JPY continues to weaken as Fed rate cut expectations are pared back

JPY: A bad start to the year as gives back strong gains from December

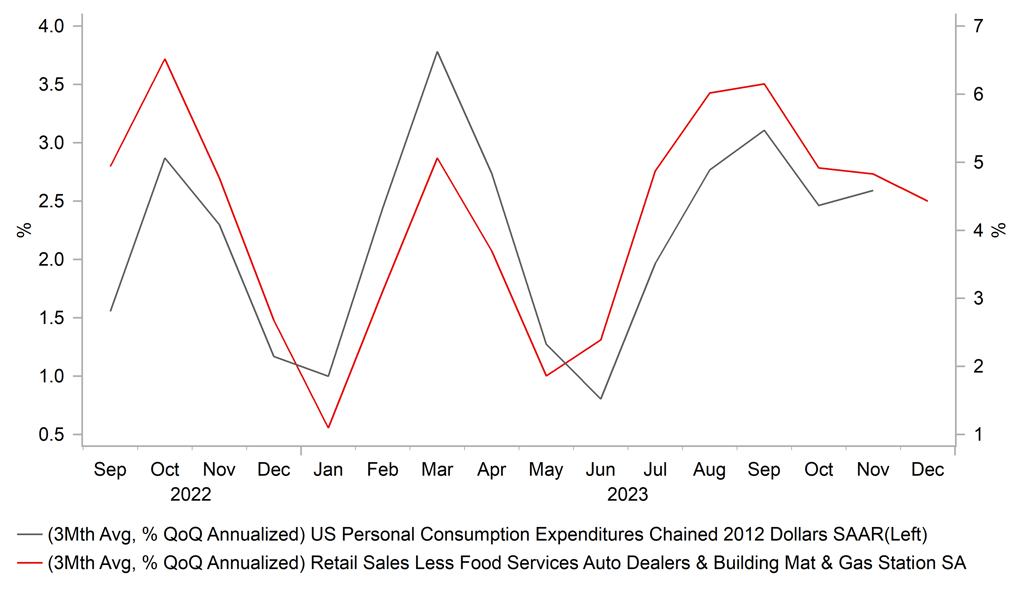

The yen has continued to underperform at the start of the new calendar year resulting in USD/JPY hitting fresh high yesterday at 148.52 as it continues to rebound after putting in place a low at 140.25 on 28th December. The yen has now fully reversed all of the gains recorded in December although is still some way below last year’s peak at 151.91 recorded on 13th November. There have been three main drivers behind the sharp turnaround for the yen at the start of this year. Firstly, market participants have been scaling back expectations for rate cuts from the Fed and other major central banks outside of Japan. There was a large adjustment higher yesterday in short-term rates after the releases of the stronger US retail sales report for December and UK CPI report for December. The US rate market is now only pricing in around -16bps of Fed cuts by the March FOMC, and the UK rate market has moved to price in less a 50:50 chance (-11bps priced in) of the first BoE hike being delivered at the May MPC meeting. The implied yield on the December 2024 three-month SONIA futures contract increased by around 25bps as market participants fully priced out one BoE rate cut expected by the end of this year. The US retail sales report for December revealed that consumer spending held up better than expected in Q4. After expanding robustly by 3.1% in Q3, it was widely expected that there would be a bigger slowdown in Q4. After yesterday’s stronger retail sales data for December, the current Bloomberg consensus forecast for consumer spending growth of 2.0% in Q4 appears too low and it could be between 2.5-3.0%. It would be more consistent with the US economy growing more line with the Fed’s longer run growth estimate of around 2% in Q4. With the US economy continuing to prove resilient it is making market participants less confident that the Fed will be in a rush to cut rates. However, we still believe that the sharp slowdown in inflation and their restrictive policy stance will encourage the Fed to lower rates. If inflation continues to slow towards 2.0%, the Fed’s real policy rate adjusted for inflation will rise to just over 3.0% which will be harder to justify maintaining at such a restrictive rates. However, it is not clear that the Fed will cut rates as soon as March. The doubt is helping the US dollar rebound in the near-term.

The other two main reasons for the yen sell-off at the start of this year are domestic. Firstly, market participants have been pushing back expectations for the BoJ’s exit from negative rates. It is highly unlikely now that the BoJ will raise rates and/or exit YCC at next week’s BoJ policy meeting. We have pushed back our BoJ rate hike call to the April policy meeting which it brings it more into line with consensus expectations. At the same time, negative sentiment towards the yen has been reinforced by changes to the Nippon Individual Savings Account (NISA) at the start of this year. One important change is that annual investment limit for the tax-free savings scheme has been raised from a total of JPY1.6 million up to JPY3.6 million. The changes to the NISA scheme could be triggering a pickup in demand for foreign assets from Japanese investors at the start of this year.

US CONSUMER SPENDING IS HOLDING UP BETTER THAN EXPECTED

Source: Bloomberg, Macrobond & MUFG GMR

CHF: SNB signals more concern over franc strength

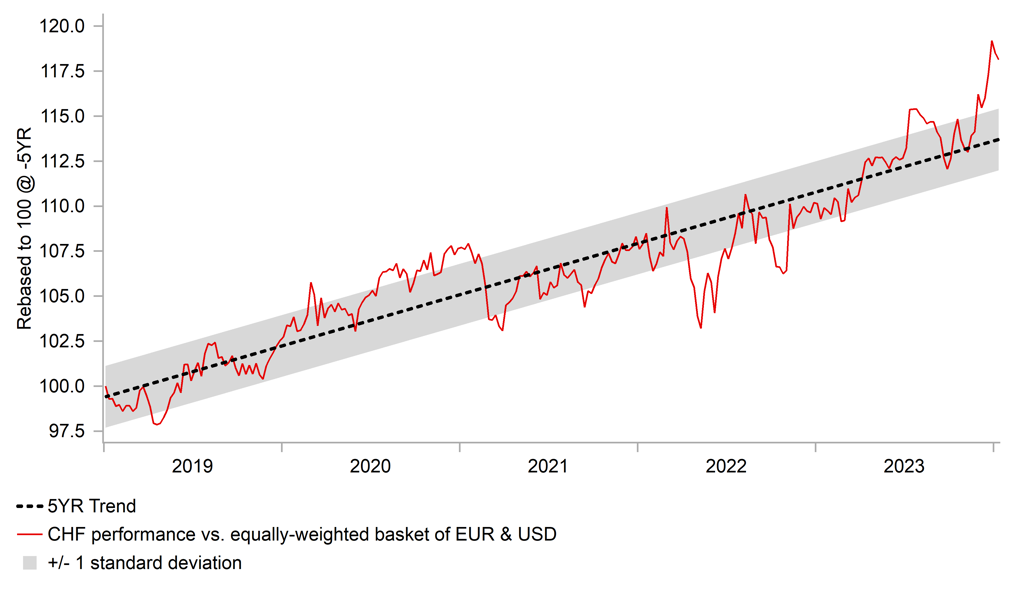

The Swiss franc has been correcting lower at the start of the calendar year giving back some of the strong gains recorded in late November and December. EUR/CHF has risen back above the 0.9400-level after hitting a low of 0.9255 on 29th December. Similarly, USD/CHF has risen back above 0.8650 at after hitting a low of 0.8333 on 28th December. At the end of last year, the Swiss franc had reached its strongest level against the euro and US dollar since January 2015 just after the SNB removed the 1.2000-floor for EUR/CHF and it temporarily surged higher.

After recent strong gains, the comments yesterday by SNB President Jordan provided the strongest indication that they are becoming more concerned again over the strength of the Swiss franc. He stated that “for quite a long time we had mainly a nominal appreciation – that was very helpful, because it shielded us from the inflation pressure from abroad. However “in the last couple of weeks of last year, we saw real appreciation. That makes the situation for some of our firms more difficult”. The comments have encouraged speculation that the SNB could act to weaken the franc if verbal intervention is not sufficient to reverse franc strength. At their last policy meeting in December, the SNB indicated that they are “no longer focusing on foreign currency sales” after their updated forecasts showed inflation now within the price stability range over the entire forecast horizon for the first time in some time. The comments from President Jordan will encourage speculation that the SNB could switch back to foreign purchases to help weaken the franc if required, and/or start cutting rates ahead of the ECB. The SNB only meets once a quarter, and market participants are currently pricing in around a 50:50 chance of the first 25bps cut being delivered in March rather than waiting for the next meeting in June.

At the same time the reversal of Swiss franc strength is being encouraged by the paring back of expectations for earlier rate cuts from the ECB and Fed. ECB officials including President Lagarde yesterday have displayed a unified front by signalling that the first rate is unlikely to until the summer leaving the June policy meeting as potentially the earliest point. Overall the developments leave the franc vulnerable to a further sell-off in the near-term as it continues to reverse strong gains from the end of last year.

CHF STRENGTH AT END OF LAST YEAR DRAWS MORE CONCERN

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Nov |

-- |

33.8B |

! |

|

UK |

09:30 |

BOE Credit Conditions Survey |

-- |

-- |

-- |

!! |

|

SZ |

10:30 |

SNB Chairman Thomas Jordan speaks |

-- |

-- |

-- |

!! |

|

US |

12:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Housing Starts |

Dec |

1.426M |

1.560M |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

207K |

202K |

!!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Jan |

-7.0 |

-10.5 |

!!! |

|

EC |

15:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

16:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg