Reuters report triggers a brief relief rally for the EUR

EUR: ECB plans to tighten excess liquidity capture market attention

The major foreign exchange rates continue to trade in tight ranges ahead of the release later this week of the latest policy updates from the Fed, BoE and BoJ. After a heavy sell off at the end of last week following the ECB’s latest policy meeting (click here), the euro staged a modest rebound yesterday hitting an intra-day high of 1.0699 as it moved further above the low from the end of last week at 1.0632. The main trigger for yesterday’s euro rebound was the release of an ECB sources report from Reuters which was titled “ECB to tackle excess liquidity in next stage of inflation fight”. The report stated that the ECB are likely to start debating how to tackle excess liquidity at the next policy meeting on 26th October. With rates likely on hold at least until December according to the report, policymakers are now starting to shift their focus to reducing excess liquidity with discussions to focus on three areas: i) the amount of reserves banks must keep at the ECB, ii) the unwinding of bond buying programmes and iii) a new framework for steering short-term rates. Several policymakers are reportedly in favour of raising the amount of reserves banks must hold at the ECB on which they do not earn interest – “from 1% of customer deposits to a figure that could be closer to 3% or 4%”. Mandatory reserves currently total just EUR165 billion compared to excess liquidity of around EUR3.7 trillion.

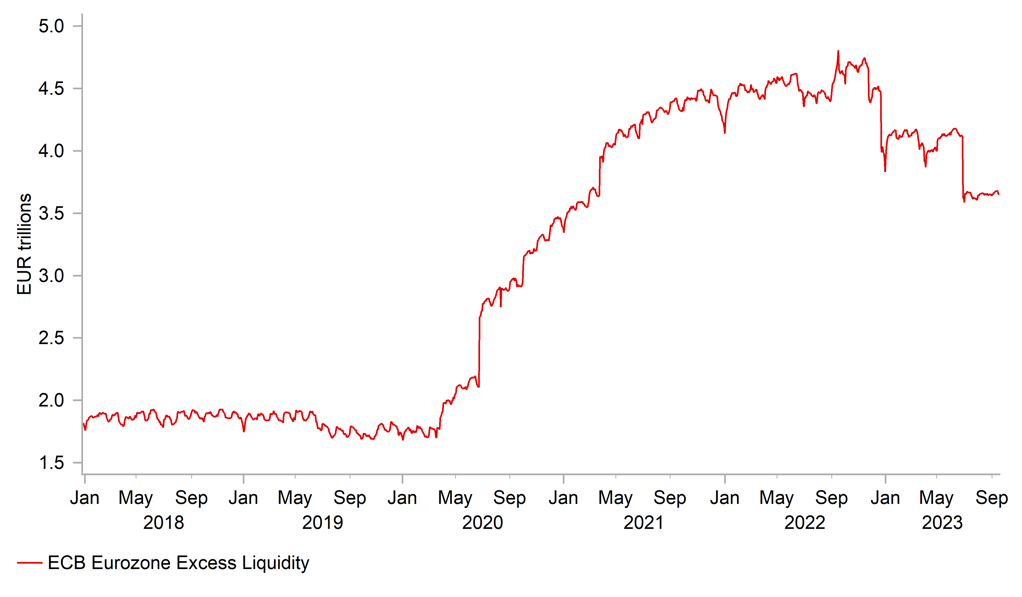

However, one source told Reuters that some policymakers wanted to combine a decision on reserve holdings with those on the ECB’s asset purchase programmes and the interest rate framework which would make the required adjustments slower to implement. Most policymakers reportedly saw scope for phasing out the ECB’s Pandemic Emergency Purchase Programme (PEPP) by not replacing bond holdings when they mature. According to the sources, the delicate balance meant that a decision on the bond buying programmes might not come this year, and any change was very unlikely to take effect until early in 2024 or even later in the spring. The ECB has already halted Asset Purchase Programme (APP) reinvestments which has increased the current run rate of quantitative tightening to around EUR25 billion/month. Finally, the sources said they had not really started to debate whether the ECB wants to continue setting a floor for the interbank rate or go back to a corridor system. The ECB is expected to have to stick with the current floor system given the amount of excess liquidity in the system. The Reuters report follows a study presented at the ECB’s Sintra symposium that showed that now monetary stimulus is no longer needed, the ECB could shrink bank liquidity to between EUR521 billion and EUR1.4 trillion while still meeting banks’ needs for reserves. According to Bloomberg, excess liquidity in the euro area has already fallen to around EUR3.7 trillion from a peak of around 4.8 trillion in September of last year but remains well above pre-COVID shock levels in late 2019 at around EUR1.7 trillion. While the ECB’s reported plans to tighten excess liquidity in the euro area have helped to support the euro, they are unlikely to be sufficient on their own to turn the current weakening trend. Any change to current policy settings does not appear likely to early next year at the earliest limiting near-term support.

EURO AREA EXCESS LIQUIDITY REMAINS WELL ABOVE PRE-COVID LEVELS

Source: Bloomberg, Macrobond & MUFG Research calculations

EM FX: China growth outlook remains in focus ahead of FOMC meeting

It has been a mixed week for EM FX. Latam and Asian currencies have outperformed supported by an easing of investor pessimism over the outlook for China’s economy and stronger pushback from Chinese policymakers against CNY weakness. The best performing EM currencies over the past week have been the COP (+1.6% vs. USD), BRL (+1.6%), MXN (+0.9%), CLP (+0.9%), and KRW (+0.4%). In contrast, EMEA EM currencies have continued to underperform. The worst performing EM currencies over the past week have been the THB (-1.0% vs. USD), ZAR (-0.8%), RON (-0.8%), RUB (-0.7%), PLN (-0.7%), HUF (-0.6%), and TRY (-0.6%). Central & Eastern European currencies continue to be hurt by the NBP’s decision earlier this month to deliver a larger than expected rate cut. CNB Governor Michl has pushed back against rate cut expectations ahead of the CNB’s upcoming policy meeting on 27th September have helped to boost the CZK at the start of this week pulling EUR/CZK back below the 24.500-level. At the same, the ongoing rise in the price of oil is providing a headwind.

Net energy imports are equivalent to ~2-3% of GDP in many countries in Central Eastern Europe (CEE) and Asia. Countries like Egypt, Turkey and Romania, who have current account deficits that are funded in large part by short-term capital inflows.

Asian and Latam FX have benefitted over the past week from release of tentative evidence showing that China’s economy picked-up in August after slowing in Q2 and at the start of Q3. Retail sales (+4.6%Y/Y) and industrial production (+4.5%) both picked up in August although weakness in fixed asset investment (+3.2% YTD Y/Y) and property investment (+-8.8% YTD Y/Y) continued. It provided the first tentative signs that policy stimulus is beginning to help stabilize growth in China. However, the scale of the improvement has not yet been significant enough to trigger a bigger reversal of the recent weakening trends for China related currencies. USD/CNY has dropped back below the 7.3000-level after strong pushback from domestic policymakers as well. The PBoC’s decision to lower rates further last week (25bps RRR cut) is keeping upward pressure on the USD/CNY as yield spreads are moving in favour of a stronger USD.

Market attention will now turn to the Fed’s latest policy update in the week ahead. It is viewed as a done deal that the Fed will leave rates on hold this week so the updated forward guidance and economic projections will be the main market movers. The updated projections should include a significant upward revision to growth this year up from 1.0% to closer to 2.0%, while the core inflation forecast for this year should be lowered as it has been surprising to the downside in recent months. As a result it remains to be seen whether the median projection amongst FOMC participants will continue to show one more hike later this year. We expect any sell-off on the back of the FOMC meeting to prove short-lived. Please see our latest EM EMEA Weekly report for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Jul |

30.2B |

35.8B |

!! |

|

EC |

10:00 |

CPI (YoY) |

Aug |

5.3% |

5.3% |

!!! |

|

US |

13:30 |

Building Permits |

Aug |

1.440M |

1.443M |

!! |

|

US |

13:30 |

Housing Starts |

Aug |

1.440M |

1.452M |

!! |

|

CA |

13:30 |

CPI (YoY) |

Aug |

3.8% |

3.3% |

!!! |

Source: Bloomberg