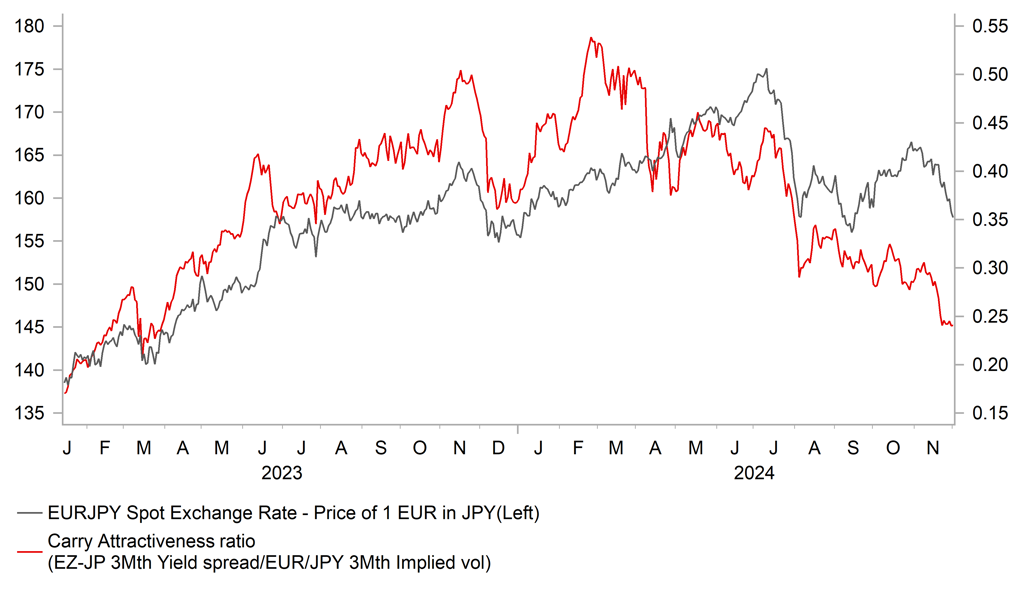

Hawkish BoJ comments & French politics bringing down EUR/JPY

USD/JPY: BRICS tariff threat & hawkish comments from BoJ Governor in focus

The US dollar is staging a rebound a start of this week partially reversing losses recorded at the end of last month. The dollar index has climbed back above the 106.00-level after hitting an intra-day low of 105.62 on Friday. The US dollar has been supported by comments from US President-elect Donald Trump over the weekend threatening to impose 100% tariffs on BRICS countries for trying to move away from the US dollar. He posted on Truth Social that “we require a commitment from these countries that they will neither create a new BRICS currency, nor back any other currency to replace the mighty US dollar or, they will face 100% tariffs, and should expect to say goodbye to selling into the wonderful US economy”. It follows a Bloomberg news report from back in April in which it was reported that Trump and his economic advisers have been discussing ways to punish allies and adversaries alike who seek to engage in bilateral trade in currencies other than the dollar including options such as export controls and levies on trade. The BRICS group of emerging market countries includes Brazil, Russia, India, China and South Africa, and was expanded this year to include Iran, the UAE, Ethiopia and Egypt. The BRICS group discussed the issue of de-dollarization at a summit in 2023. While we don’t see an immediate risk that 100% tariffs will be implemented against BRICS countries, the comments provide another signal that Trump will use the threat of tariffs as a negotiating tool during his second term as President to force change amongst US trading partners. It follows on from posts last week threatening to impose 25% tariff hikes on Canada and Mexico for all imported goods, and to raise tariffs by a further 10% for China. We outlined our thoughts on those tariff threats in more detail in our last FX Focus report released on Friday (click here).

The broad-based rebound for the US dollar has helped to lift USD/JPY back above the 150.00-level overnight despite comments from BoJ Governor Ueda signalling that they could raise rates as soon as next month. In an interview with the Nikkei newspaper held at the end of last week, Governor Ueda stated that the next rate hikes are “nearing in the sense that economic data are on track”. He continued to express caution though over rushing to raise rates given the “big question mark left on the outlook for US economic policy” following Donald’s Trump’s election win. On the yen specifically he added that “if the yen weakens further when the rate of inflation starts to rise above 2%, the central bank might have to resort to countermeasures, if necessary, to the movement posing great risks to us”. He reiterated that BoJ staff estimate the natural rate of interest to be roughly between “negative 1% and positive 0.5%”, and therefore if inflation is at 2%, then the policy rate may settle in the range of around 1.0% to 2.5% indicating that there is room for the policy rate to keep moving higher. Overall, the comments reinforce our updated forecast for the BoJ to hike rates again as soon as next month which is helping to provide more support for the yen heading into year end.

EUR/JPY VS. CARRY ATTRACTIVENESS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: National Rally moves closer to bringing down French government

The euro has come under renewed selling pressure at the start of this week resulting in EUR/USD falling back towards the 1.0500-level after hitting a high of 1.0597 at the end of last week. The main trigger for the euro sell-off at the start of this week has been the warning from National Rally President Jordan Bardella that “the National Rally will activate the censure vote unless of course there is last minute miracle”. He wants Prime Minister Barnier to make last minute changes to his budget text between now and 3pm , but he’s got little hope that Barnier will see the light given we’ve been ignored and scorned for several months.

The stand-off between the French government and the National Rally party has hardened over the weekend after Finance Minister Antoine Armand stated yesterday that “the French government doesn’t take ultimatums” and “we won’t be blackmailed”. Budget Minister Laurent Saint-Martin told Le Parisien newspaper over the weekend that requests to amend the budget would cost nearly EUR10 billion and that the government would not make any further concessions after dropping plans to raise electricity prices last week. The National Rally has since outlined additional demands including reduce drug reimbursements, call a moratorium on any new or higher taxes, help to boost competitiveness for small and medium firms and to index pensions on inflation from 1st January. Opposition parties are expected to initiate the process to call a vote of no confidence today, and the vote could happen as soon as Wednesday. While political uncertainty in France has had limited impact on the euro so far, the collapse of the French government does pose a downside risk heading into year end.

Heightened political uncertainty could also play a role at the margin in keeping alive market expectations for larger 50bps ECB rate cut this month although the hard economic data is not fully supportive. The latest euro-zone CPI report released at the end of last week was in line with market expectations showing headline inflation coming in at 2.3% and core inflation at 2.7% in November. We still believe that the ECB will stick to a 25bps cut in December but could become more open to a larger cut in Q1.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Manufacturing PMI |

Nov |

-- |

52.4 |

! |

|

EC |

09:00 |

Manufacturing PMI |

Nov |

45.2 |

46.0 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Nov |

48.6 |

49.9 |

!!! |

|

IT |

10:00 |

Italian GDP (QoQ) |

Q3 |

0.0% |

0.0% |

! |

|

EC |

10:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Unemployment Rate |

Oct |

6.3% |

6.3% |

!! |

|

CA |

14:30 |

Manufacturing PMI |

Nov |

50.8 |

51.1 |

! |

|

US |

14:45 |

Manufacturing PMI |

Nov |

48.8 |

48.5 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

Oct |

0.2% |

0.1% |

!! |

|

US |

15:00 |

ISM Manufacturing PMI |

Nov |

47.7 |

46.5 |

!!! |

|

US |

20:15 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

US |

21:30 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg