US debt ceiling & strength of China recovery remain in focus

USD 1: China slowdown fears contrast with stronger US data

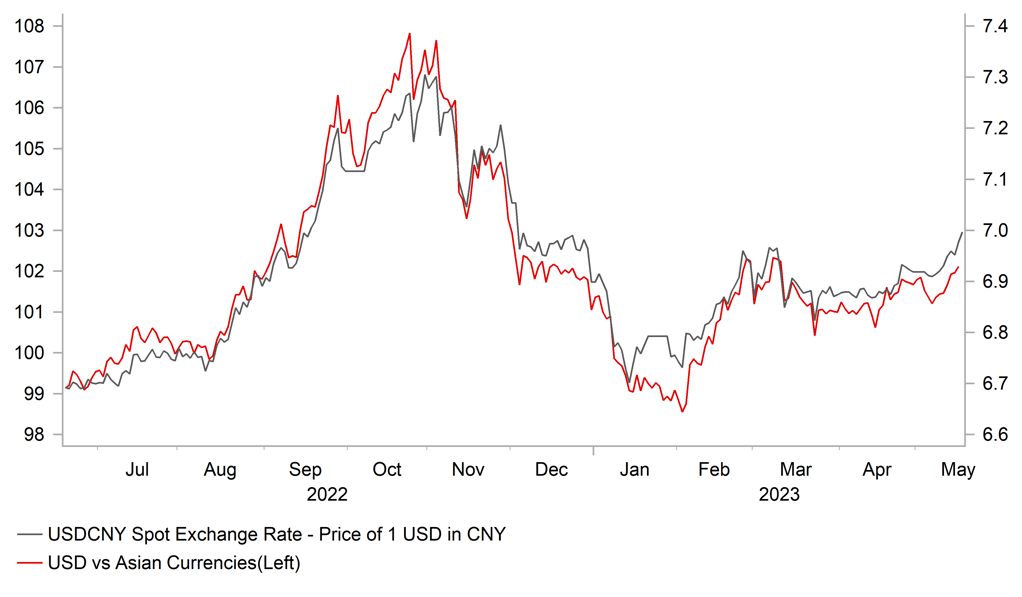

The US dollar has continued to strengthen overnight resulting in USD/CNH moving back above the 7.0000-level for the first time since the end of last year. There has also been spill-over weakness to other Asian currencies following on from sharp sell-offs yesterday in the Latam currencies of the Brazilian real and Chilean peso. The worst performing Asian currencies overnight have been the Malaysian ringgit and Indonesian rupiah. The weakness in Asian and Latam currencies reflects more unease amongst market participants over the strength of the economic recovery in China following the release yesterday of disappointing economic activity data for April (click here). The softening outlook for growth outside of the US is helping to provide more support for the US dollar in the near-term. At the same time, the US dollar has been deriving support from a pick-up in US yields. The 2-year US Treasury yield climbed to an intra-day high yesterday of 4.12% as it moved further above the low from earlier this month at 3.65%. US rate market participants have been scaling back the amount of Fed rate cuts expected later this year in response to stronger US economic data releases.

The releases of the latest US retail sales, industrial production and NAHB housing market index yesterday all came in stronger than expected, and helped to dampen fears over sharper slowdown/recession. The control retail sales component increased by 0.7% in April following a contraction of -0.4% in March. It was a stronger than expected start to Q2 but is unlikely to alter expectations that personal consumption growth is set to moderate after expanding strongly by 3.7% in Q1. The Bloomberg consensus forecast amongst US economists had been looking for a much weaker expansion of just 0.5% in Q2 although those forecasts is likely being revised upwards. There was also a pick-up in industrial production output in April which expanded by 0.5% following flat growth in the following two months. Manufacturing output was boosted by a 9.3% jump in motor vehicle output. Finally, the NAHB housing survey continued to rebound in April rising by a further 5 points to 50 in May as it moved further above the low from the end of last year at 31 in December signalling an improving outlook for home builders. The economic data has provided some short-term relief, although the underlying trend is still softening. According to Bloomberg, the US economic surprise index had fallen back into negative territory at the start of this week for the first time since February. We still believe that support for the US dollar from higher short-term US yields will prove short-lived.

REVERSAL OF CHINA REOPENING OPTIMISM TRADES

Source: Bloomberg, Macrobond & MUFG GMR

USD 2: No break through in US debt ceiling talks

The other main focus yesterday was the latest US debt ceiling meeting between President Biden and Congressional leaders. There were two main developments. Firstly, President Biden has announced that he will be cutting short his trip to Asia and the Pacific and return back to Washington immediately after the G7 meetings in Japan. Secondly, both sides agreed to narrow the talks with White House staff negotiating directly with House leader McCarty’s designee Republican Graves and his staff. It points to a more intense phase of negotiations in order to reach deal to raise the debt ceiling, and suggests that both sides want to reach a deal before the June X date. However, it does appear that both sides remain far apart on reaching an agreement that would impose spending caps as part of the deal to raise the debt ceiling. It remains our base scenario that a last-minute deal will be reached to raise the debt ceiling that would avoid no deal options including default, payment prioritization or President utilizing the 14th Amendment to continue debt payments. As we get closer to the X date without deal, we expect financial market conditions to become more volatile. A period of risk reduction by global investors could begin to weigh more heavily on high beta currencies such as commodity and emerging market currencies at least until a deal is reached. So far though the impact on the foreign exchange market has remained relatively contained.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

CPI (YoY) |

Apr |

7.0% |

6.9% |

!!! |

|

EC |

10:30 |

ECB's Panetta Speaks |

-- |

-- |

-- |

!! |

|

UK |

10:50 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

Building Permits |

Apr |

1.437M |

1.430M |

!!! |

|

US |

13:30 |

Housing Starts |

Apr |

1.400M |

1.420M |

!! |

Source: Bloomberg