FOMC’s 50bp cut lifts the dollar – what next?

USD: FOMC goes big in order to revert to small

In line with the MUFG house view, the FOMC last night cut the federal funds rate by 50bps and while that was not the consensus amongst economists and strategists it is clear now that it was for market risk-takers with positioning likely the factor behind the appreciation of the dollar today. The DXY index is up 0.3% from yesterday’s close but on an intra-day basis the swing has been more notable – the dollar from yesterday’s low after the announcement to today’s Asia high gained 1.3% but the dollar is coming under renewed downward pressure now. This move stronger for the dollar looks certainly like Asian market participants cutting short dollar positions.

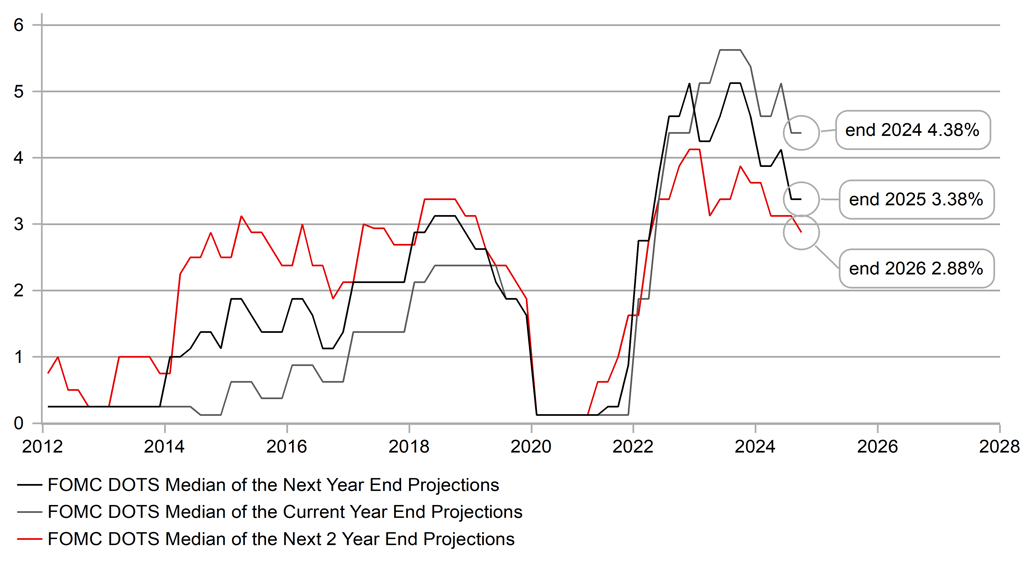

But we are still likely to see further dollar depreciation going forward. Our main message to readers today is that the economic forecasts in the Summary of Economic Projections look wildly optimistic and steady 2.0% real GDP growth every year to 2027 and only a 0.2ppt increase in the unemployment rate (to 4.4%) in this economic cycle looks very unrealistic. The FOMC has dramatically cut its median dot profile from just three months ago which really tells you that the FOMC could well have fallen behind the curve and certainly should have been cutting in July. The median dots for this year and next year have both been cut by 75bps and for 2026 by 25bps to 4.38%, 3.38% and 2.88% respectively. One factor in the lack of dollar selling follow-through yesterday was the 2024 median dot implies two smaller 25bp cuts in November and December. We see a high probability the FOMC may have to do more. The SEPs forecasts on the labour market really do not allow for very much surprise weakness at all.

The press conference coincided with the turn in the markets to lower equities and a stronger dollar so possibly market participants were looking for a more forceful message of being open to cut by 50bps as and when needed. Powell did stress a “meeting-by-meeting” approach but the dots spread amongst the 19 FOMC members shows seven members only looking for one more cut and two looking for no cuts at all. So Powell was more balanced on the way forward. But it really is, as usual, all about the data and in particular the labour market data. It was the jobs market that encouraged this larger cut and we believe just one weak labour market report would see a quick repricing of more cuts this year. The OIS market is currently pricing the November FOMC at -32bps.

The rebound of the US dollar is in our view unlikely to last. The ‘buy the rumour, sell the fact’ philosophy may see some further dollar buying near-term but we would be surprised if there was much momentum to that trade. The dollar remains vulnerable to the US rates curve pricing in more cuts and that will curtail dollar appreciation. While Powell was reluctant to suggest the FOMC is guided by theoretical levels of R*, the median dots profile suggests restrictive policy all the way through 2025 and into 2026. The Fed will cut faster than the dots profile and the forward OIS curve.

FOMC SEP MEDIAN DOTS 2024 TO 2026 – THE FOMC WILL LIKELY CUT MORE

Source: Bloomberg, Macrobond & MUFG GMR

GBP: MPC vote today & Alan Taylor

We mentioned here yesterday that we did not believe the MPC would cut rates today given the CPI data was not enough to prompt some increased speculation. Indeed, the OIS probability of a 25bps cut declined by about 10% to just 15% now. Hence, an unchanged policy announcement remains our view along with most of the market. The vote split is something that could prove important though. It’s seems most likely that we get either an 8-1 or 7-2 vote with Swati Dhingra and possible Deputy Governor Dave Ramsden voting to cut. There is an added element of uncertainty however with Jonathan Haskel’s term expired and Professor Alan Taylor replacing him. Given how hawkish Jonathan Haskel was it is reasonable to assume that the MPC in totality will shift move dovish going forward. In six of the last nine MPC meeting Jonathan Haskel voted in the minority for higher rates. But how great will that MPC shift be? Certainly if the vote is 6-3 with Alan Taylor supporting a cut we would expect a bigger reaction as this would imply the greatest potential dovish shift for the MPC.

So who is Alan Taylor? He is currently Professor of International and Public Affairs at Colombia University and is a research associate of the National Bureau of Economic Research. He is also known for his research on austerity and the UK economy and in 2013 in a research piece concluded that the austerity at the time was damaging the economy. This could prove relevant of course given the Labour government is scheduled to present its budget on 30th October that we have been warned will be tough. How dovish Alan Taylor is may become a little clearer later today.

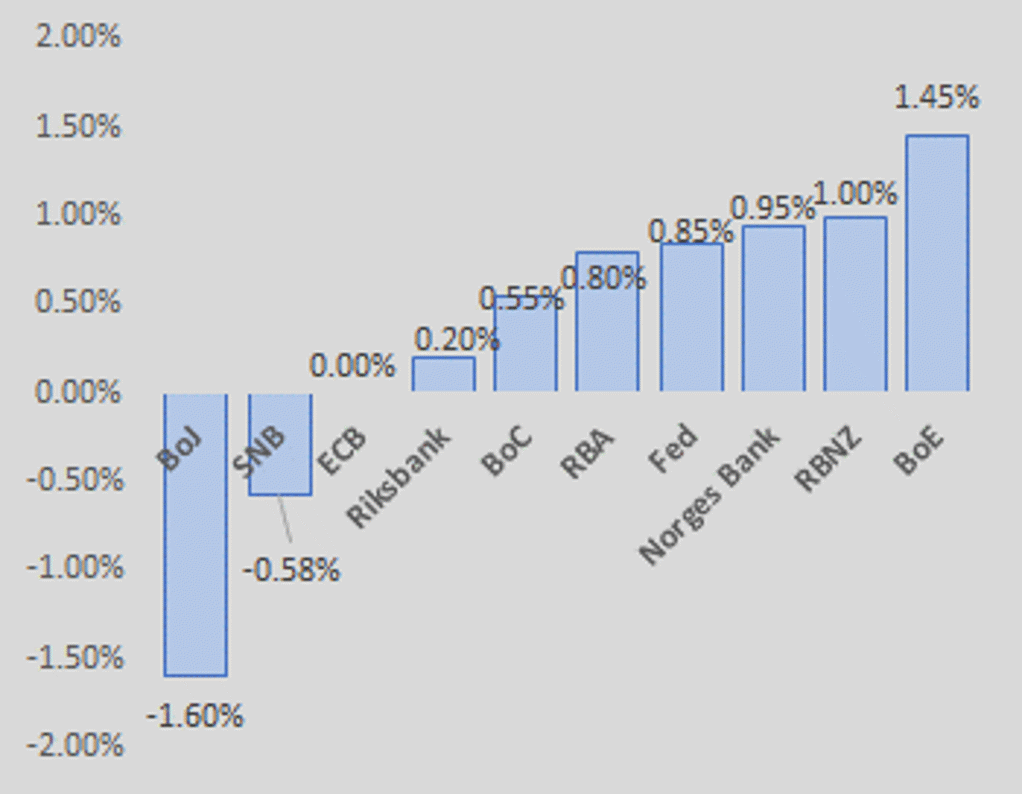

Of course a 6-3 vote (or 5-4) with Taylor voting to cut will have the biggest negative impact on the pound as it will have the greatest capacity to shift rate expectations not just over the coming MPC meetings but throughout 2025 as well. As we have argued here before, the OIS implied extent of rate cuts by the BoE is still too conservative. The OIS forward rates curve has adjusted to more realistic levels but given pound outperformance (3rd best quarter-to-date in G10 after JPY & CHF) the BoE could have to cut further still than currently implied. GBP has had a long run of outperformance and could be set to run out of steam over the coming months.

IMPLIED REAL POLICY RATE ACROSS G10 BY THE MIDDLE OF 2025

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Interest Rate Decision |

-- |

4.50% |

4.50% |

!! |

|

EC |

09:00 |

Current Account |

Jul |

40.3B |

51.0B |

! |

|

EC |

09:00 |

Current Account n.s.a. |

Jul |

-- |

52.4B |

! |

|

EC |

10:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

UK |

12:00 |

BoE MPC vote cut |

Sep |

2 |

5 |

!!!! |

|

UK |

12:00 |

BoE MPC vote hike |

Sep |

0 |

0 |

!!!! |

|

UK |

12:00 |

BoE MPC vote unchanged |

Sep |

7 |

4 |

!!!! |

|

UK |

12:00 |

BoE Interest Rate Decision |

Sep |

5.00% |

5.00% |

!!!! |

|

UK |

12:00 |

BoE MPC Meeting Minutes |

-- |

-- |

-- |

!!!! |

|

UK |

12:30 |

BOE Inflation Letter |

-- |

-- |

-- |

!! |

|

UK |

12:30 |

BoE Quarterly Bulletin |

-- |

-- |

-- |

! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,850K |

1,850K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

230K |

230K |

!!! |

|

US |

13:30 |

Current Account |

Q2 |

-259.0B |

-237.6B |

!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Sep |

-0.8 |

-7.0 |

!!! |

|

US |

13:30 |

Philly Fed Employment |

Sep |

-- |

-5.7 |

!! |

|

US |

13:30 |

Philly Fed Prices Paid |

Sep |

-- |

24.00 |

! |

|

US |

15:00 |

Existing Home Sales (MoM) |

Aug |

-- |

1.3% |

!! |

|

US |

15:00 |

Existing Home Sales |

Aug |

3.92M |

3.95M |

!!! |

|

US |

15:00 |

US Leading Index (MoM) |

Aug |

-0.3% |

-0.6% |

!! |

|

US |

15:30 |

Natural Gas Storage |

-- |

53B |

40B |

! |

|

EC |

15:40 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg