronger than expected data. Housing Starts and Industrial Production data for July helped reinforce the prospect of strong GDP growth in Q3. The Atlanta FedNow GDP tracker for Q3 is now running at 5.8% underlining the potential for the markets to reconsider its call for an end to Fed tightening and/or the extent of rate cuts priced in 2024. Last week, the Dec-23-Dec-24 fed funds futures spread implied 125bps of easing. Now that has shrunk to 100bps.

As we have been indicating here and in our FX Weekly (here) last Friday, the short-term bias remains favourable for the dollar and the minutes and the data support that view. The further strengthening of the dollar has brought USD/JPY into the danger zone for intervention to halt the move higher. Resistance to a higher USD/JPY could at least involve allowing the 10-year JGB yield to drift further higher. You cannot fight a weaker yen and higher yields in a credible manner. From an intra-day low on 28th July, USD/JPY is 8 big figures higher so this move is of a scale that could justify action.

2024 FED CUTS SLOWLY BEING REDUCED – HELPING LIFT USD

Source: Bloomberg, Macrobond & MUFG GMR

USD: Foreign investors demand for US equities surges to record

The Treasury International Capital (TIC) flow data for June was released on Tuesday evening and much of the focus was on the ongoing decline in China holdings of US Treasury bonds. China’s holdings fell to USD 835bn, down USD 12bn from May and the lowest total since June 2009. The only caveats in regard to that data is firstly some of this decline has been offset by China’s increased holdings of US Agency bonds. The June holdings of Agency debt totalled USD 270bn – a record in data since 2011. Those holdings have increased USD 70bn since the end of 2021, the time since China’s holdings of UST bonds declined more quickly, by USD 205bn. Secondly, holdings are probably larger with holdings from China captured incorrectly elsewhere.

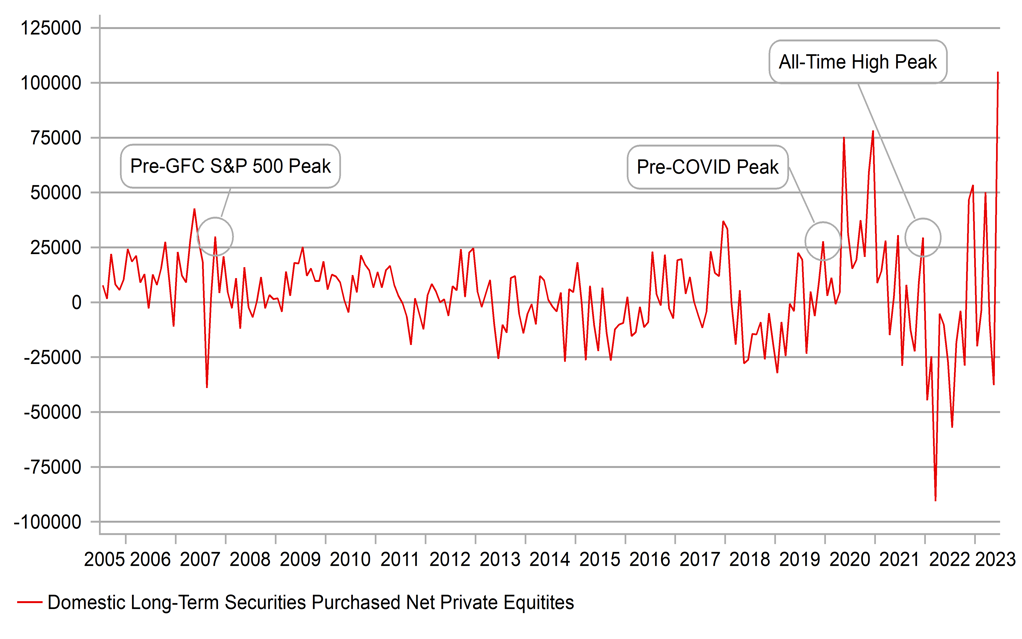

But the China holdings reduction has been ongoing since the peak in 2014 and wasn’t a particular surprise. What was much more notable was the data showing a record surge in buying by US equities by foreign investors, which totalled USD 105bn. June was a month of strong risk appetite with US equities performing well. Tech and AI was a particular theme and that could well have been the strong draw for foreign investors. Nvidia shares surged on 25th May after the chipmaker forecast a huge jump in revenues in anticipation of the impact of broadening demand fuelled by demand for AI technologies. From then to the high in July Nvidia shares surged 57%.

There was limited impact on the dollar from this surge in demand – this is often the case and the TIC flow data is not a reliable guide of FX direction. The Fed’s TWI for advanced economies fell modestly in June. Two factors on this occasion can help explain this. Firstly, US investors also were strong buyers of foreign equities in June, buying USD 34bn worth, the second largest one-month outflow to foreign markets on record, surpassed only once in March 2014. Secondly other drivers like broader strong risk appetite can over-power the equity-specific flow itself.

RECORD FOREIGN INVESTOR BUYING OF US EQUITIES IN JUNE

Source: Macrobond & Bloomberg

NOK: Norges Bank should keep open prospects of more hikes

Norges Bank is expected to hike its key policy rate today (0900 BST) by 25bps, taking it to 4.00%. Norges Bank signalled at the June policy meeting when they hiked by 50bps that they intended to take the key policy rate to 4.25%, so if 25bps is delivered today, any guidance in the statement will be important. Inflation in August came down more than expected offsetting the upside surprise in July. That plus the recovery of NOK versus EUR from the record level in May should allow Norges Bank to hike by 25bps today and leave open the prospect of more. Norges Bank will likely be conscious of the risk of increased volatility and risk aversion going forward which could fuel renewed NOK selling.

It’s also important for Norges Bank to leave open the prospect of more hikes given the policy rate in real terms remains deeply negative. Even after the sharper drop in inflation this month, Norway’s real policy rate remains the third lowest at -2.65% with only Sweden’s and Japan’s real policy rates lower. We believe it is no coincidence that JPY, SEK and NOK are three worst performing G10 currencies since the start of 2022.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Interest Rate Decision |

-- |

4.00% |

3.75% |

!!! |

|

EC |

10:00 |

Trade Balance |

Jun |

18.3B |

-0.3B |

! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,700K |

1,684K |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

240K |

248K |

!!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Aug |

-10.0 |

-13.5 |

!!! |

|

US |

13:30 |

Philly Fed Business Conditions |

Aug |

31.6 |

29.1 |

! |

|

US |

13:30 |

Philly Fed CAPEX Index |

Aug |

9.20 |

8.60 |

! |

|

US |

13:30 |

Philly Fed Employment |

Aug |

-0.7 |

-1.0 |

!! |

|

US |

13:30 |

Philly Fed New Orders |

Aug |

-13.5 |

-15.9 |

!! |

|

US |

13:30 |

Philly Fed Prices Paid |

Aug |

10.10 |

9.50 |

! |

|

US |

15:00 |

US Leading Index (MoM) |

Jul |

-0.4% |

-0.7% |

! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

8,208B |

!! |

|

US |

21:30 |

Reserve Balances with Federal Reserve Banks |

-- |

-- |

3.229T |

! |

Source: Bloomberg