Yen giving back recent gains ahead of BoJ policy meeting

USD/JPY: A weaker yen ahead of tomorrow’s BoJ & FOMC meetings

The yen has continued to weaken overnight ahead of tomorrow’s BoJ policy meeting which has resulted in USD/JPY rising back up to the 150.00-level. USD/JPY has been supported by the pick-up in US yields over the past week. After hitting a low of 3.83% on 11th March, the 2-year US Treasury yield hit a high yesterday of 4.06%. The pick-up in US yields was supported yesterday by the release of the latest US retail sales for February which has helped to ease fears over a sharper slowdown for the US economy. The report revealed that the control group of retail sales increased more strongly than expected by 1.0%M/M in February following a downwardly revised contraction of -1.0% in January. The strength of spending in control retail sales came from online sales (+2.4%) and health and personal stores (+1.7%). The 3-month average annualized rate of growth for control retail sales slowed to 2.6% in February down from 3.1% in January and further below the peak from September of 5.9%. The report supports expectations that the pace of consumption growth is likely to be cut in half in Q1 after robust but unsustainable growth of 3.7% in Q3 and 4.2% in Q4 of last year. In the first two months of this year spending on autos, furniture and sporting goods has been weak which looks like payback weakness after strong spending on those categories in Q4. Market participants will be watching closely to see if the weak start for the year for consumer spending continues in the coming months to see if the weakness turns into a more sustained slowdown. The recent sharp deterioration in measures of consumer confidence has added to those concerns. We expect the Fed to acknowledge that downside risks to growth have increased at tomorrow’s FOMC meeting although not sufficiently to encourage the Fed to consider cutting rates again at the current juncture.

The key focus for yen this week will come tomorrow with the BoJ policy meeting followed later in the day by the FOMC policy announcement. The market is fully priced for no change in BoJ policy but recent speeches on the topic of the ‘terminal rate’ means investors will be focused on any signal from Governor Ueda on a potential hint that the terminal rate could be higher. A Bloomberg survey last week (52 respondents) indicated 1.25% as the median level for the terminal rate with a range of 0.50% to 2.50%. But the survey also indicated concerns over the BoJ potentially being too cautious in hiking with 39% seeing a “real risk” of the BoJ falling behind the curve and a further 27% saying it was difficult to tell. 55% believed it was a “high” or “very high” hurdle for the BoJ to buy JGBs if yields increased rapidly. Deputy Governor Uchida in a speech on 5th March stated that the BoJ didn’t know the terminal rate and that it would not be good communication for the BoJ to cite a level anyway. Policy Board Member Hajime Takata in February spoke of the range for the neutral rate being very wide and concluded in a speech that conditions are falling into place that would require the BoJ to return to “policy conduct that is in line with what is seen in normal times”. That speech helped lift market expectations of the terminal rate which has now gone from around 0.90% at the end of 2024 to close to 1.20% now.

We would expect this adjustment in the pricing of the terminal rate to be maintained following the BoJ meeting. While we doubt Governor Ueda will dwell on the topic of the terminal rate he will likely confirm progress continues to be made in reaching the inflation goal. The Rengo wage announcement last week is a very important part of this BoJ view being maintained. The ‘shunto’ wage negotiation by Rengo came in at 5.46% with a base pay of 3.84% above the Bloomberg consensus (5.1% & 3.4%) and will clear Governor Ueda to signal further hikes ahead. We expect the next 25bp hike in July but there is a risk of it coming sooner, in June. Our bias remains selling USD/JPY on rallies. Please see our latest FX Weekly for more details (click here).

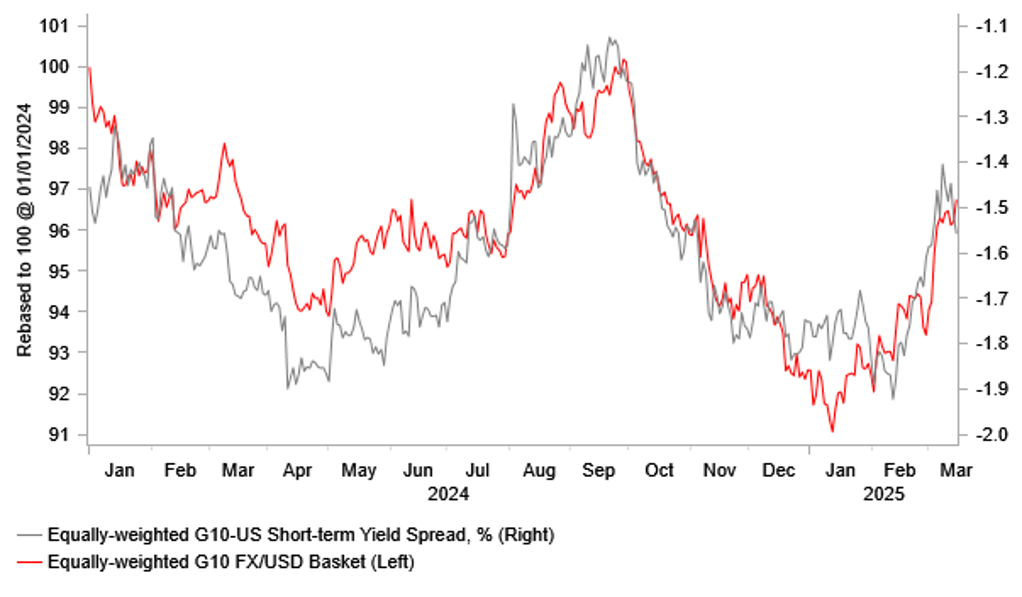

USD REMAINS CLOSELY LINKED TO SHORT-TERM YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: On track for strongest quarterly performance since Q4 2020

Emerging market currencies have continued to rebound against the USD at the start of this year, and they are currently on track for their best quarterly performance since Q4 2020 following the negative COVID shock. The best performing emerging market currencies over the past week have been the RUB (+4.1% vs. USD), BRL (+2.2%), MXN (+1.6%), CLP (+1.5%) and COP (+1.5%). While the MYR (-0.7% vs. USD) and TWD (-0.4%) have underperformed. The RUB has benefitted from building optimism over a potential ceasefire deal between Russia and Ukraine. According to press reports, Presidents Trump and Putin are expected to speak again tomorrow to discuss territory and dividing up certain assets. President Trump has expressed optimism that there is a “very good chance” for a deal.

Latam currencies have outperformed supported in part by the pick-up in commodity prices this month. The price of copper has risen up to its highest level since Q2 of last year. It follows the announcement towards the end of February that President Trump has ordered an investigation into copper imports which is encouraging market participants to bring forward demand. At the same time, the latest activity data from China at the start of this year is proving stronger than expected providing support for commodity prices and related-currencies. Retail sales (+4.0% YTD YoY), industrial production (+5.9% YTD YoY) and fixed asset investment excluding rural (+4.1% YTD YoY) all came in stronger than expected in February. It provides some comfort for Chinese policymakers before the 20 percentage points of tariff hikes were put in place on imports from China at the start of Trump’s second term. China has provided updated guidelines for providing fresh support for consumption including room for expanding the goods trade-in program and childcare subsidies although it was short on details.

The weaker USD and lower US yields are providing a tailwind for emerging market currencies. Building fears over slower US growth in response to heightened policy uncertainty and trade tariffs have hurt business and consumer confidence. At this week’s FOMC meeting, we expect the Fed to acknowledge that downside risks to US growth have increased but still reiterate that they are not in a rush to resume rate cuts right now. The US rate market has already moved to bring forward expectations for the next Fed rate cut to June and is pricing in 2-3 further cuts in total this year which should help to dampen the negative impact on the USD from the Fed’s policy update. Please see our latest EM EMEA Weekly (click here) for more details.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Current Conditions |

Mar |

-80.5 |

-88.5 |

!! |

|

EC |

10:00 |

Trade Balance |

Jan |

14.0B |

15.5B |

!! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Mar |

43.6 |

24.2 |

!! |

|

US |

12:30 |

Building Permits |

Feb |

1.450M |

1.473M |

!! |

|

US |

12:30 |

Export Price Index (MoM) |

Feb |

-0.2% |

1.3% |

!! |

|

US |

12:30 |

Housing Starts |

Feb |

1.380M |

1.366M |

!! |

|

CA |

12:30 |

CPI (YoY) |

Feb |

2.1% |

1.9% |

! |

|

US |

12:55 |

Redbook (YoY) |

-- |

-- |

5.7% |

! |

|

US |

13:15 |

Industrial Production (MoM) |

Feb |

0.2% |

0.5% |

!! |

|

JP |

23:00 |

Reuters Tankan Index |

Mar |

-- |

3 |

! |

Source: Bloomberg