Paring back of Fed rate cut expectations continues to support USD

USD: ISM survey casts further doubts over Fed rate cuts supporting US dollar

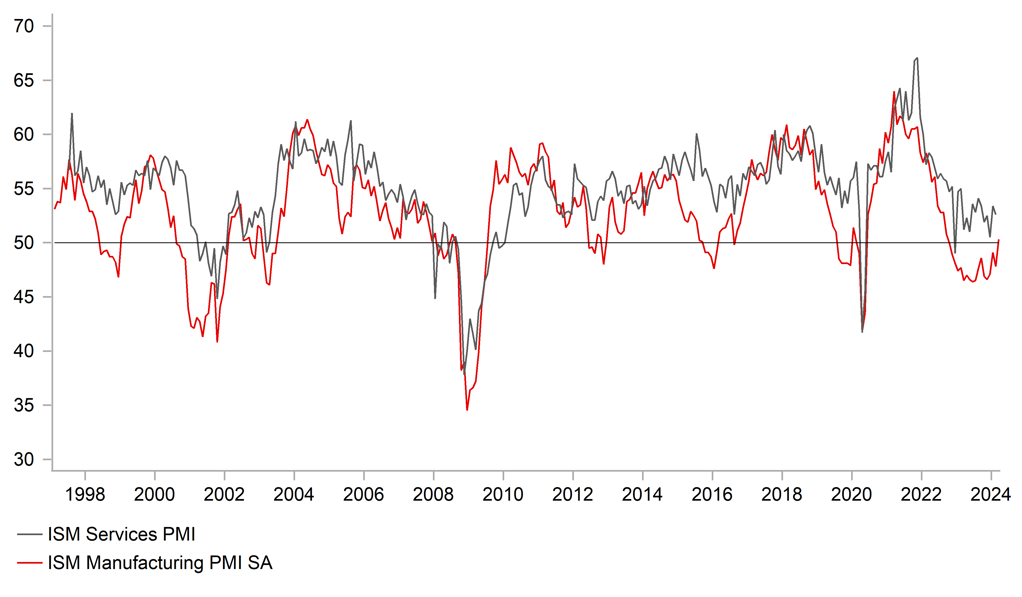

The US dollar has continued to trade at stronger levels during the Asian trading session following the release yesterday of the stronger than expected ISM manufacturing survey for March. It has resulted in the dollar index rising to a fresh year to date high as it has moved back above the 105.00-level for the first time since the middle of November. The dollar index has now rebounded by around +2.6% since the low from 8th March. The US dollar continues to derive support at the start of this year from the paring back of Fed rate cut expectations. After yesterday’s stronger than expected ISM manufacturing survey for March, the US rate market is no longer fully pricing in a cumulative total of 75bps of hikes by the end of this year. It has also lifted US bond yields close to year to date highs as well. The 2-year and 10-year US Treasury yields are currently trading just below year to date highs at 4.7% and 4.3% respectively. US yields and the US dollar both adjusted higher yesterday after the ISM survey revealed that the business confidence in the manufacturing sector rose back above the 50.0-level for the first time since the since September 2022. The 6.2 point increase in the production sub-component and 2.2 point increase in the new orders sub-components also signalled that the manufacturing sector is likely to begin a gradual recovery in the coming months. The manufacturing sector has been stagnating since Q1 2022 when output peaked in April 2022, and has since contracted by -1.5% to February 2024. While the manufacturing sector only accounts for around 10% of US GDP, a gradual recovery would cast fresh doubts on whether the Fed will need to cut rates as soon and as deeply as the US rate market is currently pricing especially with the prices paid sub-index also rising by 3.3 point to its highest levels since July 2022.

It follows comments from Fed Chair Powell at the end of last week in which he emphasized that the Fed does not need to be in a “hurry” to cut rates. He stated that that Fed can wait and become more confident that, in fact, inflation is coming down to 2% on a sustainable basis. While the US economy looking strong for now, Chair Powell noted that “if we were to see unexpected weakness in the labour market…than that’s something we would be looking at carefully, and could draw a response as well”. Market attention in the week ahead will focus on the health of the US labour market with the release later today of the latest JOLTS job openings report for February and nonfarm payrolls report for March on Friday. Unless there is significant slowdown in US employment growth, the US dollar is likely to continue to trade on a stronger footing this week to reflect the building risk that the Fed could lag behind European central banks when starting to cut rates.

ISM MANUFACTURING SURVEY RISES BACK ABOVE 50.0-LEVEL

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Threat of intervention dampens USD/JPY upside from higher US yields

US dollar strength has been capped against the yen in the near-term by the heightened threat of intervention from Japanese officials to support the yen. It has helped to keep USD/JPY below the 152.00-level. Japanese Finance Minister Suzuki reiterated again overnight that the government will monitor market developments closely with a high sense of urgency, and will take appropriate measures against excessive moves, without ruling out any options. He felt that the pace of yen depreciation had accelerated considerably last week when he said that they would take “bold action” against excessive moves. He also added that exchange rate movements are determined not only by monetary policy, but also by various other factors including balance of payments, geopolitical risks, market participants’ sentiment and speculation. The latest IMM report revealed that short yen positions held by Leveraged Funds remained relatively stable in the week ending 26th March just after the BoJ’s last policy meeting ending and remain close to their highest levels since 2018. The last time Japan intervened to support the yen was back in September/October 2022 when they purchased a total of JPY 9.2 trillion. It helped mark a near-term peak for USD/JPY but importantly the correction lower also coincided with US yields moving lower as well.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Manufacturing PMI |

Mar |

-- |

51.9 |

! |

|

EC |

09:00 |

Manufacturing PMI |

Mar |

45.7 |

46.5 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Mar |

49.9 |

47.5 |

!!! |

|

GE |

13:00 |

German CPI (YoY) |

Mar |

2.2% |

2.5% |

!! |

|

US |

15:00 |

Factory Orders (MoM) |

Feb |

1.1% |

-3.6% |

!! |

|

US |

15:00 |

JOLTs Job Openings |

Feb |

8.760M |

8.863M |

!!! |

|

US |

17:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg