Fresh highs for USD after Fed signals rates to remain higher for longer

USD: Renewed upward momentum after Fed’s hawkish policy update

The US dollar has hit fresh year to date highs overnight following the hawkish policy update from the Fed. It has helped the US dollar to regain upward momentum lifting the dollar index to a high of 108.27. The stronger US dollar has been encouraged by the further paring back of Fed rate cut expectations. The US rate market is now only fully pricing in one more rate cut from the Fed by the end of next year in anticipation that the Fed is moving closer to pausing their easing cycle. US rates are expected to remain at higher levels for longer thereby creating a wider policy divergence with other major central banks such as the ECB and PBoC who are expected to keep cutting rates further to support growth next year. Building expectations for wider policy divergence alongside the looming risk of higher tariffs being imposed at the start of Trump’s second term as president will keep upward pressure on the US dollar heading into next year as it becomes even more overvalued. The hawkish shift in US rate market expectations was encouraged by the Fed’s updated policy guidance. Fed Chair Powell stated that the Fed’s easing cycle was entering a “new phase” in which it would proceed “cautiously”. The updated DOT plot revealed that Fed participants are now only planning to deliver two rate cuts next year rather than the four previously forecast back in September. The timing of the policy rate moving back closer to their estimate of the neutral rate at closer to 3.00% has been delayed by a year into 2027.

Plans for a slower pace of easing mainly reflect unease amongst Fed officials that higher inflation will prove more persistent. The median forecast profile for core inflation was raised by 0.2ppts to 2.8% for this year, by 0.3ppts to 2.5% for 2025 and by 0.2ppts to 2.2% for 2026. Fed Chair Powell described recent inflation developments as “disappointing”. He also added that the slower path for future rate cuts reflected the fact that growth has proven stronger than expected, the Fed’s policy rate is 100bps closer to neutral than at the start of the easing cycle, and that some Fed officials had already started to incorporate expected Trump policy shocks into their forecasts. The potential inflationary impact from Trump’s trade, immigration and fiscal policies argue in favour of the Fed becoming more cautious over delivering further easing next year. Market participants are already anticipating that if those policy risks materialize early next year then the Fed could deliver even less than the two cuts currently planned for next year. At the same time, the Fed decided to lower the rate on ON RPP balances by 5bps aligning it with the bottom of the target range of 4.25% It has no implications for the stance of monetary policy but will help to lower repo rates when faced with increasing upward pressure heading into year end. Overall, the Fed’s hawkish policy update has increased upside risks to our forecasts (click here) for a stronger US dollar in the 1H of next year.

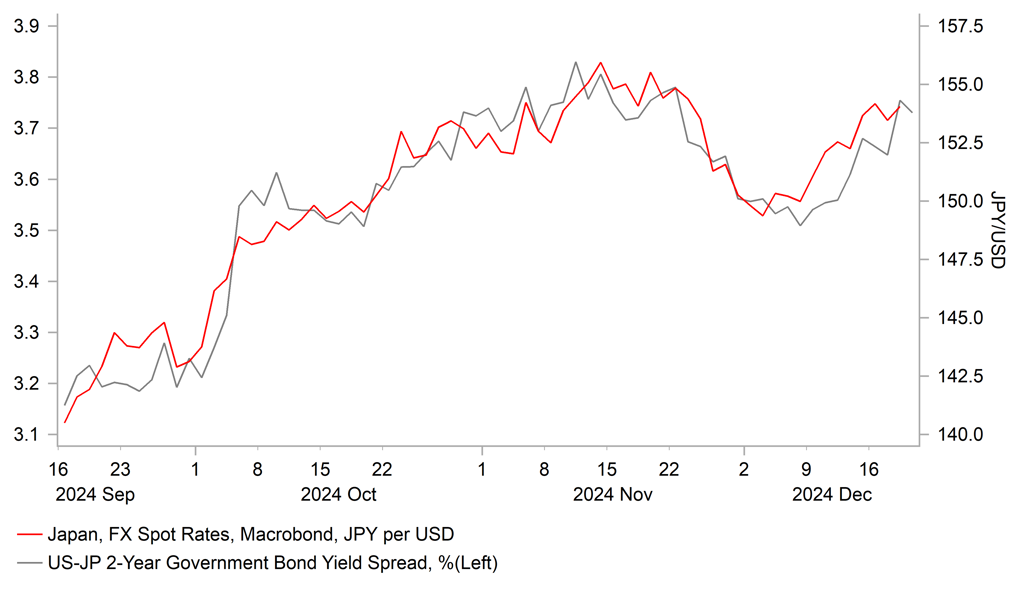

USD/JPY HEADS BACK TO YEAR TO DATE HIGHS AFTER POLICY UPDATES

Source: Bloomberg, Macrobond & MUFG GMR

JPY: BoJ caution leaves door open for yen to weaken further

The yen has been hit the hardest amongst G10 currencies by the Fed’s hawkish policy update. The yen sell-off has extended further overnight after the BoJ’s latest policy update. It has resulted in USD/JPY climbing back above the 156.00-level to a high at the start of the European trading session of 156.78. The yen has been undermined further by the BoJ’s reluctance to tighten policy when the policy rate was left unchanged as expected at 0.25% overnight. In the accompanying press conference, Governor Ueda reiterated that the BoJ would raise rates further if the economic outlook is realized but added that they need more information on wage hikes and want to see the impact of US policies. The BoJ will be watching closely momentum towards next spring’s wage talks. The timing of the next rate hike remains data dependent. He expressed the view that recent economic data was broadly in line with their outlook although it was not sufficient to encourage another rate hike as soon as at today’s meeting.

More importantly, Governor Ueda refrained from sending a strong signal that the BoJ is planning to hike rates at the next policy meeting on 24th January. He only added that there will be a certain amount of information available by the next meeting while emphasizing that the full picture on the wage trend will be clear in March or April. With Trump’s second term not starting until 20th January, the BoJ will not have much time to assess the impact of US policies by the next policy meeting. He finished off by saying that he can’t say if we’ll have enough info by the next policy meeting. Overall, the comments from Governor Ueda will push back expectations for the timing of the next BoJ rate hike from January to March. It has provided a green light for speculators to rebuild short yen positions and increases the likelihood that USD/JPY will rise back up toward year to date highs at just above the 160.00-level. A much weaker yen could then become a factor early next year that encourages the BoJ to hike rates sooner in January rather than wait until March. According to Bloomberg, the probability of a January hike has fallen to closer to 50:50 after today’s policy update.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Interest Rate Decision |

-- |

4.50% |

4.50% |

!! |

|

EC |

09:00 |

Current Account |

Oct |

33.5B |

37.0B |

! |

|

UK |

12:00 |

BoE Interest Rate Decision |

Dec |

4.75% |

4.75% |

!!! |

|

UK |

12:00 |

BoE MPC Meeting Minutes |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

GDP (QoQ) |

Q3 |

2.8% |

3.0% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

229K |

242K |

!!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Dec |

2.9 |

-5.5 |

!!! |

|

US |

15:00 |

Existing Home Sales |

Nov |

4.09M |

3.96M |

!!! |

|

US |

15:00 |

US Leading Index (MoM) |

Nov |

-0.1% |

-0.4% |

!! |

|

US |

21:00 |

TIC Net Long-Term Transactions |

Oct |

-- |

216.1B |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,897B |

!! |

Source: Bloomberg