BoE to hike as inflation & wage data point to “inflation persistence” risks

GBP: Further near-term support

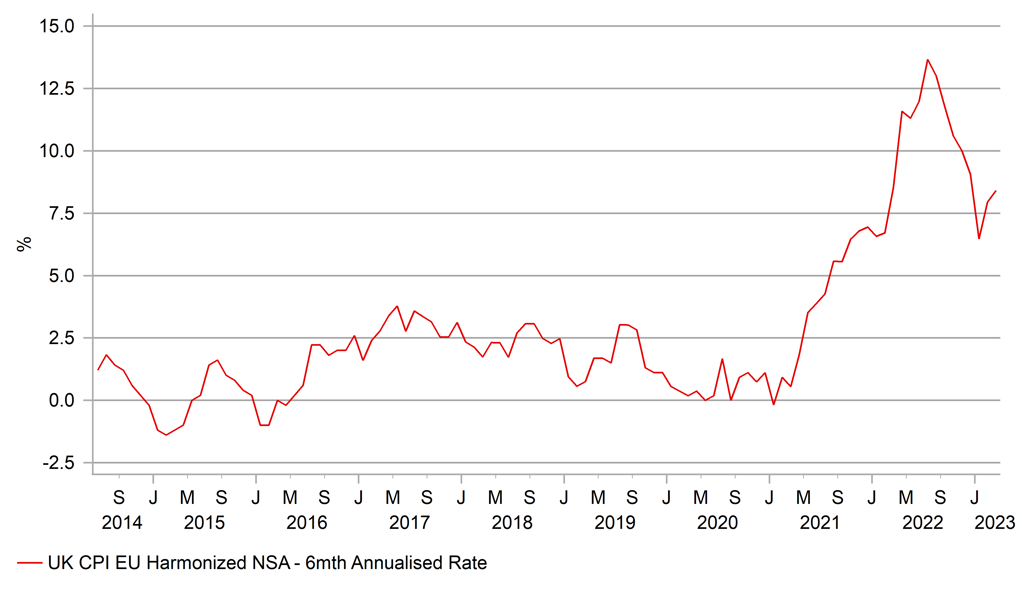

The inflation data just released in the UK was again stronger than expected following on from the stronger wage growth data released yesterday in the jobs report. The decline in the annual rate of CPI from 10.4% to 10.1% was less than expected and the annual rate in Q1 2023 as a whole came in at 10.18%, above the BoE’s February forecast of 9.73%. This fact along with the stronger than expected wage growth data yesterday provide compelling reason for the BoE to now hike by 25bps at the next meeting on 11th May. The market is fully priced for this now and with the Fed expected to hike in May and the ECB to hike by more over the coming months, the positive impetus from this data for the pound will likely be contained.

The breakdown of the data today revealed a slowdown in goods inflation from 13.4% to 12.8% while services inflation remained unchanged at 6.6%. The BoE indicated in March that it expected services inflation to remain roughly unchanged but goods inflation is being supported by continued strong inflation in food. Non-processed food inflation jumped sharply from 14.9% to 16.5% while processed food and non-alcohol inflation jumped from 20.5% to 21.3%. Overall food inflation is the highest in over 45yrs.

The MPC guidance currently indicates that the MPC is closely monitoring indications of “persistent inflationary pressures” measured by labour market conditions, wage growth and services inflation. Some measures of labour demand eased but wage pressures were certainly stronger and while services inflation was as the BoE expected in March, the overall stronger inflation report combined with the wage data will likely be the justification for another hike.

The pound has advanced modestly so far in response to the data. The dollar is strengthening more broadly this morning as short-term yields in the US continue to grind higher. The 2-yr UST note yield is now up 45bps from the low earlier in April and will curtail GBP strength. But the likely hike by the BoE will help provide GBP with support over the coming weeks. The possibility of a 50bp hike by the ECB (mentioned by uber-dove Philip Lane) will also limit GBP strength versus EUR although technically EUR/GBP is beginning to look like a move lower is plausible. If the current high in April holds it will mark the 3rd month of lower highs while the 100-day moving average is currently being tested on the downside.

6MTH ANNUALISED CPI HAS ACCELERATED FOR TWO MONTHS

Source: Bloomberg, Macrobond & MUFG GMR

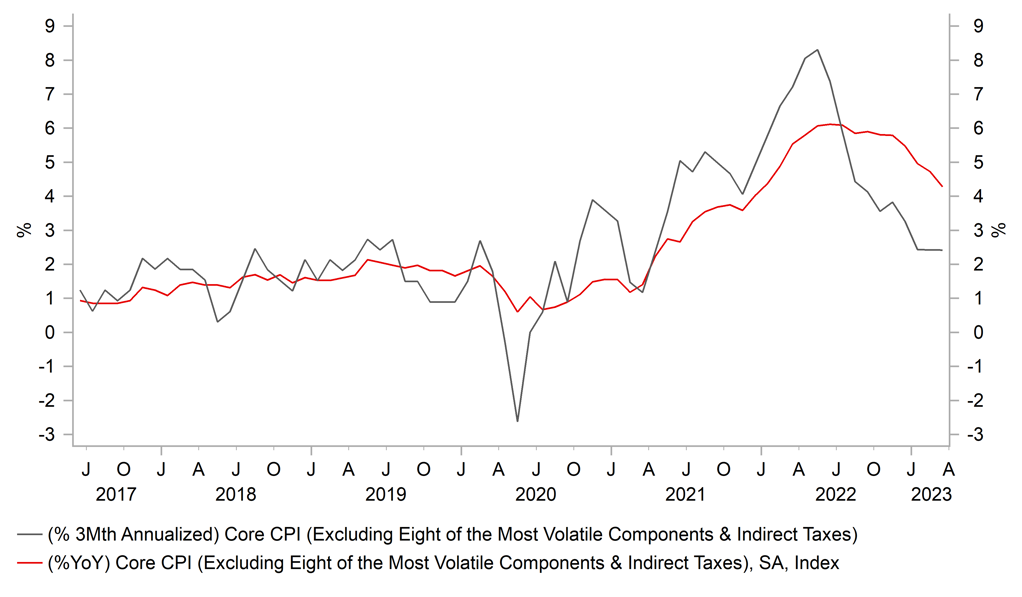

CAD: Inflation moderating justifying BoC pause

There were no big surprises yesterday with the Canada March inflation data largely coming in as expected, with the overall annual rate slowing from 5.2% to 4.3% as energy base-effects begin to work through. The Trim and Median CPI annual rates also slowed to 4.4% (from 4.8%) and 4.6% (from 4.9%) underlining some weakening at the underlying level as well. Another measure, CPI excluding indirect taxes and the eight most volatile components declined also and on a 3mth annualised basis fell slightly further, to 2.4% - back within the BoC’s 1.0%-3.0% inflation target band.

BoC Governor Macklem testified in parliament yesterday and repeated the BoC view that inflation is coming down but that there remains challenges ahead in restoring inflation to the BoC’s price stability goal. He maintained that to achieve that would involve a further slowdown in wage growth and further declines in inflation expectations. The next key test therefore will be the Canada jobs data on 5th May with a particular focus on the hourly wage rate of permanent employees that remains elevated at 5.2% on an annual basis. Excluding the volatility during covid, the annual wage measure has been above 4.0% for the longest period since 2006.

We open a short USD/CAD trade idea in our FX Weekly on Friday (here) based on our rates/crude oil regression model indicating the current spot rate was signalling that USD/CAD spot has scope to drop by a few big figures. That divergence has closed a little but more reflecting the move higher in US yields as the markets position for another 25bp rate hike by the Fed. The model still points to downside scope for USD/CAD although further moves higher in US yields, especially if that move higher hits risk and crude oil prices, would likely see the divergence close further and reduce the near-term downside scope for USD/CAD. The technical backdrop was also favourable after a breach of the 200-day moving average last week. The current spot rate remains marginally below that level.

CORE ANNUAL CPI IN CANADA ON 3MTH ANN BASIS BACK TO TARGET

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

SNB Gov Board Member Maechler Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

Current Account |

Feb |

-- |

17.0B |

! |

|

EC |

10:00 |

Construction Output (MoM) |

Feb |

-- |

3.91% |

! |

|

EC |

10:00 |

Core CPI (YoY) |

Mar |

5.7% |

5.6% |

!!! |

|

EC |

10:00 |

Core CPI (MoM) |

Mar |

1.2% |

0.8% |

!! |

|

EC |

10:00 |

CPI (YoY) |

Mar |

6.9% |

8.5% |

!!! |

|

EC |

10:00 |

CPI (MoM) |

Mar |

0.9% |

0.8% |

!! |

|

EC |

10:00 |

HICP ex Energy & Food (YoY) |

Mar |

7.5% |

7.4% |

!!! |

|

EC |

10:00 |

HICP ex Energy and Food (MoM) |

Mar |

1.1% |

0.9% |

!! |

|

EC |

11:35 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

5.3% |

! |

|

CA |

13:15 |

Housing Starts |

Mar |

237.8K |

244.0K |

!! |

|

CA |

13:30 |

IPPI (YoY) |

Mar |

-2.1% |

1.4% |

! |

|

CA |

13:30 |

IPPI (MoM) |

Mar |

1.6% |

-0.8% |

! |

|

CA |

13:30 |

RMPI (YoY) |

Mar |

-11.8% |

-5.2% |

! |

|

CA |

13:30 |

RMPI (MoM) |

Mar |

0.0% |

-0.4% |

!! |

|

EC |

16:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!!! |

|

SZ |

17:00 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

!! |

|

UK |

17:30 |

BoE MPC Member Mann |

-- |

-- |

-- |

!!! |

Source: Bloomberg