EUR stabilizes at weaker levels after last week’s sell-off

AUD: RBA remains one of the most hawkish G10 central banks

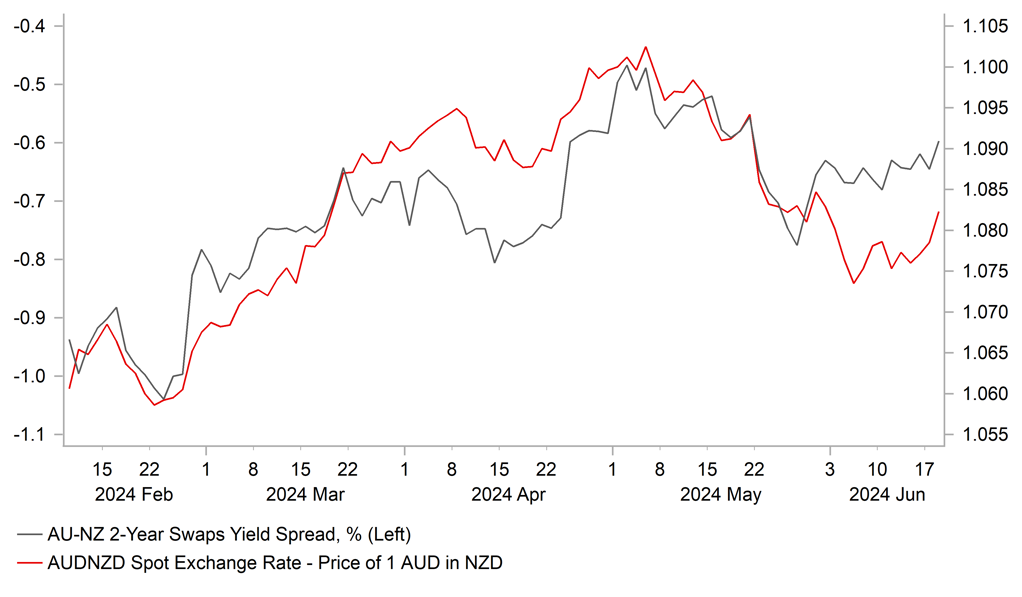

The main event risk overnight has been the RBA’s latest policy meeting. The Australian dollar has strengthened modestly after today’s RBA policy meeting resulting the AUD/USD and AUD/NZD rates both rising to intra-day highs of 0.6632 and 1.0834. In the updated policy statement, the RBA noted that inflation is easing but has been doing so more slowly than previously expected and it remains high. The RBA remains uncertain over the path for interest rates that will return inflation to target in a reasonable timeframe, and as a result is “not ruling anything in or out”. In the accompanying press conference Governor Bullock noted that the board discussed the case for hiking the policy rate at today’s policy meeting although emphasized that she “wouldn’t say the case for a rate hike is increasing”. It leaves the RBA in data dependency mode as the statement continues to highlight that the board rely upon the data and evolving assessment of risks which involves paying close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market. In the press conference Governor Bullock emphasized that the CPI report for Q2 will be particularly important as it will provide a more comprehensive view on prices. The Q2 CPI report is released on 31st July and could prove pivotal in determining whether the RBA decides to hike rates further in 2H of this year.

One reason why the RBA has decided not to hike rates further at today’s policy meeting was due to downside risks for Australia’s economy. In the updated policy statement, the RBA noted that there have been indications that momentum in economic activity is weak, including slow growth in GDP, a rise in the unemployment rate and slower than expected wage growth. While the RBA is still talking up the possibility of hiking rates further, the Australian rate market is less convinced that they will back up tough talk with policy action. Market participants still expect the RBA’s next policy move to be a rate cut later this year. A view that we share although acknowledge that the RBA is one of few G10 central banks that could still tighten policy further this year alongside the BoJ. A development that would provide more support for the Australian dollar alongside our outlook for soft landing for the global economy (click here).

RISK OF ANOTHER RBA HIKE IS PROVIDING SUPPORT FOR AUD

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB officials comment on French government bond sell-off

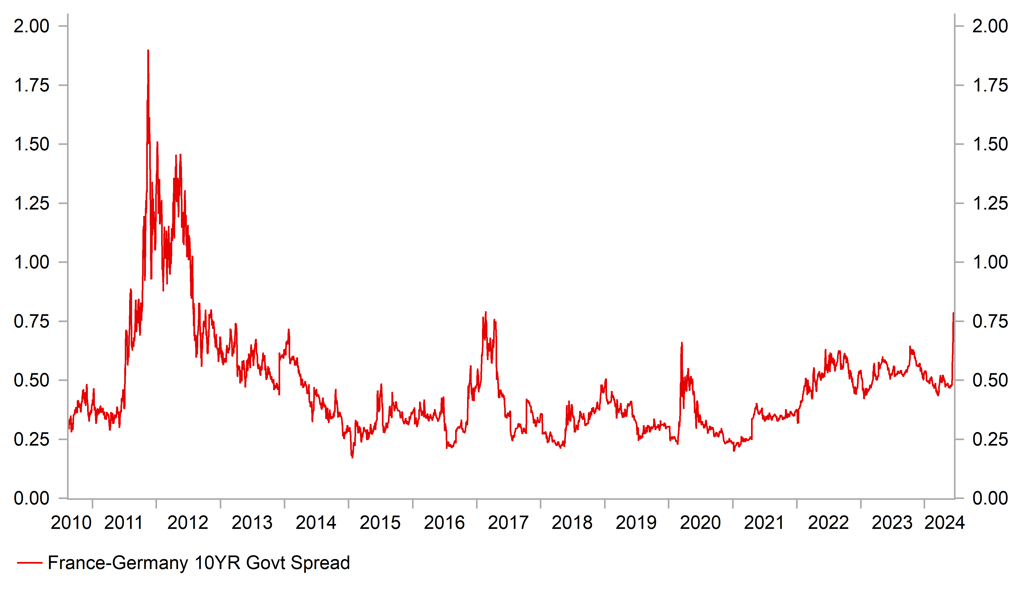

The euro has stabilized at the start of this week at just above the 1.0700-level against the US dollar after falling to a low at the end of last week at 1.0668. Similarly, the 10-year yield spread between French and German government bonds widened more modestly yesterday by only 2bp after an increase of 16bps in the final two days of last week. At close to 80bps the yield spread has widened sharply since French President Macron called a snap election when it was trading close to 48bps, and is currently at the widest level since February 2017 when it hit a peak of 79bps. A break above that level would take the spread back to levels last recorded during the euro-zone sovereign debt crisis between 2011 and 2012.

It is therefore understandable that the recent spread widening has started to attract more attention. ECB President Lagarde stated yesterday that officials “are attentive to the good functioning of financial markets, and I think that today in any case we’re continuing to be attentive, but it’s limited to that”. It followed similar comments earlier in the day from ECB Chief Economist Lane who played down the need to intervene to support the French government bond market. While he noted that the ECB can’t let market panic disrupt monetary policy and the ECB’s transmission protection instrument (TPI) is super important for the monetary union, he is of the view that we are seeing “market repricing, and not disorderly dynamics”. In addition, his comments on the outlook for monetary policy supported our view that the ECB is likely to cut rates further in September rather than at the next meeting in July. He stated that they will need more than a month of data on services inflation to decide whether to cut again. He sounded relatively dovish by stating that he is happy to lump through short-term bumps in inflation and expects new cost pressures to be “pretty muted” in 2025.

The more modest widening of the yield spread between France and Germany at the start of this week has been encouraged by comments from Le Pen to Le Figaro newspaper over the weekend in which she noted that “I’m respectful of institutions; I do not call for institutional chaos. There will simply be cohabitation [with Mr Macron’s presidency]”. She also stated that if the National Rally formed the next government, they would hold an audit of the public finances before rolling out their policies which include lowering the retirement age to 60, and exempting under-30’s from income tax. Overall, the developments do not change our view that the euro could weaken further ahead of the elections in France. Please see our latest FX Focus report for more details (click here).

CLOSE TO WIDEST LEVELS SINCE EURO-ZONE DEBT CRISIS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Current Conditions |

Jun |

-65.0 |

-72.3 |

!! |

|

EC |

10:00 |

CPI (YoY) |

May |

2.6% |

2.4% |

!!! |

|

US |

13:30 |

Retail Sales (MoM) |

May |

0.3% |

0.0% |

!!! |

|

US |

14:15 |

Industrial Production (MoM) |

May |

0.3% |

0.0% |

!! |

|

US |

15:00 |

Business Inventories (MoM) |

Apr |

0.3% |

-0.1% |

!! |

|

US |

15:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg