Trump tariff threats are disruptive and support a stronger USD

USD: China growth & budget deficit targets in focus ahead of Fed & BoJ

It has been another relatively quiet trading session overnight ahead of the latest central bank policy updates from the Fed, BoE and BoJ later this week. The dollar index continues to trade just below an important resistance level at 107.00 while the yen remains on a softer footing. It has helped to lift USD/JPY back above the 154.00-level. Renewed yen selling this month has been encouraged by the scaling back of BoJ rate hike expectations. Market participants are more confident now that the BoJ will wait at least until early next year before hiking rates further. The Japanese rate market is currently pricing in only around 5bps of hikes for this week’s policy meeting. Given the BoJ has stated that it wants to more clearly communicate policy action to avoid a repeat of financial market instability experienced in early August, it appears highly unlikely that the BoJ will surprise market participants by delivering a rate hike this week unless a last minute media report is released in the coming days to significantly alter market expectations ahead of Thursday’s meeting.

Similar to the yen, the Chinese renminbi is falling back towards year to date lows against the US dollar encouraged by widening yield spreads between the US and China this month. The sharp adjustment lower for yields in China have been encouraged by building expectations that the PBoC will deliver further rate cuts to support growth. It has been reported as well overnight that Chinese leaders plan to set an annual growth target for next year of around 5% which would match this year’s target. Given that economic growth this year has become more reliant on external demand which is likely to face headwinds next year from higher tariffs implemented under the incoming Trump administration, Chinese policymakers will be under more pressure to boost domestic demand to meet next year’s growth target. The report adds that Chinese leaders will raise the budget deficit target for next year to 4.0% of GDP to allow more room for further fiscal stimulus to support growth. Setting a 4.0% headline budget deficit target would be the widest since a major tax reform in 1994 according to Bloomberg. Top officials also promised to issue more special treasury bonds and local government special bonds last week which are not covered by the official deficit target but have been an important source of infrastructure investment.

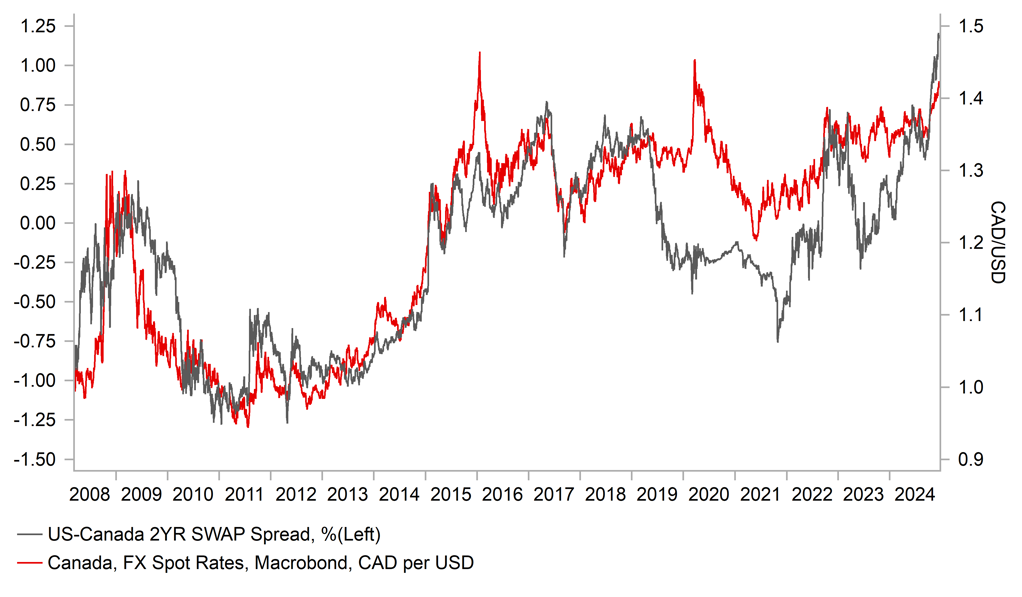

UNUSUALLY WIDE POLICY DIVERGENCE ENCOURAGING WEAKER CAD

Source: Bloomberg, Macrobond & MUFG GMR

CAD: Trump tariff threat contributes to political uncertainty in Canada

One of the main developments yesterday was the surprise decision by the Canadian Finance Minister Chrystia Freeland to resign just hours ahead of presenting the so-called fall economic statement. The decision triggered a modest sell-off for the Canadian dollar which is currently trading close to year to date lows against the US dollar at around 1.4270. There was also a sell-off in the Canadian government bond market with the 10-year yield rising by around 8bps up to a high of 3.23% before dropping back to 3.18%. Former Finance Minister Freeland’s decision to resign was driven by a falling out with Prime Minister Trudeau over the direction of fiscal policy. Freeland stressed that the government should keep “our fiscal powder dry today, so we have the reserves we may need for a coming tariff war. That means eschewing costly political gimmicks, which we can ill afford and which make Canadians doubt that we recognize the gravity of the moment”. She had refused an offer for a new role in the government involved in helping to manage the Canada-US trade relationship but would not have included running a government department.

The Canadian government ran a much larger fiscal deficit than planned in the last fiscal year coming in at CAD62 billion compared to former Former Finance Minister Freeland’s pledge to keep the shortfall at or below CAD40.1 billion. Higher than expected charges for Indigenous contingent liabilities and COVID support allowances added CAD21.1 billion to the deficit in the last fiscal year. According to the fall economic update, the government will run a narrower deficit of CAD48.3 billion in current fiscal year 2024-25 coming at around 1.6% of GDP compared to the finance department’s forecasted deficit of CAD42.2 billion. Despite running a wider deficit again, the size of Canada’s budget deficit remains relatively smaller than for other major economies. The fall economic update also outlined key new expenditures including a CAD1.3 billion for border agencies over six years in an attempt to tighten border controls in response to President-elect Trump’s threat (click here) to impose 25% tariffs on all goods imported from Canada unless they take action to address inflows of illegal immigrants and drugs. The government also announced an extension of tax breaks on business investment through to 2030 that will cost CAD17.4 billion.

Freeland’s decision to resign and publicly criticize the government’s fiscal policy plans has further weakened Prime Minister Trudeau’s grip on power in Canada. In September, the New Democratic Party pulled out of a so-called “supply and confidence” arrangement that helped the Liberals pass laws in the house of Commons, where they are the largest party but don’t have a majority of seats. The unfavourable political developments are supportive for our long USD/CAD trade idea (click here) although are unlikely to trigger a significant sell-off for the Canadian dollar on their own.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Ifo Business Climate Index |

Dec |

85.5 |

85.7 |

!! |

|

GE |

10:00 |

German ZEW Economic Sentiment |

Dec |

6.8 |

7.4 |

!! |

|

EC |

10:00 |

Trade Balance |

Oct |

11.7B |

12.5B |

!! |

|

US |

13:30 |

Core Retail Sales (MoM) |

Nov |

0.4% |

0.1% |

!!! |

|

CA |

13:30 |

Core CPI (YoY) |

Nov |

-- |

1.7% |

!! |

|

US |

14:15 |

Industrial Production (MoM) |

Nov |

0.3% |

-0.3% |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Dec |

47 |

46 |

! |

Source: Bloomberg