USD rebounds driven by negative developments outside of US

CNY & JPY: China activity data in focus at start of this week

The foreign exchange market has remained relatively stable at the start of this week with the US dollar continuing to trade at stronger levels after rising to its highest level since early in May at the end of last week. The US dollar benefitted last week mainly from negative developments overseas reflecting the pick-up in political risk in France, and further disappointment over the slow pace of policy normalization in Japan. It has meant that the US dollar has strengthened even though US yields have continued to correct lower. The 2-year and 10-year US Treasury yields have both fallen back to their lowest levels since the start of April at around 4.70% and 4.20% respectively. Negative developments overseas have helped to dampen the negative impact on the US dollar from clear evidence of softer US inflation in May that revitalized expectations that the Fed will deliver multiple rate cuts in 2H of this year. Two 25bps Fed rate cuts are almost full priced back in by the end of this year. The ongoing drop in US yields and more risk off trading at the end of last week did though prevent the yen from continuing to sell-off after the BoJ policy meeting on Friday. After initially hitting a high of 158.26 on Friday morning, USD/JPY has since fallen back to pre-policy announcement levels at around 157.40. The yen rebound was encouraged in part by comments from BoJ Governor Ueda in the press conference who stated that the reduction in JGB purchases when they are announced next month will be a “considerable amount”. In addition, he appears to have upped the importance of the impact on the inflation outlook from the weaker yen. He stated that FX rates are likely to have a “bigger impact” than in the past, and that the BoJ is “checking daily the range of FX fluctuations, their sustainability, and the extent to which they will be passed on to domestic prices”. Those comments keep alive our expectation for the BoJ to hike rates again as soon as next month. In light of these developments and with yields outside of Japan continuing to correct lower alongside rising political risks in France, we recommended a short EUR/JPY trade idea in our latest FX Weekly (click here) report released on Friday. Our quant analysis found that the correlation between the yen and Swiss franc has strengthened over the past month perhaps providing an early indication that the yen’s safe haven status is reviving.

The main focus during the Asian trading session overnight was the release of the latest monthly activity data from China for May. The data has added to concerns that China’s economy is slowing in Q2 after the stronger than expected growth at the start of this year when the annual rate of growth picked up to 5.3%. It was revealed overnight that industrial production slowed to an annual rate of 5.6% in May down from 6.7% in April, and similarly fixed asset investment growth slowed to 4.0% in the first five months of 2024 compared to 4.2% in January to April. The one bright spot was the pick-up in retail sales growth to 3.7%Y/Y in May up from 2.3% in April although it was boosted by a long holiday according to Bloomberg. Weakness in the housing market remains a drag on growth with property investing contracting by an annual rate of -10.1%. Recent measures rolled out by the government to support the housing market should help to boost the economy in the coming months. Overall the report is unlikely to reverse the bearish trend for the renminbi. USD/CNY is continuing to trade close to the top of the daily band that comes in at 7.2570, and the PBoC have been allowing the daily fix to move gradually higher over the past month. A retest of last year’s highs for USD/CNY between 7.3000 and 7.3500 still appears likely.

POLITICAL RISKS ARE WEIGHING ON EURO

Source: Bloomberg, Macrobond & MUFG GMR

EUR/GBP: Politics tips balance of risks to downside for EUR/GBP

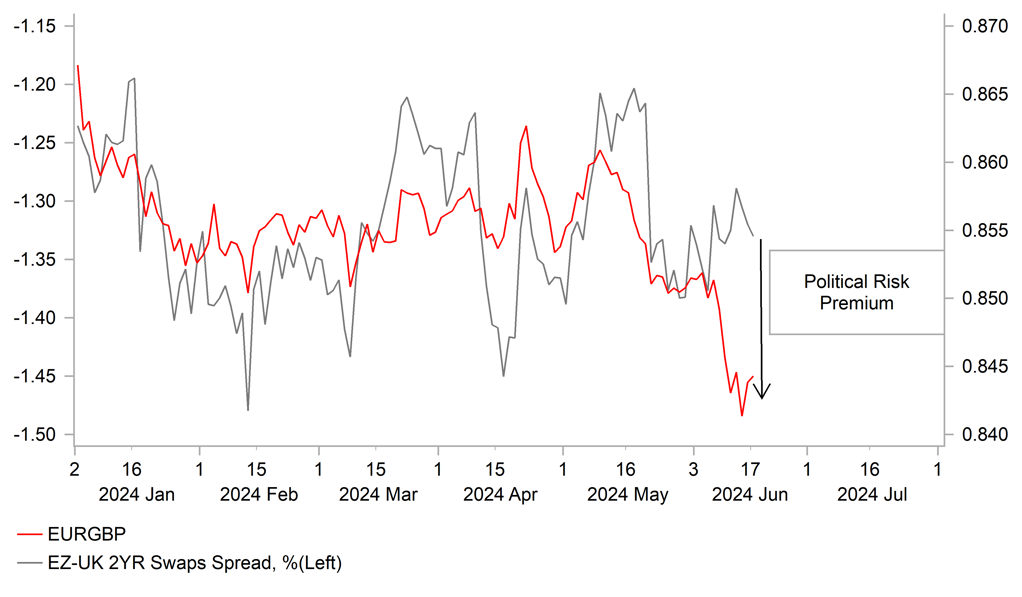

The pound has continued to be one of the better performing G10 currencies so far this month. While cable has been consolidating between 1.2650 and 1.2800 as the USD has staged a modest rebound, the GBP has continued to strengthen against the EUR resulting in EUR/GBP breaking below important support at the 0.8500-level at the start of last week. The bearish technical developments signal that the pair is likely to continue adjusting lower in the near-term. After breaking below support at the 0.8500-level which had held over the past year, the next important support level is provided by the low from August 2022 at 0.8340 and then the April 2022 low at 0.8250.

The bearish break out for EUR/GBP over the past week has been driven mainly by political developments in Europe. French President Macron’s decision to hold snap parliament elections on 30th June and 7th July has encouraged a weaker EUR as market participants move to price in a higher political risk premium (click here). Heightened fiscal concerns is one area that is attracting more market attention and has already resulted in the yield spread between French and German 10-year government bonds widening sharply to the highest level since in early 2017. In contrast, the upcoming general election in the UK which is scheduled to take place on 4th July has had limited impact on GBP performance so far. Market participants remain comfortable with the prospect of the Labour party winning a strong majority in parliament. The release of the Labour party’s official manifesto (click here) contained no major policy surprises as it outlined relatively modest tax and spend plans. As we highlighted in our UK election preview (click here), a strong Labour majority could even be viewed as supportive for the GBP by welcoming in a period of greater political stability in the UK and opening the door for closer relations with the EU. The possibility of closer relations with the EU has attracted more attention at the start of this week after Labour shadow chancellor Rachel Reeves told the FT that “we would look to improve our trading relationship with the EU”. She suggested that Labour could revise parts of the Brexit trade deal including seeking closer alignment with EU rules in the chemicals and veterinary sectors, better touring rights for UK artists, and greater mutual recognition of qualifications for financial services workers. She did though reiterate that Labour would not seek to rejoin the single market or join a customs union with the EU.

The main two main event risks in the week ahead for the GBP that could have a significant impact on BoE rate cut expectations are the release of the latest UK CPI report for May on Wednesday followed by the BoE’s latest policy update on Thursday. Of the two events we expect the release of the UK CPI report to have a bigger impact on GBP performance as it will also have an influence on the BoE’s subsequent policy update. At the BoE’s last policy meeting, they opened the door to begin cutting rates over the summer but those expectations have since been dampened by the upside surprise for services inflation in April which surprisingly held at 5.9% while headline inflation fell back close to the BoE’s target at 2.3% driven by lower energy prices. If services inflation continues to prove persistent in May, it will cast more doubt on the likelihood of the BoE beginning to cut rates in August and encourage a stronger GBP. Whereas if services inflation drops back in May, market expectations for the BoE to begin cutting rates in August would intensify and trigger a reversal of recent GBP gains. In our base scenario we expect the BoE to vote to keep rates on hold next week with the same number of dissenters (MPC members Dhingra and Ramsden) voting for a cut. A much weaker services CPI reading for May would be required to prompt another MPC member to vote for a rate cut next week supported as well by building evidence of the softening labour market.

In these circumstances, we expect the GBP to strengthen further against the EUR ahead of the French parliamentary elections resulting in the pair moving close to support between 0.8250 and 0.8350. The release of the UK CPI report for May would have to be much weaker than expected and/or the BoE send a stronger signal that they are planning to cut rates in August to trigger a reversal of the current trend.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (YoY) |

May |

0.8% |

0.8% |

! |

|

EC |

09:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Labor Cost Index (YoY) |

Q1 |

4.90% |

3.40% |

! |

|

CA |

13:15 |

Housing Starts |

May |

247.0K |

240.2K |

!! |

|

US |

17:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg