USD is holding on to gains from earlier in the week

USD: Resilience of US economy casting doubt on timing of first Fed rate cut

The US dollar has continued to hold on to gains from earlier in the week when it extended the rebound from earlier in the month. The dollar index has now run into resistance in the near-term provided by the 200-day moving average at just below 103.50. The US dollar has benefitted this week from evidence revealing the US economy is continuing to prove more resilient than expected to higher rates. While growth slowed at the end of last year, the slowdown does not appear to have been as a sharp as expected following the unsustainable pace of growth recorded in Q3 when the US economy expanded by 4.9%. The ongoing resilience of the US economy is making market participants question how quickly the Fed will pivot and begin to cut rates this year which is helping to reverse the US dollar sell-off at the end of last year. The main beneficiary from the broad-based US dollar rebound and pick-up in US yields has been USD/JPY. The pair has rebounded sharply from a low of 140.25 on 28th December and hit a fresh high overnight at 148.80. The move in the spot rate is backed up by our short-valuation model estimate that has moving higher as well indicating that the rebound for USD/JPY is justified by short-term fundamental drivers.

Over the past week US yields have picked up after bottoming on 12th January. So far in January the US rate market has removed around 20bps of cuts by the end of this year, and now judges that the March FOMC meeting is more of a 50:50 call as to whether the Fed will deliver the first rate cut at that meeting. The release yesterday of the latest weekly initial and continuing claims data continued to dampen concerns as well over the health of the US labour market. While it is clear that US labour demand slowed in the second half of last year it is not resulting in a pick-up in unemployment. The level of initial and continuing claims have both been declining over the past month with initial claims falling to the lowest level since September 2022.

The favourable developments for the US economy do not mean that the Fed will not cut rates in response to inflation falling back towards their 2.0% target but there is more uncertainty now over how quickly they will begin to lower rates. As Fed Governor Waller indicated earlier this week, so long as the US economy continues to hold up and it is a softer landing than the pace of rate cuts is more likely to be gradual than during previous rate cut cycles when the US economy fell into recession. It favours rate cuts of 25bps once the rate cut cycle gets underway. The risk of another US government shutdown was avoided yesterday after the House and Senate passed the latest Continuing Resolution bill. The bill passed in the House by 314 to 108 votes with the Republican speaker once again relying on Democratic votes to avoid a government shutdown at midnight tonight. It buys the government some time before the next important deadlines on 1st and 8th March when another round of brinkmanship appears inevitable.

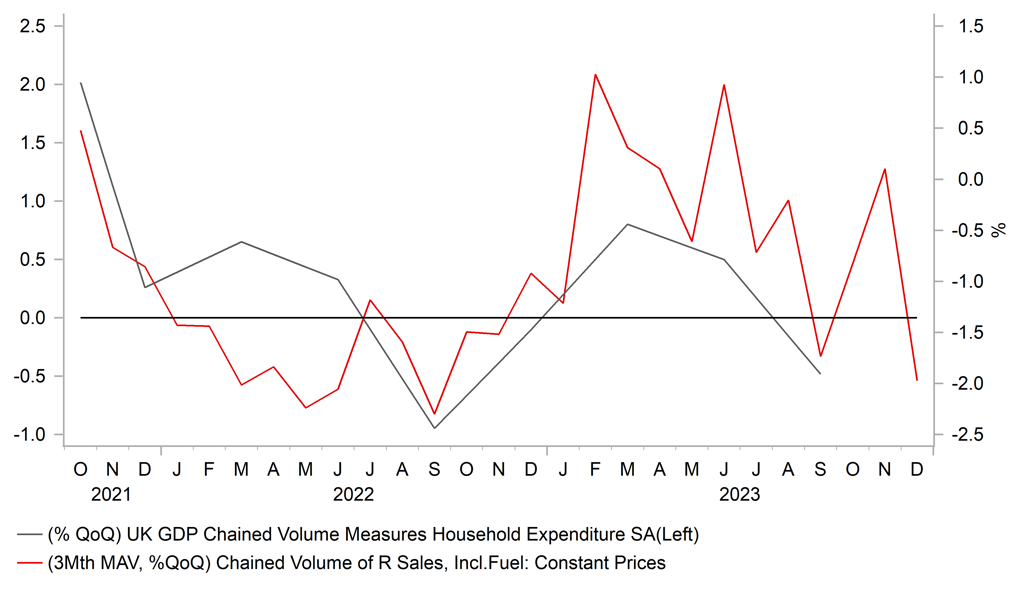

WEAK END TO YEAR FOR UK RETAIL SALES

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Retail sales cast doubt on whether UK economy avoided recession

The main economic data release at the start of the European trading session has been the release of the latest UK retail sales repot for December. The report revealed that retail sales were surprisingly weak over the Christmas holiday period. The headline figure for retail sales contracted by an outsized -3.2% in December which was the weakest mthly reading since January 2021. It was a bigger payback than expected following the stronger growth recorded in November of 1.4% which suggests that consumers brought forward spending ahead of the Christmas period. The weakness in sales was broad-based in December. Food store sales contracted by -3.1% and non-food store sales by -3.9%. The scale of weakness in non-specialised stores sales was a stand-out contracting by -7.1%.

The report will cast doubt on recent investor optimism that the UK economy avoided falling into technical recession at the end of last year after contracting marginally by -0.1% in Q3. It follows more favourable reports recently showing that service sector activity picked up more strongly than expected in November by +0.3% and the pick-up in PMI surveys in Q4. The composite averaged 50.5 in Q4 compared to 49.3 in Q3. However it does not alter the big picture significantly that the UK economy has been stagnating for just over a year now. For the BoE to become more confident that they can begin to lower rates to provide more support for growth in the UK, they will need to see further evidence that persistent inflation risks are diminishing. We expect the first rate cut from the BoE to come as early at the May MPC meeting but the risk is that it could be delayed until August. While the weak retail sales report from the UK today has taken some of the shine off the pound, it is still the second best performing G10 currency at the start of this year.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

CA |

11:00 |

Leading Index (MoM) |

Dec |

-- |

-0.01% |

! |

|

CA |

13:30 |

Retail Sales (MoM) |

Nov |

0.0% |

0.7% |

!! |

|

US |

15:00 |

Existing Home Sales |

Dec |

3.82M |

3.82M |

!!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Jan |

70.0 |

69.7 |

!! |

|

US |

18:00 |

Atlanta Fed GDPNow |

Q4 |

2.4% |

2.4% |

!! |

|

US |

21:00 |

TIC Net Long-Term Transactions |

Nov |

-- |

3.3B |

!! |

|

US |

21:15 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg