Another week of gains for the USD

USD: Strong US economy & rising Trump election odds remain supportive

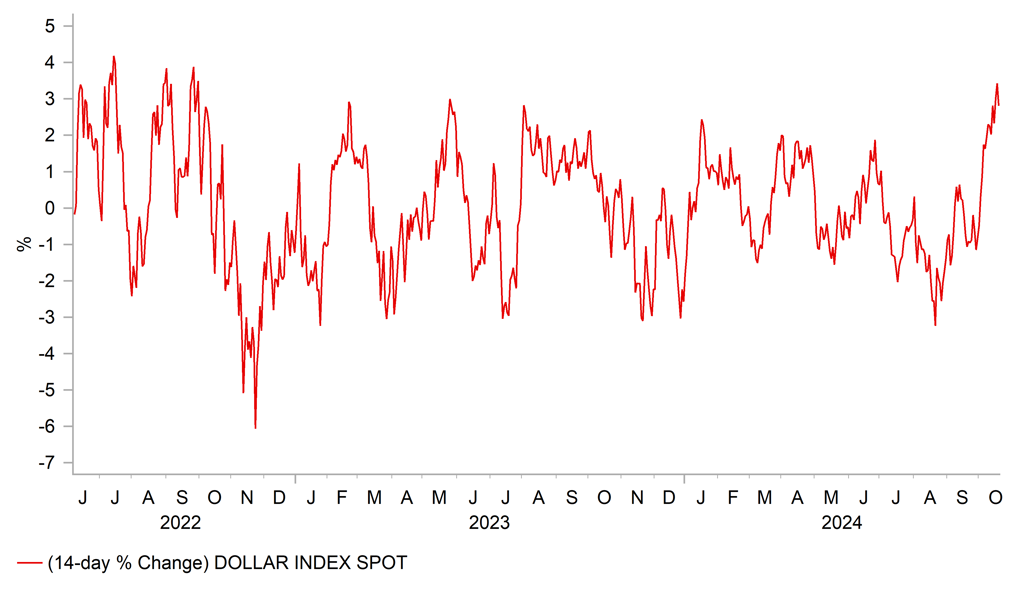

The US dollar has weakened modestly overnight after another week of gains. The dollar index closed higher yesterday for the fourteenth consecutive trading day and has now run into resistance from the 200-day moving average that comes in at around 103.80. It has been the strongest run of US dollar gains over an equivalent period in just over two years. The US dollar’s rally extended yesterday after the release of the latest US retail sales report for September revealed that the US economy is continuing to grow more strongly than expected which has put a further dampener on market expectations for Fed rate cut expectations. While the US rate market is almost fully pricing in one more 25bps rate cut by the Fed at the next FOMC meeting in November, market participants are becoming less confident that the Fed will also cut rates at the final FOMC meeting of this year in December. There are currently around 43bps of cuts priced in by December. The rising probability of Donald Trump winning the US election next month is likely contributing to the hawkish repricing of Fed rate cut expectations in the near-term and encouraging a stronger US dollar. According to PolyMarket, the probability of Donald Trump winning the election rose back above 60% yesterday and closer to levels prior to President Biden’s decision to drop out of the race to seek re-election.

At the same time, the release yesterday of the latest US retail sales report for September revealed that the US economy remains strong casting some doubt on whether the Fed’s policy stance is as restrictive as the they and market participants currently assume. The report revealed that control retail sales increased by +0.7%M/M in September. It lifted the annualized rate of growth for the control measure of retail sales to 6.4% in Q3 up from 1.3% in Q1 and 3.3% in Q2. It was driven by a 1.5%M/M jump in clothing store sales and a 1.0%M/M increase in food store spending. The report suggests that personal consumption growth likely increased robustly by between 3.5-4.0% in Q3 up from 2.8% in Q2. While there are doubts over the sustainability of such strong growth with employment and wage growth slowing, it sends a cautionary signal to the Fed not to cut rates too quickly heading into year end.

USD IS STAGING STRONG REBOUND AHEAD OF US ELECTION

Source: Bloomberg, Macrobond & MUFG GMR

CNY: Signs of bottoming growth in China before stimulus roll out

The stronger US dollar has been encouraged as well by negative developments outside of the US recently. The release overnight of the latest GDP report from China provided further confirmation that growth slowed over the summer. The annual rate of GDP growth slowed to 4.6% in Q3. The quarterly pace of growth in Q3 came in weaker than expected at 0.9% following a downwardly revised expansion of 0.5% in Q2. However, there were some encouraging signs of a pick-up in growth at the end of Q3. Retail sales (+3.2%Y/Y, industrial production (+5.4%Y/Y, and fixed asset investment (+3.4%YTD Y/Y) all came in stronger than expected in September. It will provide encouragement to market participants that China’s economy is bottoming out with growth set to be boosted by the broad-based package of easing measures announced in recent weeks heading into next year although there remain doubts over how effective the stimulus measures will prove to be at lifting growth.

Economic data releases this week have also provided evidence that inflation is slowing more quickly outside of the US as evident by the downside surprises for the latest CPI reports released from Canada, New Zealand and the UK. The reports have encouraged market expectations that their domestic central banks will speed up the pace of rate cuts. The RBNZ has already recently delivered a larger 50bps rate cut, and we expect the BoC to deliver a larger 50bps rate cut next week. Market participants will be listening to BoE officials next week including Governor Bailey to see how recent softer inflation and wage growth has impacted their outlook for policy. We still expect the BoE to deliver back-to-back rate cuts in November and December despite the release this morning of stronger UK retail sales growth in September. It was the third consecutive month of positive retail sales growth in Q3. At the same time, the ECB sped up the pace of easing at yesterday’s policy meeting and left the door open to another rate cut in December (click here). Bloomberg subsequently reported that ECB officials reckon another rate cut in December is highly likely according to people familiar with the matter although larger 50bps cuts are not being discussed. With the Fed set to slow rate cuts while other G10 central banks are speeding up easing, it will keep upward pressure on the US dollar in the near-term.

One exception is Japan where the release of the latest CPI report for September surprised to the upside. The annual rates of growth for ex fresh food, and ex fresh food & energy measures of inflation came in 2.4% and 2.1% respectively. The BoJ has indicated that it will tighten policy further if Japan’s economy performs in line with their outlook. With the yen re-weakening recently lifting USD/JPY back above the 150.00-level, we are sticking to our call that the BoJ could hike again this year in December rather than wait until early next year.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Aug |

42.2B |

39.6B |

! |

|

EC |

10:00 |

Construction Output (MoM) |

Aug |

-- |

0.00% |

! |

|

EC |

11:00 |

EU Leaders Summit |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Building Permits |

Sep |

1.450M |

1.470M |

!! |

|

US |

13:30 |

Housing Starts |

Sep |

1.350M |

1.356M |

!! |

|

US |

14:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

US |

15:30 |

Atlanta Fed GDPNow |

Q3 |

3.4% |

3.4% |

!! |

|

US |

17:10 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

US |

17:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Federal Budget Balance |

Sep |

34.5B |

-380.0B |

!! |

Source: Bloomberg