Governor Ueda fails to push back strongly against weaker JPY

JPY: Governor Ueda refrains from signalling a December rate hike

The yen has weakened modestly at the start of this week resulting in USD/JPY rising back up to the 155.00-level. It follows the much anticipated speech overnight from BoJ Governor Ueda. It was his last major speech before the BoJ’s final policy meeting of this year on 18th-19th December. Market participants were watching closely to see if he would give any clear signal that the BoJ are planning on raising rates one more time this year. However, Governor Ueda refrained from providing any clear signal over the likely timing of the next rate hike. He stated that “the actual timing of the adjustments will continue to depend on developments in economic activity and prices as well as financial conditions going forward”. When asked by the possibility of a rate hike at the next policy meeting he stated “for the December meeting, for example, we will make the right policy decision at that time and adjust our outlook as needed for assessing risks and additional information that we’ve gathered since the October meeting”. He did reiterate though that if the BoJ’s outlook for economic activity and prices are realized, the bank will continue to raise rates.

At the BoJ’s last policy meeting, Governor Ueda emphasized that it’s no longer necessary for the bank to say they had “time to mull” before making further policy adjustments. It sent a signal to market participants that the hurdle to another rate hike had diminished. However, based on comments overnight from Governor Ueda it appears unlikely that the next rate hike will be delivered as early as next month given that BoJ is placing even more importance now on flagging policy adjustments in advance to help dampen market volatility. While it does not completely rule out a rate hike in December, the yen would have to continue to weaken sharply to prompt the BoJ to bring forward rate hike plans. At the moment, the BoJ appears comfortable enough with recent yen price action and the comments from Governor Ueda will encourage market participants to keep selling the yen heading into year end. Yet the risk of intervention and/or the BoJ hiking rates earlier to support the yen would rise if USD/JPY continued to rise sharply up towards the year to date highs at just above the 160.00-level. Overall, the comments from Governor Ueda fit with our forecast for the next rate hike to be delivered in January. The BoJ will have been encouraged by release of the latest GDP report released last week that revealed much stronger than expected private consumption growth in Q3. Private consumption growth picked up to 0.9%Q/Q in Q3 from 0.7% in Q2. The strongest two quarters of personal consumption growth since Q2 & Q3 2022. It should give the BoJ more confidence that stronger wage growth is helping to boost consumption, and will help to maintain higher inflation. Please see our latest FX Weekly report for more details (click here).

HIGHER USD/JPY BACKED UP BY SHORT-TERM DRIVERS

Source: Bloomberg, Macrobond & MUFG GMR

USD: Fresh uncertainty over Trump’s Treasury Secretary pick

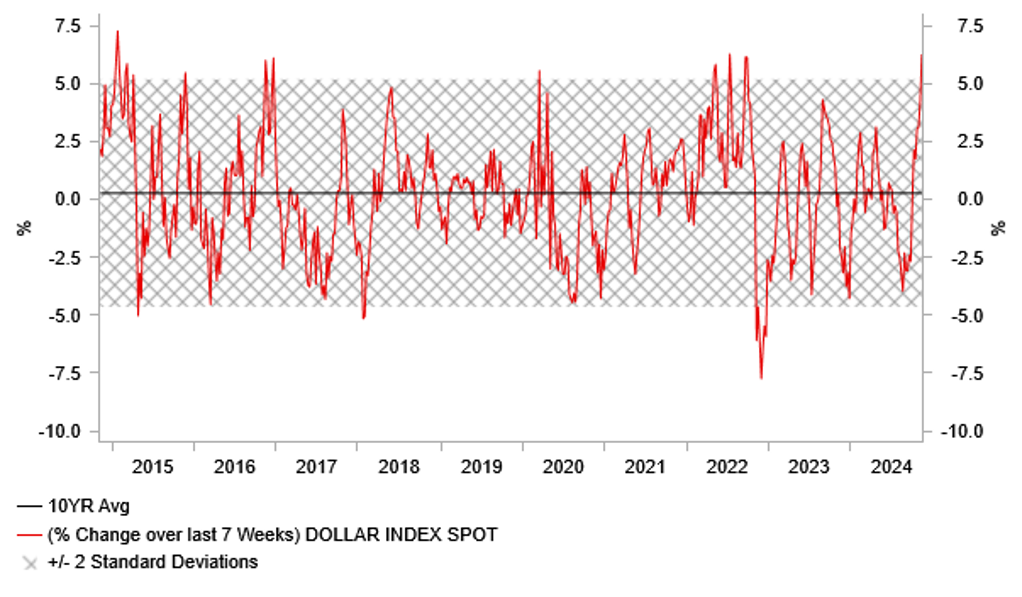

The US dollar has continued to trade at close to recent highs at the start of this week. The dollar index ran into technical resistance at the end of last week provided by the highs from autumn of last year at just above the 107.00-level. The US dollar is taking a breather after strong gains around the US election. The dollar index has risen by almost 7% since the end of September. It is the strongest equivalent period of gains since the autumn of 2022 which proved to be a significant peak for the US dollar. On this occasion we are more confident that the US dollar can extend its advance following the US election victory for Donald Trump and move closer to the highs set in September and October 2022 which are still around 5-6% higher. Donald’s Trump picks over the past week for his leadership team have reinforced market expectations that he will put into place his disruptive policy pledges. Two well-known China hawks Marco Rubio and Mike Waltz have been chosen to be the next US Secretary of State and National Security Advisor. Furthermore, Donald Trump has chosen Tom Homan to be his new border czar.

Market participants are still eagerly waiting to see who Trump will pick to be his Treasury Secretary and US Trade Representative. Over the weekend, it was reported that Elon Musk and Key Square Group LP founder Scott Bessent spoke after Musk publicly endorsed a separate candidate, Howard Lutnick, as the best pick for the role according to people familiar with the matter. Bloomberg has reported that Trump appeared frustrated with the infighting for the role, and his staff have been looking for alternatives. Alternative candidates reportedly include: former US Trade Representative Robert Lighthizer, Senator William Hagerty, Apollo Global Management Inc. Chief Executive Officer Marc Rowan and former Fed Governor Kevin Warsh. It follows a tweet from Elon Musk over the weekend in which he stated that Scott Bessent would be the “business as usual choice” while Howard Lutnick would “actually enact change”. Howard Lutnick has been saying that Scott Bessent is soft on key protectionist pledges including tariffs according to people familiar with the matter. Developments over the weekend have injected fresh uncertainty into who is likely to be picked as Treasury Secretary. We are assuming whoever is picked will be a supporter of implementing of tariffs but the choice of candidate could influence the timing and scale of tariffs that are introduced which is important for US dollar performance heading into next year. More front-loaded and bigger tariffs would be more bullish for the US dollar.

USD HAS ALREADY STRENGTHENED SHARPLY AROUND US ELECTION

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Trade Balance |

Sep |

7.9B |

4.6B |

!! |

|

EC |

13:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:15 |

Housing Starts |

Oct |

239.0K |

223.8K |

!! |

|

UK |

14:00 |

NIESR Monthly GDP Tracker |

Oct |

-- |

0.2% |

!! |

|

GE |

14:00 |

German Buba Vice President Buch Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

15:00 |

NAHB Housing Market Index |

Nov |

42 |

43 |

! |

|

EC |

18:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

21:00 |

Overall Net Capital Flow |

Sep |

-- |

79.20B |

! |

Source: Bloomberg