USD gives back recent gains as tariff fears ease

USD: US tariff fears ease in response to Treasury Secretary pick speculation

The US dollar has continued to trade at weaker levels overnight after yesterday’s correction lower. It has resulted in the dollar index falling back towards the 106.00-level after hitting a high of 107.06 at the end of last week. The US dollar sell-off was triggered yesterday by reports that Donald Trump is leaning towards picking former Fed Governor Kevin Warsh to be the next Treasury Secretary. According to people familiar with the matter, Donald Trump’s transition team is considering pairing Kevin Warsh in the Treasury Secretary role with hedge fund manager Scott Bessent as the director of the White House’s National Economic Council. In contrast, Howard Lutnick the CEO of Cantor Fitzgerald LP is no longer seen as in contention for the Treasury Secretary role. Howard Lutnick is viewed as being a stronger supporter of tariffs. The increasing likelihood of former Fed Governor Kevin Warsh as Treasury Secretary is reassuring for market participants as he could help to reign in some of the more disruptive parts of Trump’s policy agenda. He was an economic advisor to President George W. Bush from 2002 to 2006 and a Fed Governor from 2006 to 2011. It was during this time that he was central figure in shaping the response to the 2007-2008 global financial crisis. More recently, he has been working on Trump’s transition team helping with economic policy and personnel according to The Journal.

In the past he has expressed the view that “while tariffs can be useful as a short-term negotiating tool, they should not be relied upon for long-term economic strategy”. He has argued that tariffs lead to higher consumer prices which can negatively affect households especially those with lower incomes. He has expressed concern that aggressive tariff policies can strain relations with key trading partners, potentially leading to retaliatory measures and trade wars. Instead of relying on tariffs, he advocates for structural economic reforms that enhance competitiveness such as tax policy changes, regulatory reforms and investment in technology and infrastructure. Overall, he has a more measured approach compared to the aggressive tariff strategies proposed by Donald Trump. As such he would be expected push back against some the most extreme tariff scenarios such as imposing a 10-20% tariff on imports from all of the major trading partners of the US. The US dollar has already started to weaken as market participants have tentatively moved to price out some of the tail risk of a more disruptive tariff scenario for the global economy in the coming years. At the same time, Kevin Warsh has been critical of Fed policy recently although this should have less impact on market expectations. If he becomes Treasury Secretary he unlikely to be in the running again to replace Jerome Powell as Fed Chair when his term ends in 2026. He criticized the Fed’s recent decision to lower rates by 50bps at the September FOMC meeting arguing that they are declaring victory over inflation prematurely.

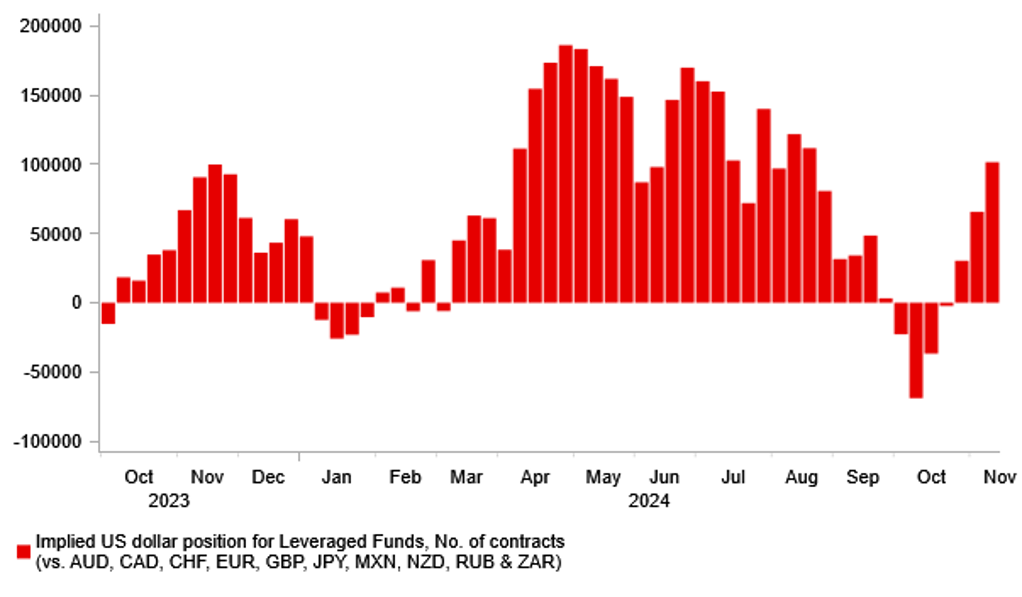

ROOM FOR LEVERAGED FUNDS TO CONTINUE REBUILDING USD LONGS

Source: Bloomberg, Macrobond & MUFG GMR

EUR/JPY: Euro hit harder than yen by initial fallout from US election

The broad-based correction lower for the US dollar at the start of this week has helped to prevent USD/JPY from extending its advance beyond the 155.00-level. The yen initially sold-off after yesterday’s keynote speech from BoJ Governor Ueda in which he refrained from providing a clear signal that they are planning to raise rates again this year in December (click here). It leaves the yen vulnerable to further weakness heading into year end. A gradual weakening of the yen would attract less concern than a continuation of the recent sharp pace of depreciation that would likely be met by stronger pushback from Japanese policymakers. Finance Minister Kato warned market participants again overnight that they will take appropriate action against rapid FX moves, and that they are watching FX moves with a very high sense of urgency. He described recent moves since September as sudden and one-sided. The comments send a clear warning that Japan will intervene again to support the yen if it continues to weaken sharply lifting USD/JPY back up towards the year to date highs from earlier this year at just above the 160.00-level.

The yen has held up better against the US dollar than most other G10 currencies so far this month resulting in other yen crosses moving lower. The yen has been the third best performing G10 currency in November after the US dollar and Norwegian krone while the euro has been the worst performing. It has resulted in EUR/JPY dropping back towards the 162.00-level after hitting a high at the end of last month at 166.69. The euro has been hit the hardest amongst G10 currencies by the US election result and the potential hit to growth in the euro-zone from a trade conflict between the US and EU. While the US rate market has moved to price out Fed rate cuts in response to the inflationary impact of higher import tariffs, the euro-zone rate market has continued to price in more aggressive rate cuts from the ECB placing more emphasis on the negative impact on growth with headline inflation already back at target in the euro-zone. The wide divergence in monetary policy expectations between the ECB and Fed is highlighted by the fact there are around 140bps of cuts priced in by the end of next year for the ECB compared to around 80bps for the Fed. Another ECB rate cut next month is viewed as a done deal while it is a closer call for the Fed now.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Sep |

27.0B |

31.5B |

! |

|

UK |

10:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

UK |

10:00 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

CPI (YoY) |

Oct |

2.0% |

2.0% |

!!! |

|

US |

13:30 |

Housing Starts |

Oct |

1.340M |

1.354M |

!! |

|

CA |

13:30 |

CPI (YoY) |

Oct |

1.9% |

1.6% |

! |

|

US |

18:10 |

Fed Schmid Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg