All eyes on FOMC meeting after BoJ policy update has limited impact on JPY

JPY: BoJ refrains from providing stronger guidance over next hike

The yen has continued to weaken overnight following the BoJ’s latest policy meeting resulting in USD/JPY rising briefly back up above the 150.00-level. The BoJ decided to leave their policy rate unchanged at 0.50% as expected after raising rates by a further 25bps at their previous policy meeting in January. In the accompanying press conference, Governor Ueda stated that the price trend was to be in line with their goal in the 2nd half outlook and reiterated that they plan to raise rates further if the economic outlook is realized. Even after the recent move higher in yields, he emphasized that the real interest rate in Japan is very low. He was encouraged by recent developments in the labour market where he sees evidence that wage hike moves are getting broader. The Rengo wage negotiation results for the upcoming fiscal year were described as “somewhat strong” although the current wage hike trend was described as still in line with their outlook. He reiterated that the BoJ will need to keep closely watching the wage trend. One area which is contributing to the BoJ’s caution over hiking rates further in the near-term is the “high uncertainties” over US policies.

Governor Ueda stated that he feels that the pace of US tariff policy is speeding up. He added that the BoJ will decide the appropriate monetary policy stance in Japan while assessing the tariff impact on Japan’s economic outlook. There was more unease displayed over overseas uncertainties which were described as rising quickly. He believes that the BoJ will be in a better position to quantify uncertainties from overseas from early April when President Trump plans to announce plans for “reciprocal tariffs” and sector specific tariffs on autos, semi-conductors and pharmaceuticals. The BoJ’s next policy meeting takes place on 1st May when the BoJ will have more clarity over President Trump’s tariff plans. When asked about the neutral rate he reiterated that it was still hard to pinpoint and that they watch the impact of rate hikes to better assess the neutral rate. The most hawkish comment delivered at the press conference was when Governor Ueda stated that we “want to act” so we don’t fall behind in response to impact although he judges that the risk of falling behind the curve isn’t so high.

However, he did not provide any clear guidance today over the timing of the next rate hike. The Japanese rate market is currently pricing in around 4bps of hikes by the May policy meeting, 13bps of hikes by the June policy meeting and 19bps by the July policy meeting. Today’s policy meeting does not change our forecast for the next rate hike in July although we acknowledge the risks that it could be delivered sooner. Finally, Governor Ueda reiterated as well that the BoJ is currently not considering stepping in to support the JGB market after the recent sharp move higher in yields. He stated that “now is not the time the BoJ needs to step in” and believes that rising yields are responding to inflation and economic data. The BoJ would be prepared to step in if JGB yields suddenly spike higher. Overall today’s BoJ policy meeting has not provided much further clarity over the timing of the next BoJ hike. The BoJ will be in a better position to assess the potential impact from President Trump’s tariff policies at the next policy meeting in May. The lack of guidance over the timing of the next BoJ hike and displaying more concern over overseas uncertainties initially weighed modestly on the yen but is not sufficient to trigger a bigger sell-off with the BoJ remaining on course to hike rates further.

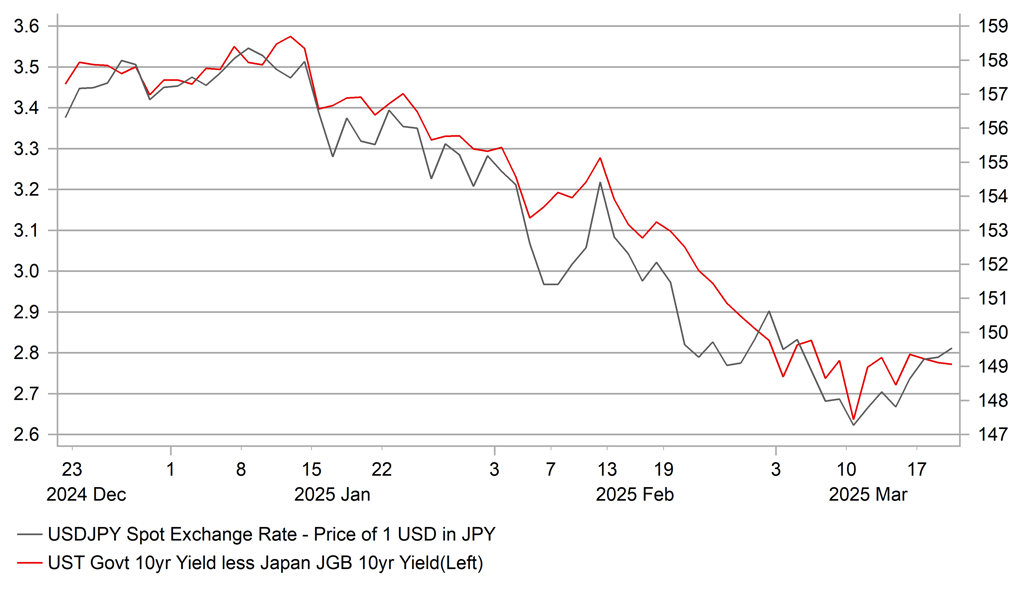

USD/JPY VS. LONG-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

USD: Fed to stand pat as waits for more info on Trump’s economic policies

The US dollar is trading close to recent lows ahead of today’s FOMC meeting with the dollar index trading near the lows from the day of the US election on 5th November at 103.37. US dollar selling has continued at the start of this week even as US yields have been staging a modest rebound. The 2-year and 10-year US Treasury yields have picked up to 4.06% and 4.35% respectively helping to move yield spreads back in favour of the US dollar. Today’s FOMC policy update will be important in determining whether US yields continue to bottom out in the near-term. US yields have been supported ahead of the latest FOMC meeting by the release yesterday of the US import prices report for February.

The report revealed that import prices rose by +0.4%M/M in February following an upwardly revised increase of +0.4%M/M in January. The higher price of natural gas as well as for industrial supplies and materials lifted imported prices in February. Import prices from China rose by +0.5%M/M after President Trump imposed a 10% tariff on imports from China in early February. Higher prices on imports from China were most evident for apparel manufacturing that rose by +1.1%M/M. The import cost measure for airfares that feeds into the core PCE deflator increased by +3.4%M/M on a nonseasonally adjusted basis. It will reinforce expectations for a strong core PCE deflator reading of +0.4%M/M in February which would be the highest monthly reading since last January.

Firmer inflation at the start of this year will encourage the Fed to reiterate after today’s FOMC meeting that they are “not in a hurry” to deliver further rate cuts. the Fed will still want to take their time to better assess the likely impact of President Trump’s polices on the economic outlook before cutting rates further. A key date will be the 2nd April when President Trump is expected to announce plans for “reciprocal tariffs” and sector specific tariffs on auto, semi-conductors and pharmaceuticals. Us Treasury Secretary Bessent stated yesterday that each country will get a tariff number with 15% of countries making up the bulk of tariffs. The reciprocal tariffs could be “stacked” on top fo the tariffs already imposed on steel and aluminium. The scale and breadth of the tariff hikes will give the Fed more clarity over the potential uplift to inflation at least over the next six to twelve months. At the current junction though we expect only a modest upward revisions to the inflation forecasts at today’s FOMC meeting.

On the other hand, FOMC participants are expected to make modest downward revisions to the growth forecasts to better reflect the loss of growth momentum at the start of this year. The recent sharp drops in consumer and business confidence in response to heighted Us policy uncertainty at the start of Trumps second term will add to the Fed’s concerns over downside risks to growth although is unlikely to be sufficient yet to prompt the Fed to consider cutting rates again right now. The Fed acknowledging those risks could trigger some initial US dollar selling even if the main signal is that they remain comfortably on hold.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

CPI (YoY) |

Feb |

2.4% |

2.5% |

!!! |

|

EC |

10:00 |

Wages in euro zone (YoY) |

Q4 |

-- |

4.40% |

!! |

|

EC |

10:00 |

Labor Cost Index (YoY) |

Q4 |

-- |

4.60% |

! |

|

GE |

11:00 |

German Buba Monthly Report |

-- |

-- |

-- |

! |

|

US |

18:00 |

Fed Interest Rate Decision |

-- |

4.50% |

4.50% |

!!! |

|

US |

18:30 |

FOMC Press Conference |

-- |

-- |

-- |

!!! |

|

US |

20:00 |

Overall Net Capital Flow |

Jan |

-- |

87.10B |

! |

|

NZ |

21:45 |

GDP (QoQ) |

Q4 |

0.4% |

-1.0% |

!! |

Source: Bloomberg