Jackson Hole in focus as USD/JPY plunges again

USD/JPY: Powell guidance and FOMC minutes in focus

US yields rebounded toward the end of last week in part on the Michigan Consumer Confidence data that included inflation expectations readings that were a bit higher than expected. That followed retail sales data on Thursday that were stronger than expected fuelling optimism that the US economy will avoid a hard-landing. The 2-year UST note yield finished last week unchanged but 10bps higher since the sales data.

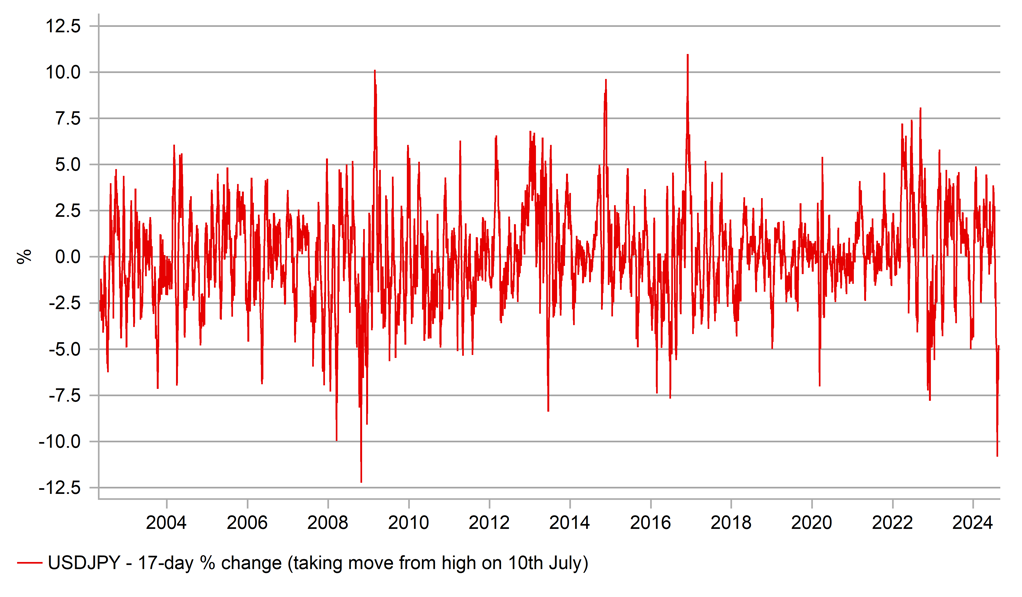

That was a big factor in helping lift USD/JPY although the price action toward the end of last week was notable. The 2yr US yield closed modestly lower Friday after Thursday’s big jump but in FX-land USD/JPY retraced a large part of the yield-fuelled jump on Thursday. It provides possible evidence of our view laid out in the FX Weekly (here) on Friday that the dynamics in the USD/JPY market have likely changed after a 20-big figure drop in such a short period of time – indeed, the largest drop in such a short period of time since the GFC in October 2008. There will likely be greater appetite for yen buying to cover upside yen exposures after such a move. Indeed, in October 2008 we bounced initially by a similar degree before then falling once again. The yen performance today again is very notable – in a day of generally only modest US dollar moves, USD/JPY is 1.5% lower. We see today’s move as another example of how the process of short yen position-liquidation may have more to run as investors’ expectations of yen direction is fundamentally changing after such a large and rapid drop from the highs in July.

The moves this week for US yields will be very much dictated by two key events – the release of the FOMC minutes from the meeting on 31st July and the Jackson Hole Symposium and the scheduled speech by Fed Chair Powell on Friday at 3pm.

The FOMC meeting on 31st July was when Fed Chair Powell put a rate cut at the next meeting on the table explicitly for the first time since the Fed ended tightening its policy stance in July last year. The press conference was certainly dovish – the 2-year yield dropped 10bps that day and hence the minutes will be important in giving a gauge of the scale of support for a possible rate cut in September. Fed President Goolsbee on Friday certainly suggested he was supportive of opening up the prospect of a cut when he stated the economy and labour market were “flashing warning signs”. Rising credit card delinquencies and growing defaults in small businesses were examples he cited. We’d expect the minutes to include content helping explain Powell’s dovish comments. The FT today is also reporting that San Francisco Fed President Daly is supportive of commencing rate cuts at a gradual pace.

The Jackson Hole symposium this year is titled “Reassessing the Effectiveness & Transmission of Monetary Policy” and Fed Chair Powell in his speech on Friday could well give a view that the transmission looks to be working given the level of restrictiveness, which would be another communication opportunity signalling the Fed’s readiness to cut rates.

This week is a light week in terms of top-tier economic data releases so Fed communications and the minutes and Powell’s speech will be key drivers. Is the plunge in USD/JPY the ‘canary in the coalmine’ that signals a period of broader dollar weakness? It could well be and this week will be important in answering that question.

18-DAY % CHANGE IN USD/JPY – RECENT DROP LARGEST SINCE 2008

Source: Macrobond & Bloomberg

USD: Democratic convention as Harris makes further gains in polls

In addition to Jackson Hole this week, there will be some increased focus on US politics with the Democratic National Convention taking place in Chicago. Kamala Harris will formally accept the presidential nomination with momentum continuing to work in har favour. Last week the Harris campaign announced some economic initiatives, some of which have not gone down well with economists. Steps to stop corporations from “price gauging” were viewed as unrealistic with price gauging not viewed by most as the problem when it comes to the cost of living crisis. Others are viewed more credible like measures to boost housing construction.

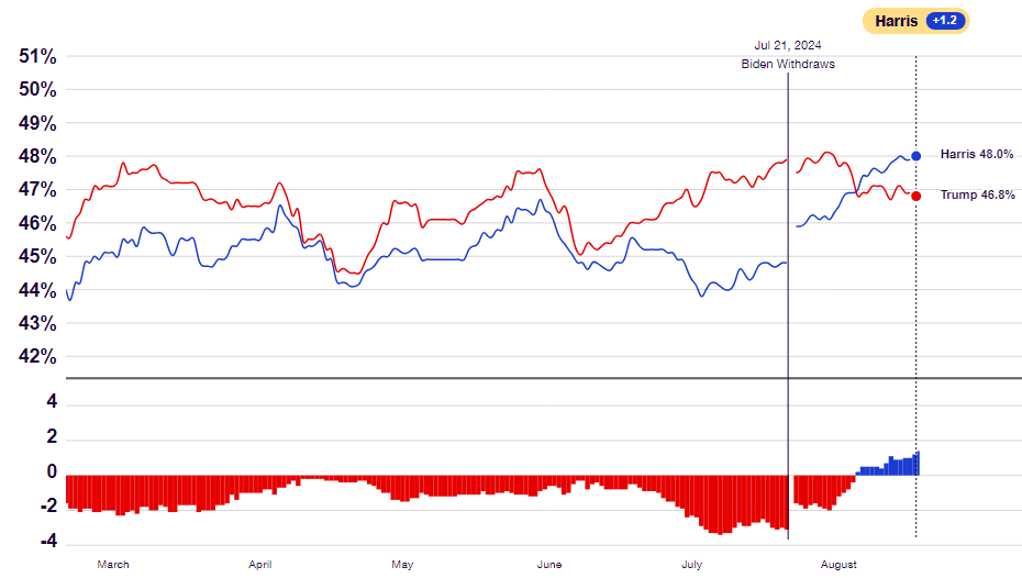

Still, former President Trump is also coming under increased criticism for not focusing on policy and personal attacks on Kamala Harris do not appear to be striking a cord with voters. The polling data continues to show Harris making gains. Real Clear Politics’ overall national poll is now showing a net gain for Harris over Trump of 1.2ppt (48% vs 46.8%) – the net gain turned in Harris’ favour on 5th August and has grown steadily since then. The FT today is running an article on how Trump is losing his grip on Pennsylvania – a key state for winning the White House with the Democrats focusing on the Hispanic vote – a segment of the population that has grown rapidly. The Cook Political Report is now showing Harris ahead of Trump in six of the seven swing states with a huge swing in Arizona with Harris now 6ppts ahead of Trump. Biden had been behind Trump by a similar margin. In Pennsylvania Harris’ lead over Trump is now 6ppts.

This only adds to the building negative momentum for the US dollar. For some time there had been strengthening expectations of a Trump win which encouraged US dollar buying and yield curve steepening trades. The DXY Index is now down close to 4% since the beginning of July and today has hit a year-to-date low. The DXY today has also just breached the trendline support from the lows in December 2023 and July 2023 which will only add further to the negative dollar momentum. It is notable too that this price action follows a week in which the US data was generally stronger than expected.

HARRIS GOES TO THE DEMOCRATIC NATIONAL CONVENTION IN CHICAGO LEADING TRUMP IN THE POLLS

Source: Real Clear Politics, as of 16th August 2024

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CH |

10:00 |

FDI |

Jul |

-- |

-29.10% |

! |

|

US |

14:15 |

Fed Waller Speaks |

-- |

-- |

-- |

!!! |

|

US |

15:00 |

US Leading Index (MoM) |

Jul |

-0.4% |

-0.2% |

!! |

|

CA |

15:30 |

BoC Senior Loan Officer Survey |

Q2 |

-- |

2.6 |

! |

|

EC |

22:30 |

ECB's Rehn speaks |

!! |

Source: Bloomberg