Yen continues to rebound from deeply undervalued levels

JPY: Is USD/JPY starting to peak out as fundamentals turn in favour of yen?

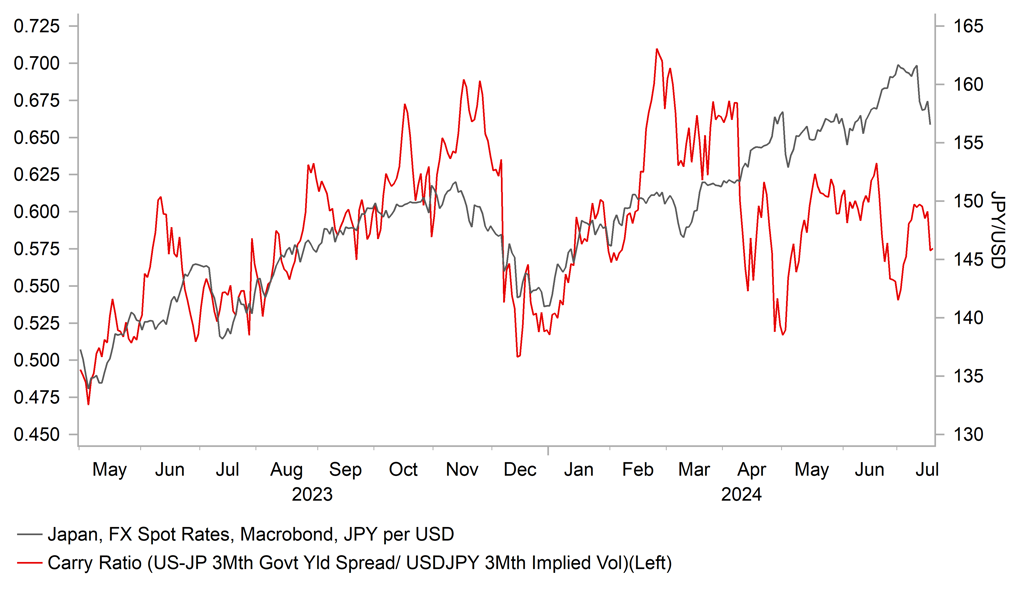

The yen has continued to strengthen overnight resulting in USD/JPY falling to an intra-day low of 155.38. The pair has now fallen by almost 7 big figures since the peak from earlier this month at 161.95. There have been a number of drivers behind the sharp turnaround for the yen. Firstly, market participants have become more confident that the Fed is moving closer to cutting rates and is likely to deliver multiple rate cuts by the end of this year in response to more compelling evidence that inflation in the US is continuing to slow back towards the Fed’s 2.0% target. Fed Governor Waller stated yesterday that “while I don’t believe we have reached our final destination, I do believe we are getting closer to the time when a cut in the policy rate is warranted”. In addition, he believes there are more “upside risks to unemployment than we have seen for a long time” and he will be paying “close attention” to the employment side of the Fed’s mandate. US yields peaked back in late April and have continued to fall so far this month helping to encourage a lower USD/JPY.

Secondly, Japan appears to have intervened on a number of occasions to support the yen this month. The intervention occurred in the days following the release of the much weaker US CPI report at the end last week when it has been estimated that Japan may have purchased around JPY5.6 trillion. While the intervention has not been officially confirmed it does suggest a change in strategy from Japan to be more proactive rather than reactive when providing support for the yen. Japanese officials took advantage of the weak US inflation data to help lower USD/JPY.

Thirdly, the yen is likely benefitting as well from the paring back of elevated yen short positions ahead of the BoJ’s upcoming policy meeting at the end of this month. We continue to believe that the Japanese rate market is underpricing the risk of a rate hike from the BoJ. There are currently around 5bps of hikes priced in according to Bloomberg which is well below our forecast for a 15bps hike from the BoJ. As a result we see room for short-term yields in Japan to continue adjusting higher. An additional upside risk for long-term yields in Japan would be if the BoJ announces plans to slowdown JGB purchases more quickly than expected in the coming years. The current consensus expectation appears to be for monthly purchases to slow initially from around JPY6 trillion to around JPY5 trillion. We don’t believe that the yen’s recent rebound will prevent the BoJ from hiking rates this month. Comments yesterday from Kono Taro, the minister for digital transformation in Japan, highlighted that yen weakness remains a concern for the Japanese government. After intervening again to support the yen, the government will be expecting the BoJ to play its part by raising rates as well. Kono Taro noted that the “currency is a problem for Japan” and that “the yen is too cheap and we need to bring it back”.

Fourthly, the yen was supported as well yesterday by the release of comments from Donald Trump in an interview with Bloomberg Business Weekly. With Trump now a clear favourite to win re-election in November, his comments are again proving to be more market moving. In the comments released yesterday, he stated that the US has currency problems with the strong US dollar hurting the US manufacturing sector. He singled out Japan and China who he blamed for weakening their currencies, and threatened to place tariffs on them if they continue. The comments were similar to at the start of his first term when he tried to talk down the US dollar. The likely desire for a weaker US dollar from a second Trump administration has attracted more attention this week following the selection of JD Vance to be Donald Trump’s vice-presidential nominee. JD Vance has previously stated “I know the strong US dollar is sort of the sacred cow of the Washington consensus, but when I survey the American economy, and I see our mass consumption of mostly useless imports on one hand and our hollowed-out industrial base on the otherhand, I wonder if the reserve currency status also has some downsides”. While Trump may desire a weaker US dollar, his inflationary policies (higher tariffs, lower taxes & lower immigration) could contribute to keeping the US dollar stronger for longer if he becomes President again. However, the comments do suggest that there is a higher risk of joint intervention between Japan and the US to help lower USD/JPY if Trump wins the election which could prove more effective especially if the Fed is also cutting rates at the start of next year.

USD/JPY IS CORRECTING LOWER ENCOURAGED BY LOWER US YIELDS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

13:15 |

Deposit Facility Rate |

Jul |

3.75% |

3.75% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

229K |

222K |

!!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

US |

18:45 |

Fed Logan Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg