Scope for divergence will likely remain limited

USD: Central bank communications indicate caution ahead

The dollar, which broke below key technical levels in recent days has failed to extend its decline with some moderate recovery yesterday from the lows. Asian equities are mixed but with a weak tone after China data revealed stronger manufacturing production that was offset by weak consumer spending. Retail sales was much weaker and policymakers have responded with the PBoC today announcing the removal of the floor on mortgage rates for individuals’ purchases of first and second homes. The minimum down payment ratios for first and second home purchases have also been lowered. The most obvious area of divergence in economic performance remains between the US and China – USD/Asia is generally higher today.

Where the divergence is becoming less clear is between the US and Europe. Expectations of divergence has been fuelled by the fact that the ECB will cut in June and the Fed continue to argue for leaving rates higher for longer. In today’s Nikkei newspaper ECB Executive Board member Isabel Schnabel is quoted saying she does not believe a July rate hike is warranted. While acknowledging the prospect of a cut

in June, Schnabel argued that inflation risks were to the upside and that caution was warranted. While Schnabel is a known hawk, we suspect this line of thinking will quite easily get support at the meeting in June and will potentially quickly become the agreed communication. This is also roughly consistent with market pricing. There is only around 5bps of additional easing priced for July but close to 25bps priced by September. The market is close to priced for a 25bps cut from the Fed by September. So the expectations on rate cuts are more aligned from September onwards.

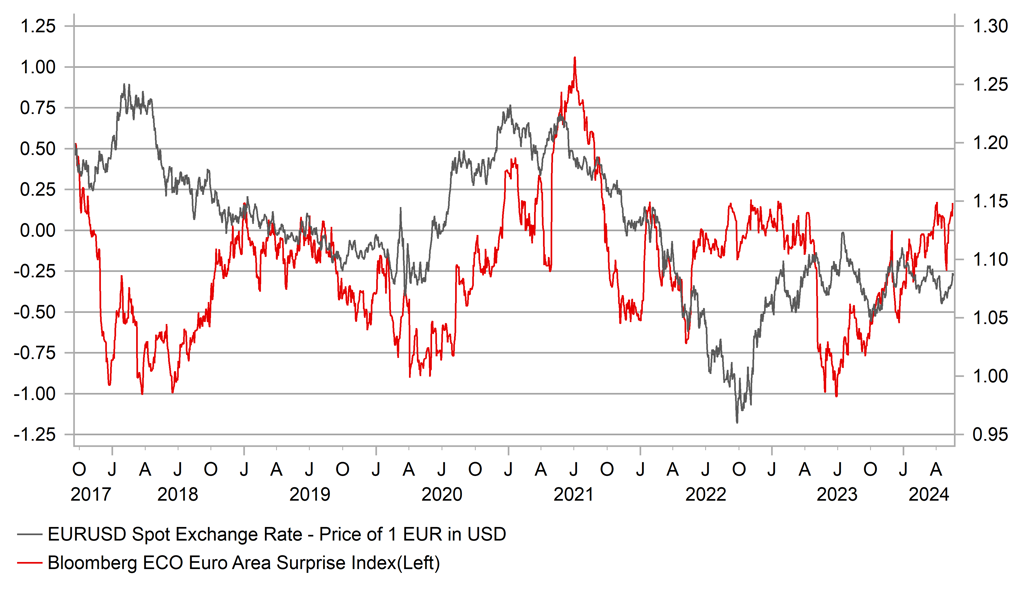

The turn in the economic data also makes it more likely that the Schnabel caution expressed today will garner support. Waiting until September aligns with the updated forecasts from the ECB and will give the ECB time to assess the strength and sustainability of the current economic upturn. Certainly relative to the US, the euro-zone is looking better than for some time. A number of the economic outlook survey data in the euro-zone are at levels not seen since before the Russian invasion of Ukraine indicating that the euro-zone has worked through the huge energy price shock. The comments this week from Fed officials were in our view still indicative of a Fed that would be willing to turn and cut relatively quickly if the evidence becomes available to back it up. Williams argued against a policy change “in the very near-term” while Barkin argued for the need for “a little bit more time” – comments we see as consistent with scope to cut by July if we see favourable inflation data from here.

EUR/USD VS EURO ECONOMIC SURPRISE INDEX RELATIVE TO THE US

Source: Macrobond, Bloomberg & MUFG Research

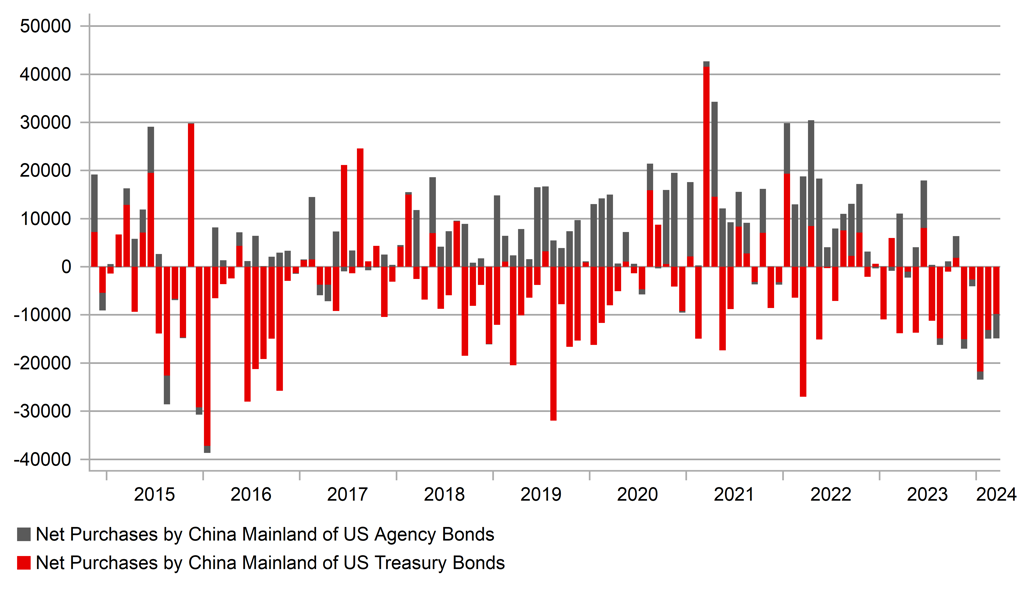

USD: Too soon to read anything into China selling

The US Treasury International Capital data for March was released on Wednesday evening and revealed solid buying of US securities. Both private and official entities were buyers of Treasury bonds and notes purchasing a combined USD 42.2bn worth, down from USD 87.4bn in February. With the details of the report however there was confirmation of further selling of US fixed income by China. China sold USD 9.8bn worth of US Treasury bonds and USD 5.1bn worth of Agency bonds. The selling of US Treasury bonds has been sustained – China has sold now for five consecutive months and since the start of 2023, China has been a net buyer in just three months.

For much of this period and indeed over many years, US Treasury bond purchases were more than offset by Agency debt purchases. Last year China bought USD 24.3bn worth of Agency debt but sold USD 68.2bn worth of Treasury bonds. But if we go right back and cover the period since China’s devaluation and financial market turmoil and cover the period from 2016, China has more than offset the sales of US Treasury bonds with purchases of US Agency bonds. Over the period 2016-2023 China has sold USD 385bn worth of US Treasury bonds but bought USD 496bn worth of Agency bonds.

What is interesting is that the flow data does suggest that China appetite for Agency bonds is now waning. China has sold Agency bonds for five consecutive months and the selling in March (USD 5.1bn) was the largest since August 2015 – the month of the CNY devaluation. In the first three months of 2024 China sold USD 8.6bn of Agency bonds and USD 44.7bn worth of US Treasury bonds. Not since the period around the CNY devaluation in 2015 have we had three consecutive months of selling of both Agency and Treasury bonds. However, Treasury bond sales have been larger in the past and the combined total of Treasury and Agency bonds is not out of the ordinary.

There is no reason to link this to anything USD/CNY policy-related. It could simply be a sign that China’s appetite for US agency bonds has reached saturation which could possibly mean a potential switch back to Treasury bonds or a more meaningful switch out from the US. China bank FX settlement data for April, released this week, does not indicate any marked change in FX demand/supply dynamics. But certainly if we get another month of sales of both Treasury and Agency bonds we will be in unprecedented territory that will get increasing attention in the markets. Four consecutive months of selling of both assets was not seen even during and immediately after the GFC when there was a sustained period of Agency bond selling (20 consecutive months in 2008-2010).

THE CHANGE IN CHINA FLOWS MORE ABOUT AGENCY BOND BUYING DRYING UP RATHER THAN UST BOND SELLING

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:20 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

UK |

09:00 |

BoE MPC Member Mann |

-- |

-- |

-- |

!!! |

|

EC |

10:00 |

Core CPI (YoY) |

Apr |

2.7% |

2.9% |

!! |

|

EC |

10:00 |

Core CPI (MoM) |

Apr |

0.7% |

1.1% |

!! |

|

EC |

10:00 |

CPI (YoY) |

Apr |

2.4% |

2.4% |

!! |

|

EC |

10:00 |

CPI (MoM) |

Apr |

0.6% |

0.8% |

!! |

|

EC |

10:00 |

HICP ex Energy & Food (YoY) |

Apr |

2.8% |

3.1% |

! |

|

EC |

10:00 |

HICP ex Energy and Food (MoM) |

Apr |

0.6% |

0.9% |

! |

|

CA |

13:30 |

Foreign Securities Purchases |

Mar |

3.51B |

-8.78B |

! |

|

CA |

13:30 |

Foreign Securities Purchases by Canadians |

Mar |

-- |

24.19B |

! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

-- |

-- |

0.0% |

!! |

|

CA |

13:30 |

New Motor Vehicle Sales (MoM) |

-- |

-- |

137.7K |

! |

|

US |

15:00 |

US Leading Index (MoM) |

Apr |

-0.3% |

-0.3% |

!! |

|

US |

15:15 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

US |

17:15 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg