US dollar is close to recent highs ahead of busy week for central bank updates

JPY: Bloomberg report attempts to downplay BoJ rate hike speculation

It has been a quiet start to the week in the FX market ahead of the latest policy updates from the Fed, BoE and BoJ in the week ahead. The dollar is continuing to trade close to recent highs after regaining upward momentum at the end of last week. It has helped to lift USD/JPY back up towards the 148.00-level. The yen was also undermined at the end of last week by the release of a report from Bloomberg that was titled the “BoJ is said to see a gap between Ueda remarks and market reaction”. The report downplays the latest comments from BoJ Governor Ueda’s at the start of last week that appeared to talk up the possibility of earlier rate hikes. According to the report “taken in total, his comments indicate little change in view among BoJ officials that they’ll need to weigh both upside and downside risks in deciding whether to adjust policies”. The report goes on to add that BoJ officials also acknowledge that inflation remains strong, requiring them to closely look at upside risks for now. That indicates the possibility of an upward revision to the quarterly inflation outlook in October. The downplaying of BoJ Governor Ueda’s comments that we thought were intended to provide more support for the yen has quickly resulted in the yen giving back all of the gains at the start of last week and leaves it vulnerable to further weakness in the week ahead. While we were already expecting no change to the BoJ’s policy stance in the week ahead, the report will further dampen expectations for more immediate policy adjustments from the BoJ. Market attention will now turn to comments from Governor Ueda at this week’s policy meeting to see what message he delivers over the future timing of rate hikes and what level of unease he displays over recent yen weakness. If BoJ Governor Ueda steps back from providing a strong signal over the possibility of rate hikes by the turn of the year, it will increase the burden on the Japanese government to support the yen through intervention like late last year if the USD//JPY jumps back above the 150.00-level and moves to retest last year’s high at 151.95.

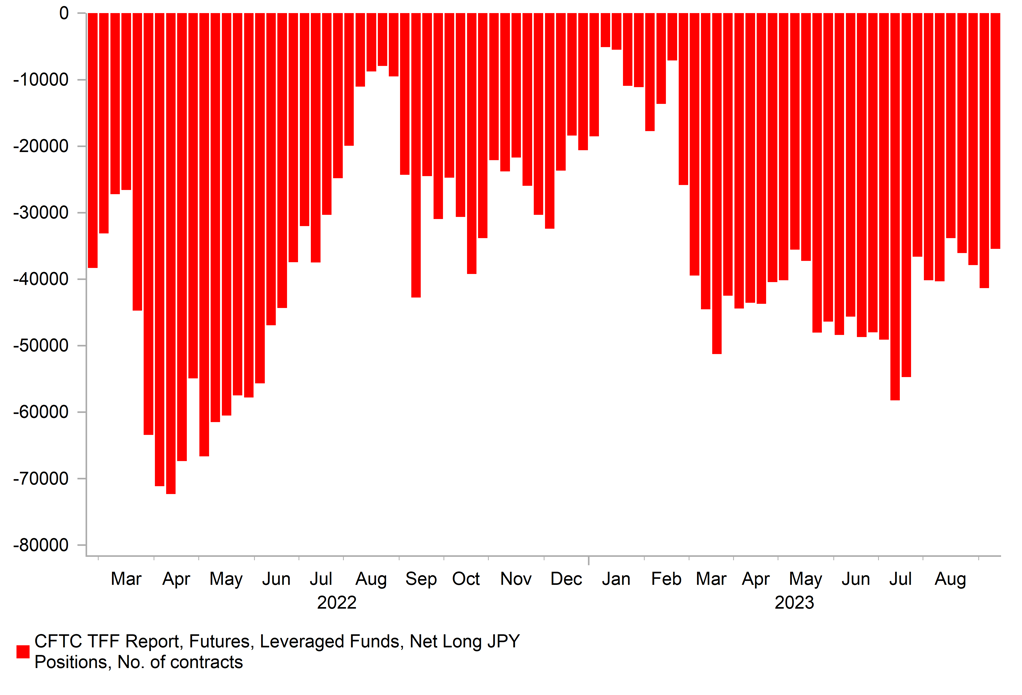

LEVERAGED FUNDS HAVE SCALED BACK JPY SHORTS OVER THE SUMMER

Source: Bloomberg, Macrobond & MUFG Research calculations

Commodity FX: Rising price of oil and better China data provide support

The best performing G10 currencies last week were the Canadian (+0.5% vs. USD) and Australian dollars (+0.2%). It has resulted in USD/CAD falling back towards the 1.3500-level and AUD/USD rising up to 0.6450 overnight. The Canadian dollar is benefitting from the ongoing rise in the price of oil with Brent moving closer to USD95/barrel. In our latest FX Weekly report (click here) we recommended a new short GBP/CAD trade idea ahead of this week’s BoE policy meeting. While we expect the BoE to raise the policy rate by a further 25bps to 5.50%, there is a significant risk that the updated guidance sends a stronger signal that the rate hike cycle is closer to an end similar to at last week’s ECB policy meeting. If that comes to fruition, it should encourage further moves lower in UK yields and the pound in the week ahead. Recent comments from BoE Governor Bailey and Chief Economist Pill both signalled that the BoE is moving closer to the end of their hiking cycle and expressed a preference for keeping rates higher for longer rather than continuing to hikes rates further into restrictive territory which would be a less disruptive outcome for the UK economy. The main risk to our view would the release on Wednesday of a much more lively than expected UK CPI report for August.

The Australian dollar derived support last week from the release of tentative evidence that global investor pessimism over the outlook for China ‘s economy may have passed the peak. After China’s economy slowed in Q2 and at the start of Q3, it was a relief that the monthly activity data for August showed some improvement. Retail sales (+4.6%Y/Y) and industrial production (+4.5%) both picked up in August although weakness in fixed asset investment (+3.2% YTD Y/Y) and property investment (+-8.8% YTD Y/Y) continued. It provided the first tentative signs that policy stimulus is beginning to help stabilize growth in China. However, the scale of the improvement has not yet been significant enough to trigger a bigger reversal of the recent weakening trends for China related currencies.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:15 |

Housing Starts |

Aug |

245.3K |

255.0K |

!! |

|

EC |

13:30 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Sep |

50 |

50 |

! |

|

EC |

16:00 |

ECB's Panetta Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg