BoJ as expected but cautious guidance sees initial yen selling

JPY: Will yen selling persist after BoJ policy changes?

The BoJ’s policy announcement today is broadly in line with the MUFG Research view outlined over recent days and weeks and broadly in line with market expectations which had shifted in recent days toward action following the numerous news reports last week and again yesterday that indicated action would be taken. The decision to lift the short-term interest rate to a range of 0.00%-0.10% ends the period of negative interest rates that was adopted in January 2016. The change in the interest rates on reserves is effective 21st March. The BoJ also confirmed the end of purchases of ETFs and REITs and will slows purchases of CPs and corporate bonds and will end those purchases “in about one year”. The “inflation overshoot” guidance was scrapped and the only reference to guidance in the statement was that “accommodative financial conditions will be maintained for the time being”.

But there has been no formal declaration of the end of deflation in Japan and the inflation goal is only judged that the price target “would be achieved in a sustainable and stable manner toward the end of the projection period”. Governor Ueda did declare however in the press conference that the “unprecedented easing has ended”.

There has been a classic ‘buy-the-rumour / sell-the-fact’ market reaction to the decisions made today with USD/JPY back close to levels where intervention has taken place previously and with JGB yields modestly lower on the day.

We are unconvinced that this initial market reaction signals what’s to come. The reality is that the guidance has likely been left purposely vague to provide flexibility. However, Governor Ueda was also clear that upside inflation risks and/or stronger economic data wold be enough to indicate additional rate hikes going forward. The BoJ is now essentially data-dependent which is a big change in the BoJ reaction function and opens up the scope for greater FX volatility that should discourage a further build-up of yen carry positions at these weaker yen levels. Import inflation is again picking up and government subsidies that are helping to depress inflation will end on 30th April. Governor Ueda today also stated that the initial Rengo ‘Shunto’ wage increase estimate announced last week (5.28%) was based on a narrow number of unions and the scale that these increases broaden across the economy will be an important determining factor in future rate decisions. Governor Ueda also declined to call the new BoJ policy framework a “Zero Rate Policy” framework suggesting the potential for additional rate hikes going forward.

Finally, Governor Ueda also stated today that the BoJ would “mull a policy response” of an FX impact on inflation suggesting a more assertive interest rate policy linked to FX that would likely also encourage the MoF to instruct the BoJ to intervene if required. Intervention risk remains elevated and the authorities can now argue intervention is more in line with the direction of monetary policy, unlike previously.

Hence, we see limits to the extent of yen selling that can take place from here. Of course there are greater USD/JPY upside risks over the very short-term given this risk event has now passed without any major hawkish surprise and if the FOMC tomorrow evening was to drop a DOT in its policy rate profile, US yields will likely jump further and potentially drag USD/JPY to intervention levels. But over the medium-term we view today’s announcements as hugely significant that is consistent with higher yields and a stronger yen.

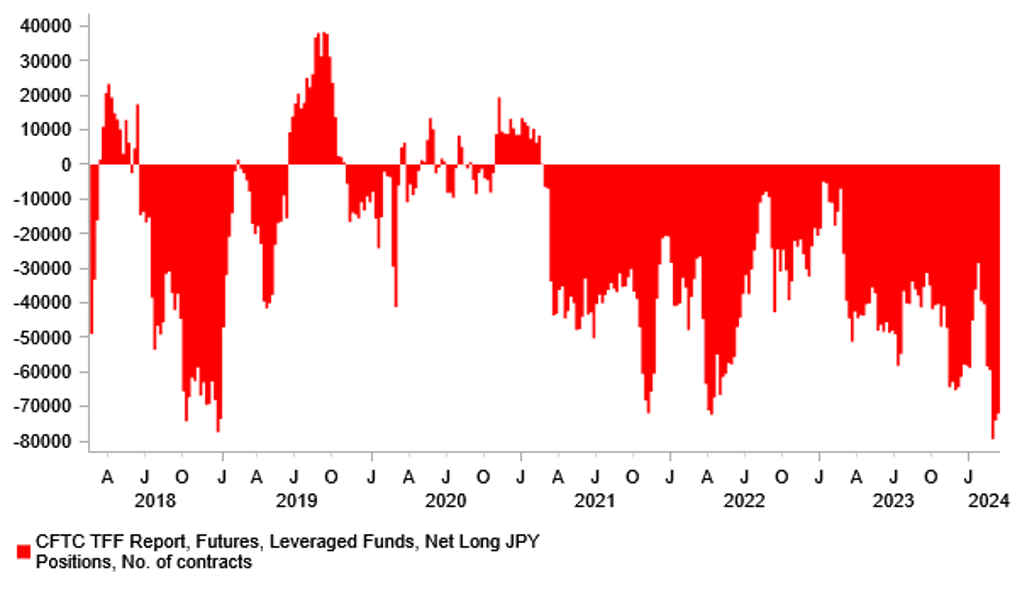

ADDING TO ELEVATED JPY SHORTS AFTER BOJ POLICY UPDATE

Source: Bloomberg, Macrobond & MUFG GMR

AUD: RBA rate guidance shift & sharp decline in price of iron ore weighs

The Australian dollar has weakened overnight following the RBA’s latest policy meeting resulting in the AUD/USD rate falling back towards the 0.6500-level as it moves further below the high from earlier this month at 0.6668. The main trigger overnight for the Aussie sell-off has been the RBA’s latest policy update. The RBA left their policy rate unchanged for the third consecutive meeting at 4.35%. However, the RBA softened their guidance over the likelihood of further rate hikes in the updated policy statement. They dropped the reference from the prior statement that “a further increase in interest rates cannot be ruled out”. It has been replaced by guidance that the “Board is not ruling anything in or out” which indicates that the next policy move could be either a rate hike or a rate cut.

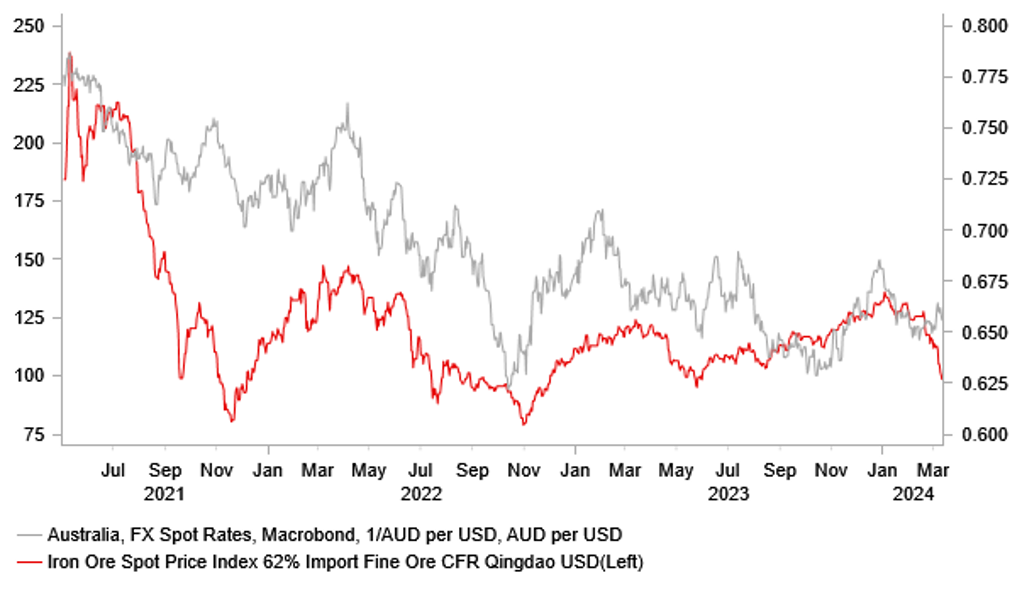

In the press conference Governor Bullock added that “where we are now is where we need to be on rates”, and that they are “more confident CPI will return to their target band for rate cuts”. However to consider delivering a rate cut, she indicated that the RBA needs more confidence on the inflation outlook. On the other hand, she still emphasized that the RBA is not confident enough to say they can rule out more hikes. Risks to the inflation outlook are judged as finely balanced. Overall, the update guidance from the RBA has made us more confident that the RBA has reached the end of their rate hike cycle although the risk of one final hike can’t be completely ruled out. We expect the RBA to begin cutting rates during the second half of this year. The Australian market is currently pricing in the first RBA rate cut by the August policy meeting when there are around -18bps of cuts priced in. One 25bps rate cut is fully then fully priced in by September with just less then 50bps of cuts priced in total by the end of this year. Unlike other major central banks like the Fed, the RBA is expected to be slower to lower rates. In contrast, one less supportive development for the Aussie has been the recent sharp decline in the price of iron ore which has continued to plunge so far this month. After peaking at the start of this year, the price of iron ore has since declined by almost 30% which continues to pose downside risks for the Aussie in the near-term.

AUD/USD VS. PRICE OF IRON ORE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Current Conditions |

Mar |

-82.0 |

-81.7 |

!! |

|

EC |

10:00 |

Wages in euro zone (YoY) |

Q4 |

-- |

5.30% |

!! |

|

EC |

10:00 |

Labor Cost Index (YoY) |

Q4 |

-- |

5.30% |

! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Mar |

25.4 |

25.0 |

!! |

|

US |

12:30 |

Building Permits |

Feb |

1.500M |

1.489M |

!! |

|

US |

12:30 |

Housing Starts |

Feb |

1.430M |

1.331M |

!! |

|

CA |

12:30 |

CPI (YoY) |

Feb |

3.1% |

2.9% |

! |

|

US |

20:00 |

Overall Net Capital Flow |

Jan |

-- |

139.80B |

! |

Source: Bloomberg