USD continues to trade close to year to date lows ahead of FOMC meeting

USD: China growth forecasts downgraded ahead of FOMC meeting

The major foreign exchange rates have remained relatively stable overnight ahead of the key event risks of the week. The dollar index has continued to trade close to year to date lows at just above the 100.00-level. There has been no significant change in US rate market pricing which is still leaning more in favour of larger 50bps cut. We continue to believe that the Fed will deliver a 50bp cuts rather than disappoint market expectations if there is no change in pricing ahead of tomorrow’s FOMC meeting. The main development from a macro perspective at the start of this week has been a further downgrade to economic growth forecasts for China. It follows the release of disappointing monthly activity data for August over the weekend. The reports revealed that retail sales, industrial production and fixed asset investment growth was all weaker than expected in August. It has heightened concerns that China’s economy will struggle to meet the government target for growth of around 5.0% for this year. It has even been suggested that President Xi’s comments late last week stating officials should ”strive to achieve” the goal have indicated more tolerance for weaker growth.

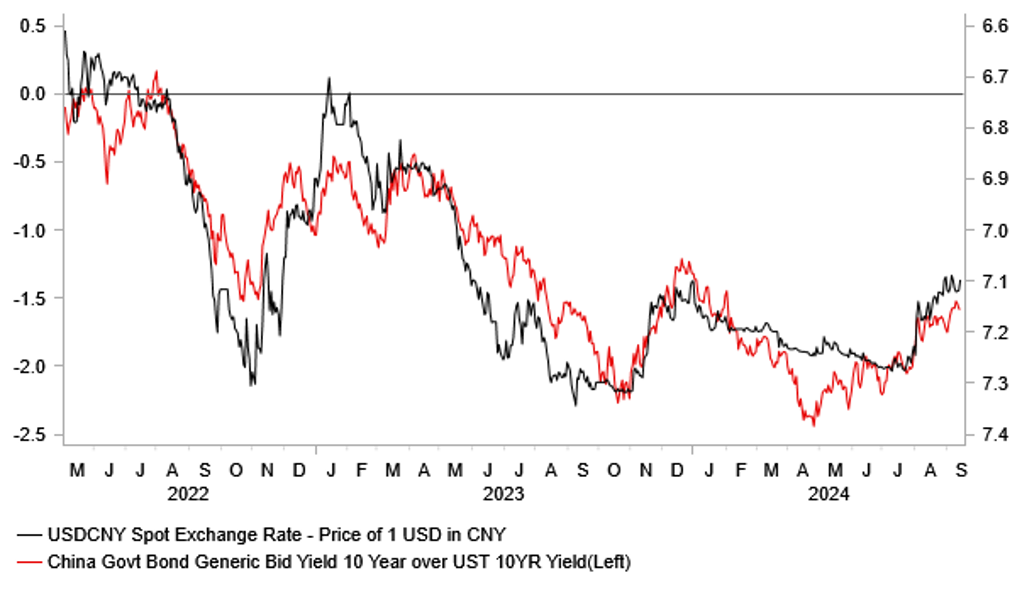

China’s equity market has continued to weaken over the summer and is moving back to within touching distance of the year to date lows from in early February. Similarly, the 10-year Chinese government bond yield has just fallen to fresh year to date lows today as it moves closer to 2.0%. The price action reflects the weakening growth outlook alongside building concerns over deflation risks in China. In contrast, the negative fallout in the FX market has been limited where any potential impact is being currently offset by building expectations for faster Fed policy easing. It has resulted in USD/CNY falling back towards the 7.1000-level while Asian currencies have outperformed over the last couple of months in particular the Malaysian ringgit (+8.7% vs. USD) and Thai baht (+8.7%). However, the negative cyclical momentum for China’s economy adds to our caution over whether recent strong gains for Asian currencies can be sustained. It is also one reason why we are only forecasting modest further downside for the US dollar despite expecting the Fed to deliver faster rate cuts.

USD/CNY VS. US-CHINA LONG-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Will the Fed give the green light for further EM FX upside?

It has been a strong week for emerging market currency performance ahead of this week’s FOMC meeting. Emerging market currencies have strengthened across the board with only the RUB (-0.4% vs. USD) and ARS (-0.4%) weakening against the USD over the past week. The best performing emerging market currencies have been the MXN (+4.6% vs. USD), CLP (+2.9%), BRL (+2.7%), ZAR (+1.9%), and HUF (+1.7%).

Emerging market currencies have been boosted by building market expectations for the Fed to cut rates more quickly ahead of this week’s FOMC meeting. The US rate market has moved to price in a higher probability of a larger 50bp cut than a 25bps to start the Fed’s easing cycle. There are currently around 42bps of cuts priced in for this week’s FOMC meeting. The dovish repricing has been encouraged by reports from the WSJ’s respected Fed watcher Jon Hilsenrath and their chief economics commentator Greg Ip who have talked up the possibility of a larger 50bps cut this week. So far there has been no pushback, and the Fed does not like to disappoint market expectations. The developments fit with our own call for a 50bp cut in order to dampen downside risks to the US labour market from keeping rates too high for too long. In contrast, the worst outcome for emerging market currencies would be if the Fed only delivers a 25bps cut and pushes back strongly against the prospect of larger 50bps cuts in the near future as well, although we doubt the Fed would want to rule out such action.

The HUF and ZAR have been the best performing EMEA currencies highlighting that emerging market carry trades are performing better ahead of the FOMC meeting. Financial market volatility has eased since the period of turbulence in early August although remains at higher levels than during the 1H of this year. The HUF’s carry appeal has also be supported recently by the NBH’s decision to pause their rate cutting cycle in August after 15 consecutive monthly cuts. The slower pace of easing has drawn criticism from the government. Economy minister described Nagy who is one of the favourites to be the next NBH Governor stated that inflation concerns were overdone after headline inflation fell more than expected by 0.7 point to 3.4% in August. The HUF has been held back recently by domestic policy uncertainty as speculation has intensified over who will be the next NBH Governor when Matolcsy’s term ends on 1st March. Investors are concerned Prime Minister Orban will favour looser monetary and fiscal policy in the run up to the elections in 2026. Developments that would both increase the likelihood of EUR/HUF moving above the 400.00-level next year in line with our forecasts. Please see our latest EMEA EM Weekly report (click here) for more details.

EUR/HUF VS. CARRY ATTRACTIVENESS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Economic Sentiment |

Sep |

17.1 |

19.2 |

!! |

|

GE |

11:00 |

German Buba Monthly Report |

-- |

-- |

-- |

! |

|

CA |

13:15 |

Housing Starts |

Aug |

252.0K |

279.5K |

!! |

|

US |

13:30 |

Retail Sales (MoM) |

Aug |

-0.2% |

1.0% |

!!! |

|

CA |

13:30 |

CPI (YoY) |

Aug |

-- |

2.5% |

! |

|

US |

14:15 |

Industrial Production (MoM) |

Aug |

0.2% |

-0.6% |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Sep |

41 |

39 |

! |

Source: Bloomberg