Positive USD momentum persists; USD/JPY takes the lead

USD: Debt ceiling fears ease helping reduce Fed easing expectations

The dollar has advanced versus most of the rest of G10 with a broader improvement in risk reducing the expectations of monetary easing. With monetary easing priced in at a relatively early stage of the curve, improved risk can come to support the dollar. When the source of the improved risk is US-specific, the catalyst for dollar strength is more compelling. That source of course is the improved optimism over the potential for a debt ceiling deal being reached soon after President Biden returns from the G7 in Japan. Rhetoric from both Biden and Kevin McCarthy suggests progress. McCarthy’s comment that a deal remains far away but that it is still possible to reach a deal by the end of the week was the real spark for improved sentiment.

The OIS market implies that nearly 30bps of easing by year-end has now been removed from the markets which we would put mostly down to reduced fears of debt ceiling related turmoil. Stronger retail sales has played a role (although the data doesn’t really alter the outlook much in our view) as has the rhetoric from Fed officials who continue to express fears over the inflation threat. While the Fed might not hike again the risk bias remains very much in that direction which without any market turbulence makes it more difficult to envisage monetary easing by December.

As stated here before, USD/JPY would in our view be the currency that would fall most in a scenario of debt ceiling related turmoil and in that sense it is not a surprise to see it as the biggest mover higher within G10. 137.77 and 137.91, the May and March highs respectively, are the key levels and an imminent breach of these highs look more likely now. Furthermore, the 200-day MAV broke yesterday and this is now the third attempt to break the 200-day MOV sustainably after failures from those two highs in March and May.

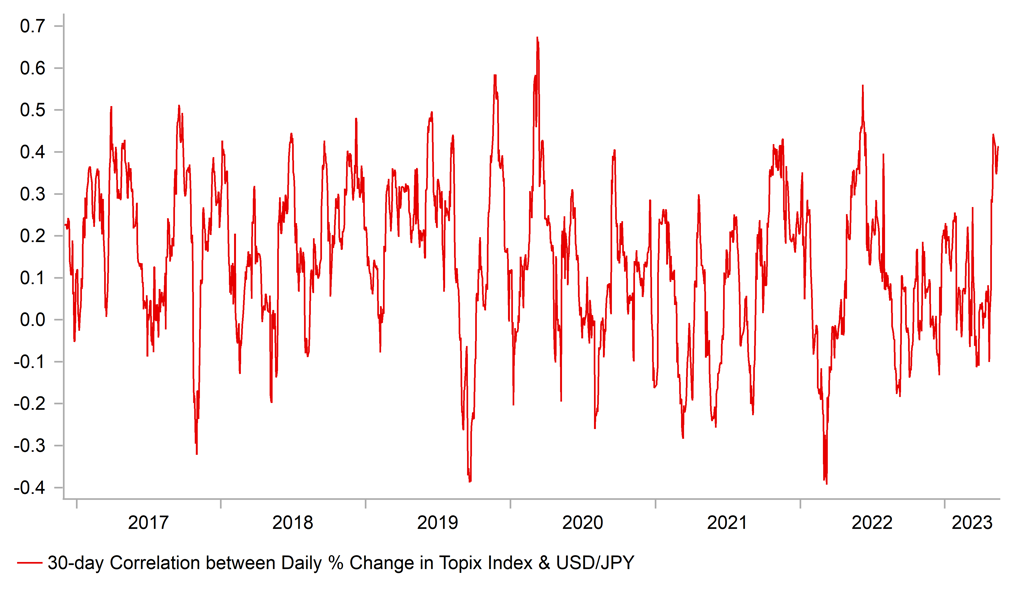

What may add momentum to USD/JPY is potential increased hedging-related yen selling flows. The Japan equity markets are surging and clearly outperforming broader markets. In both local currency and in USD terms, the Topix is outperforming. The key index hit another new high, hitting levels last seen in 1990 when Japan’s asset bubble was bursting. On a 3-month basis, the Topix is 8.3% higher and 5.8% higher in USD terms versus an S&P 500 gain of 2.0%. As we have highlighted in recent FX Weekly publications (here), we have seen record buying of Japan equities by foreign investors. That continued last week according to the weekly MoF data released today with foreign investors buying JPY 808bn worth of Japan equities, the seventh consecutive week of buying by foreign investors. Warren Buffett’s recent investments in Japan appear to have helped draw fresh flows into Japan equities. But asset managers and other investors already invested will also have seen growth in equity portfolios that may mean increased hedging-related yen selling requirements. It is often cited that yen weakness fuels equity market gains but the correlation can also reflect causality the other way.

USD/JPY & TOPIX INDEX CORRELATION HAS SURGED OF LATE

Source: Macrobond & Bloomberg

JPY: Falling energy prices reflected in trade data

While the above highlights the factors providing positive momentum for USD/JPY we remain unconvinced that the trend in yen weakness can persist. The dynamics that drove the yen weaker in 2022 are changing and that will mean upside scope will be far less going forward. We are currently running a short USD/JPY trade view in our FX Weekly which obviously is not working but we remain convinced that changing fundamentals this year will prove more supportive for the yen.

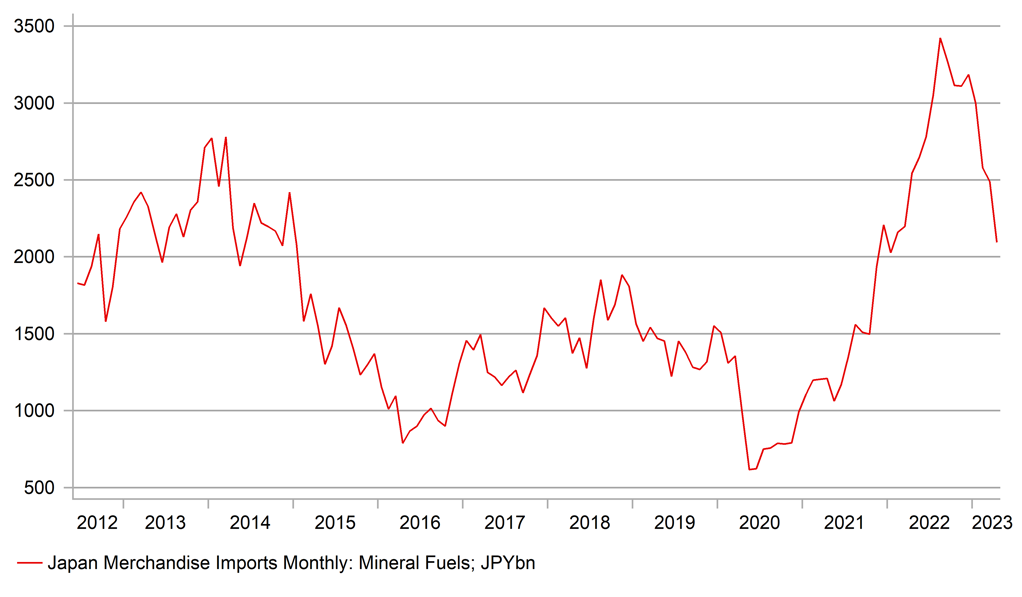

One of those changes we have highlighted is the turn in the energy markets that has seen the huge negative energy terms of trade shock start to reverse. The MoF released April trade data today and we saw Japan’s trade deficit continue to shrink helped by falling energy prices. The annual change in total imports fell 2.3% in April, the first drop since January 2021. In a six-month period we have seen total imports drop on an annual basis from 53.6%. A shrinkage in the trade deficit was further helped by a 2.6% increase in exports.

Japan’s energy import bill is now falling sharply – the annual change was -17.7% in April which contributed to 5.0ppts of decline in overall imports. The contribution of energy to total imports declined to 24% in April – in calendar year 2022 energy imports were 97% higher YoY and contributed 28.5% to total imports. The April fuel import bill totalled JPY 2,094bn, down from a peak of JPY 3,423bn in August last year. The energy deficit on an annual sum basis remains substantial at JPY 32.5trn, but the 12mth total did shrink marginally for the first time in April since the energy price shock began to unfold in 2021.

Of course this underlying change for the yen will play second fiddle to rate expectations in the US which is the current driver of the move higher in USD/JPY but will add potential impetus the other way when the US rates momentum fades, which it inevitably will do going forward.

JAPAN’S ENERGY IMPORTS CONTINUE TO TUMBLE

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

08:45 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!! |

|

EC |

10:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

UK |

10:15 |

BoE MPC Treasury Committee Hearings |

-- |

-- |

-- |

!!! |

|

UK |

12:00 |

BoE Quarterly Bulletin |

-- |

-- |

-- |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

254K |

264K |

!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

May |

-19.8 |

-31.3 |

!! |

|

US |

13:30 |

Philly Fed Business Conditions |

May |

-11.3 |

-1.5 |

! |

|

US |

13:30 |

Philly Fed Prices Paid |

May |

8.10 |

8.20 |

! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Apr |

-0.1% |

0.0% |

!! |

|

US |

14:05 |

Fed Governor Jefferson Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Existing Home Sales (MoM) |

Apr |

0.1% |

-2.4% |

!! |

|

US |

15:00 |

Existing Home Sales |

Apr |

4.30M |

4.44M |

!!! |

|

US |

15:00 |

Fed Logan Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

US Leading Index (MoM) |

Apr |

-0.6% |

-1.2% |

! |

|

CA |

15:00 |

BoC Financial System Review |

-- |

-- |

-- |

! |

|

CA |

16:00 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

8,503B |

!! |

Source: Bloomberg