US yields & USD have lost upward momentum this week

USD: US yields and the US dollar correct lower ahead of Trump’s inauguration

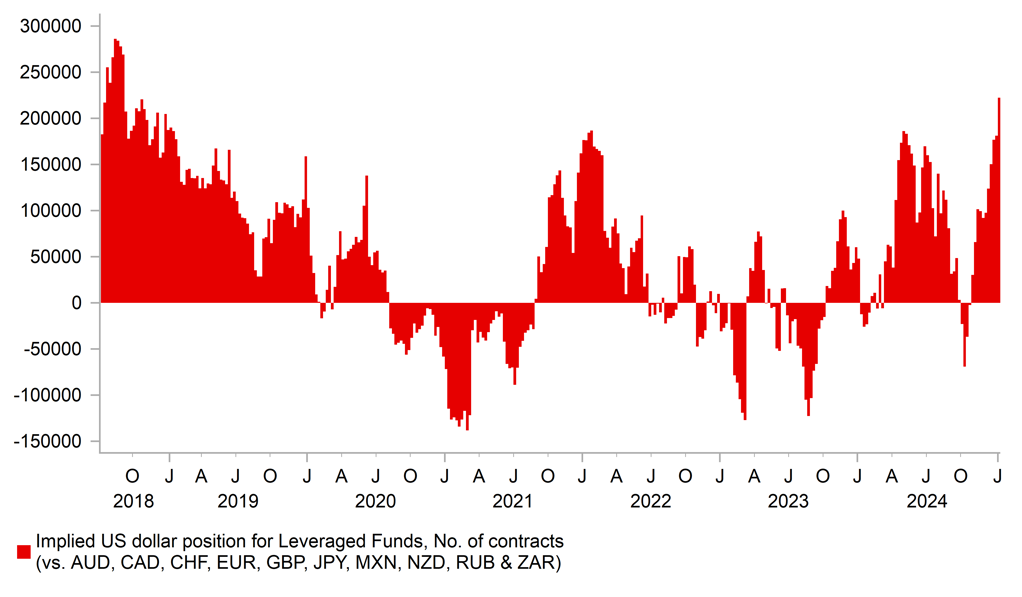

The US dollar is currently on track for its first weekly decline since the end of November. After six consecutive weeks of gains the dollar index has run into resistance at the 110.00-level over the past week ahead of next week’s inauguration of Donald Trump as the 47th president of the United States. The latest weekly positioning data from the CFTC highlights that the long USD positioning has become an increasingly crowded trade. Leveraged Funds had built up long US dollar for six consecutive weeks to the week ending 7th January. In the latest week long US dollar positioning jumped to its highest level since September 2018 which coincidentally was also the period when Trump was raising tariffs against China during his first term. The CFTC report reveals that long US dollar positions have been mainly built up against the Australian dollar, Canadian dollar, euro and the yen. After strong gains over the last couple months, market participants are now waiting for confirmation that Trump will implement front-loaded and aggressive tariff hikes at the start of his second term to encourage further US dollar strength. However it has created the risk of a short-term sell-off for the US dollar if initial tariff plans fall short of expectations. Press reports in recent weeks have suggested that key figures in Trump’s inner circle are pushing for a more gradual phase in and/or sector specific tariffs which if realized could at least trigger an initial reversal of US strength although we would still doubt how long any weakness would last.

Similar price action has been evident in the US Treasury market in recent days where yields have corrected lower at the end of this week after hitting a peak of 4.81% on Tuesday. The sharp correction lower in US yields has been encouraged by the softer US PPI and CPI reports for December which have encouraged market participants to price back in more Fed rate cuts this year. The US rate market has moved to more fully price back in 50bps of cuts by the end of this year, and bringing market pricing back more into line with the Fed’s own plans. The dovish repricing was encouraged further yesterday by comments from Fed Governor Waller who described this week’s softer US inflation data as “very good”. He went on to add that “if we continue getting numbers like this, it’s reasonable to think rate cuts could happen in the first half of this year” and he wouldn’t entirely rule out another cut as soon as in March. Based on his own estimate of the neutral rate, he believes that another three or four rate cuts are possible this year.

Whether this week’s highs for the US dollar and US Treasury yields will prove more than just temporary peaks will be determined by the market reaction to Trump’s initial policy proposals in the coming weeks. Our forecasts (click here) for further US dollar strength are built on the assumption that Trump will meet expectations for front-loaded tariff hikes but we also acknowledge that the market has already moved a long way to front run policy action since the US election.

LONG USD POSITIONING IS A VERY CROWDED TRADE

Source: Bloomberg, Macrobond & MUFG GMR

CNY: China facing a bigger challenge to meet growth target this year

The main economic data releases overnight were from China where it was confirmed that the economy met the government’s growth target for this year of around 5%. Real GDP growth picked up to an annual rate of 5.4% in Q4 from 4.6% in Q3 brining full-year growth to 5.0% representing a modest slowdown compared to growth of 5.2% in 2023. In addition, the latest monthly activity data revealed that industrial production growth picked up to an annual rate of 6.2% in December from 5.4% in November and retail sales growth to an annual rate of 3.7% in December up from 3.0% in November. Stronger growth at the end of last year was supported by the rolling out stimulus measures. Domestic policymakers have already clearly indicated that they are prepared to further step up fiscal and monetary stimulus this year if required to provide an offset to the negative impact from Trump’s upcoming tariff hikes.

Market participants are increasingly anticipating that a weaker renminbi will play a role as well in supporting China’s economy by providing an offset to the tariff hikes. USD/CNY has moved up to the top of the PBoC’s +/- 2.0% daily trading band at the start of this year indicating more selling pressure for the renminbi. However, the PBoC is still keeping the daily fix stable at just below the 7.2000-level where it has been held over the last couple of months and is helping to cap further upside for USD/CNY in the near-term. By keeping the renminbi more stable against the US dollar it has meant that the renminbi has strengthened alongside the US dollar against the currencies of other trading partners. The CFETS RMB index has increased by around 3.5% since late September reaching its strongest level since autumn 2022. Recent communication and actions taken by Chinese policymakers have indicated strongly that they continue to prioritize renminbi stability at the current juncture. Overall, the developments remain consistent with our view for only a gradual deprecation of the renminbi in the year ahead. Our latest forecasts (click here) for USD/CNY are looking for a move up to the 7.5000-level by the middle of this year.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Nov |

28.0B |

25.8B |

! |

|

GE |

10:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

CPI (YoY) |

Dec |

2.4% |

2.2% |

!!! |

|

US |

13:30 |

Housing Starts |

Dec |

1.330M |

1.289M |

!! |

|

US |

14:15 |

Industrial Production (MoM) |

Dec |

0.3% |

-0.1% |

!! |

|

UK |

17:00 |

BoE Deputy Governor Woods Speaks |

-- |

-- |

-- |

!! |

|

UK |

17:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg