Japan CPI report adds to more volatile JPY price action this week

JPY: Giving back strong gains from earlier this week after Japan CPI report

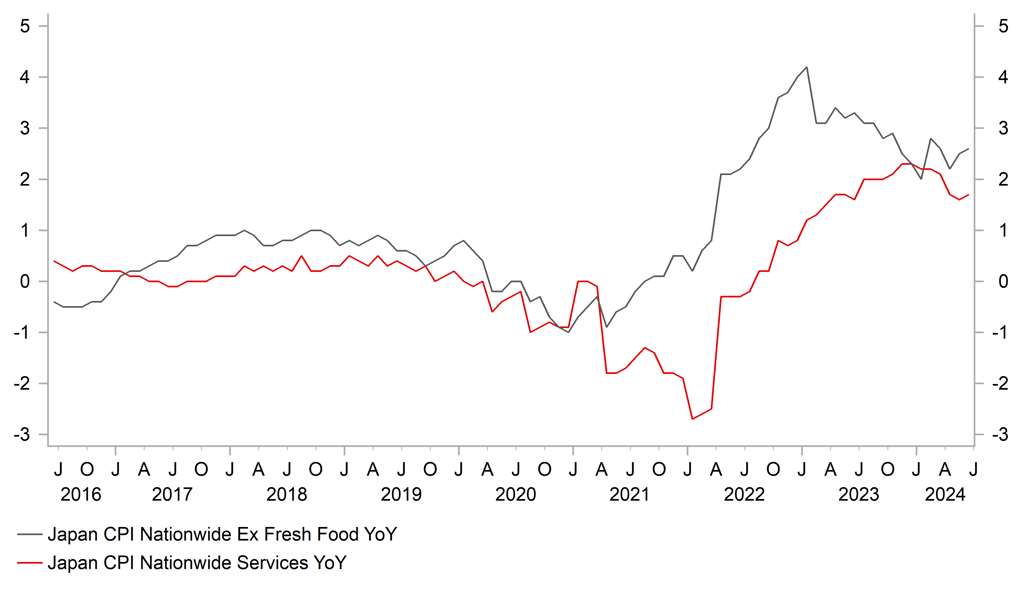

The yen has continued to reverse overnight some of the strong gains from earlier this week. After hitting a low of 155.38 yesterday, USD/JPY has risen back up closer to the 158.00-level overnight. There have been two developments during the Asian trading that have contributed to a weaker yen. Firstly, Japan’s Finance Minister Shunichi Suzuki warned fellow cabinet minister Kono Taro to be more cautious when talking about the yen. During his regular press conference, Finance Minister Suzuki stated that “I would like him to be careful in what he says, given that comments could have unexpected impacts on the market”. In a Bloomberg interview earlier this week, Digital Minister Kono Taro stated that the BoJ needs to raise interest rates to help strengthen the yen to bring down inflation in Japan. The public rebuke from Finance Minister Suzuki will have dampened some speculation over the BoJ moving to tighten policy at the end of this month and contributed to the weaker yen overnight. At the same time, the yen has been undermined by the release overnight of the slightly softer CPI report from Japan for June. The report revealed that headline inflation unexpectedly remained unchanged at 2.8% in June for the second consecutive month compared to the Bloomberg consensus expectation for an uptick to 2.9%. The measures of core inflation did pick-up in June but slightly less than expected. The Japanese-style core inflation measure excluding food increased by 0.1ppt to 2.6% in June and the core-core measure excluding fresh food and energy by 0.1 point as well to 2.2%. While those figures may have dampened some speculation over the BoJ tightening policy further at the end of this month, the breakdown was more supportive for our call for the BoJ to hike rate by a further 0.15 point. The report revealed that services inflation picked up for the first time since November 2023 by 0.1 point to 1.7% in June which should give the BoJ more confidence that the underlying inflation pressures are moving in the right direction and is indicative of a positive wage-price cycle being in place.

IMPROVING INFLATION OUTLOOK TO ENCOURAGE BOJ TO RAISE RATES

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB remains reluctant to commit to further rate cuts this year

The euro has continued to weaken modestly overnight following yesterday’s ECB policy meeting (click here). It has resulted in EUR/USD falling to an intra-day low overnight of 1.0884 although the correction lower appears to be mainly driven by a broader rebound for the US dollar rather than euro specific weakness. Market expectations for ECB rate cuts this year have not changed significantly since yesterday’s ECB policy meeting. The euro-zone rate market is still expecting the ECB to deliver the next rate cut in September. There are currently 17bps of cuts priced for the September policy meeting and 44bps in total by the end of this year. In yesterday’s press conference, President Lagarde stated that the September policy decision was “wide open” and that they will be receiving a lot of information before the September policy meeting. The updated guidance continued to signal that the ECB policy setting remains in data dependency mode and they are not pre-committing to any particular path for the policy rate.

Shortly after President Lagarde finished the press conference, a Bloomberg report was released stating that ECB policymakers are increasingly wondering if they may only be able to cut interest rates once more this year. With inflation pressures lingering, officials are reportedly becoming less confident that a path for two further reductions is realistic, and don’t want investors to assume that a move in September is a done deal. The report went on to say that one reason for a cut in September was that economic growth in the euro-zone was weak in Q2 and may struggle to pick up in Q3. However, services inflation is proving too sticky by holding at 4.1% in June which could weigh against cutting rates further in September. We are sticking to our forecast for the ECB to cut rates in September and December but acknowledge the risk that they could do less than we expect which would be a supportive development for the euro. The euro has been trending higher against the US dollar throughout this month, and we expect EUR/USD to test the top of the current 1.0500-1.1000 trading range over the summer. A break above the 1.1000-level could see the pair retest the high from the end of last year at 1.1139.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

May |

34.6B |

38.6B |

!! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

May |

-0.5% |

1.8% |

!! |

|

CA |

13:30 |

Retail Sales (MoM) |

May |

-0.5% |

0.7% |

!!! |

|

US |

15:40 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

|

US |

17:45 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg