Data not the only focus today as regional banks decline again

USD: Could the US jobs data be a sideshow today?

The US dollar suffered yesterday as UST bond yields continued to decline with the New York Community Bancorp news from Wednesday continuing to undermine investor confidence as Commercial Real Estate risks get greater attention. The KBW US regional bank index fell 2.3% after falling 6.0% on Wednesday. However, the index had been lower and sentiment improved into the US close helping regional banks recoup come losses. The broader US equity market also rallied which was further extended in after-hour trading after strong results for Meta and Amazon. The Fed’s weekly balance sheet also got greater attention given the increased banking sector concern. The Bank Term Funding Program declined from the record USD 168bn, but only by USD 3bn, suggesting arbitrage might not be a big factor in usage – although these loans are up to one year, so perhaps difficult to make a judgement.

While a further deterioration in sentiment due to regional banking sector concerns could ultimately dominate again today into the US close, we also have the crucial payrolls report – crucial in that Fed Chair Powell on Wednesday acknowledged that the jobs data was one of the key data releases that could sway the FOMC toward an earlier rate cut than currently assumed. In expressing his view that it was unlikely the FOMC would cut in March he cited weaker inflation and jobs data as the primary data points that could give the FOMC the confidence to cut in March.

There are certainly mixed signals at the moment in regard to the US labour market that suggest to us possible downside risks relative to the current market consensus of 185k. The ADP report this week was weaker than expected (107k vs 150k expected) and while the JOLTs data revealed greater job openings the details weren’t as positive with signs of weakening confidence in the labour market. 6.1mn fewer Americans quit their job in 2023, a 12% drop from 2022 while the level reached in December was the lowest in three years. The Challenger layoffs report yesterday revealed that layoffs in January were the 2nd largest in 15yrs. Finally, the ISM data yesterday saw a pick-up in sentiment but the employment index actually declined. On the flip side consumer confidence jobs plentiful index increased.

But there certainly seems to be scope for a downside surprise in the jobs data today. Watch out too for the annual benchmark revision which could see big revisions to the employment total for 2023. How the markets respond to the jobs data will depend on the sentiment on regional banks. Worsening sentiment over the short-term could see US dollar depreciation broaden but the note of caution here must be that Europe does too have banking sector risks related to commercial real estate loan portfolios. ESMA in January released a report on real estate risk exposures (here) and if market risk aversion intensifies it may quickly spread to Europe and prompt a sharp reversal of any EUR rally on current US regional banking sector risks. That would certainly make us wary of chasing EUR/USD higher if yesterday gain extends on the back of commercial real estate risks.

KBW REGIONAL BANKING INDEX HAS FALLEN SHARPLY

Source: Macrobond & Bloomberg

AUD: RBA likely to remain cautious on rate cuts

The BoE followed the ECB and the Fed in pushing back on speculation of an early rate cut in its meeting yesterday, which we covered in an FX Focus piece (here). The meeting was largely as we expected with the inevitable shift to align with the sharp decline in inflation offset by a note of caution over the still elevated level of services inflation and wages. Still, the BoE did acknowledge that the focus now is on the timing of when a cut is possible which means the incoming inflation and wage data will be crucial.

Next up is the RBA on Tuesday and while we have seen inflation come down notably in Australia as well the pricing on RBA rate cuts looks a little rich to us. The OIS market indicates a near 70% probability of a 25bp rate cut at the May meeting. The RBA’s statement from December included a bias to tighten by stating “whether further tightening of monetary policy is required” will depend upon “the data and the evolving assessment of risks”. There is an argument that this bias could be altered to signal that the RBA no longer believes it needs to tighten given the drop in inflation. The YoY Q4 headline rate fell from 5.4% to 4.1%, well down but still notably above the 1.0-3.0% target band. However, the December alone YoY inflation rate slowed to 3.4%. Today PPI data revealed a pick-up in the YoY rate from 3.8% to 4.1%.

The RBA was less aggressive in tightening monetary policy and even after this inflation drop are much more likely to wait longer before easing. Next week will mark the beginning of a new set-up to the RBA policy decision-making with the meeting taking place over two days and that will be followed by a press conference by Governor Bullock. So any tweak in wording in the statement can be clarified by Bullock in the press conference and we would expect Bullock to imply that the timing of rate cuts will be further out than currently implied by the rates market. If the US dollar remains on a weaker footing that could help see AUD/USD rebound.

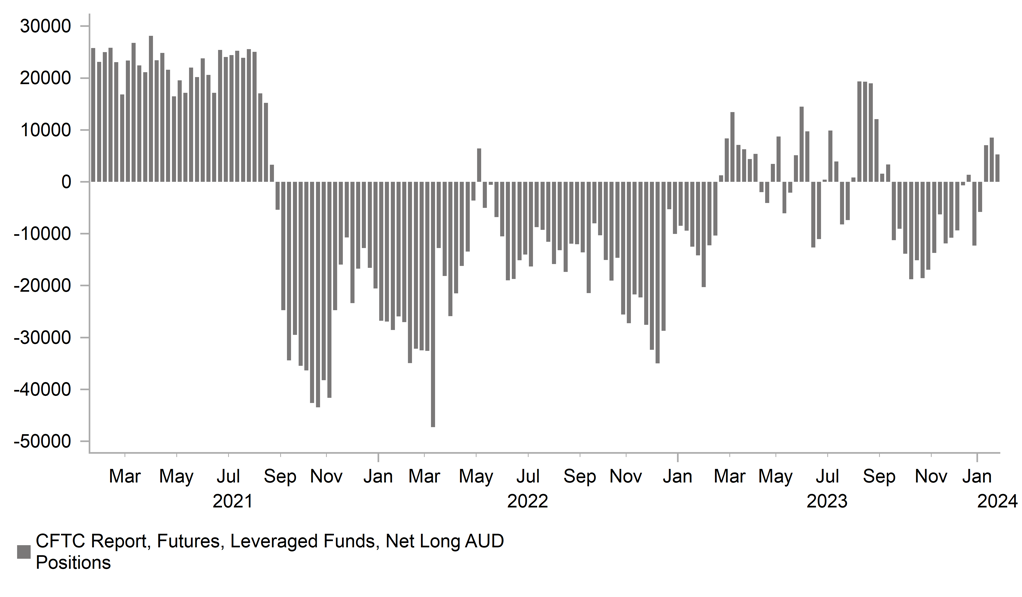

LEVERAGED FUNDS MODESTLY LONG AUD

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Unemployment Rate n.s.a. |

Jan |

2.10% |

1.90% |

! |

|

UK |

12:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

Jan |

4.1% |

4.1% |

!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Jan |

0.3% |

0.4% |

!!!! |

|

US |

13:30 |

Average Weekly Hours |

Jan |

34.3 |

34.3 |

! |

|

US |

13:30 |

Nonfarm Payrolls |

Jan |

187K |

216K |

!!!!! |

|

US |

13:30 |

Manufacturing Payrolls |

Jan |

5K |

6K |

! |

|

US |

13:30 |

Participation Rate |

Jan |

-- |

62.5% |

!! |

|

US |

13:30 |

Payrolls Benchmark |

-- |

-- |

568.00 |

!! |

|

US |

13:30 |

Unemployment Rate |

Jan |

3.8% |

3.7% |

!!! |

|

US |

15:00 |

Factory Orders (MoM) |

Dec |

0.3% |

2.6% |

!! |

|

US |

15:00 |

Factory orders ex transportation (MoM) |

Dec |

-- |

0.1% |

! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Jan |

2.9% |

3.1% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Jan |

2.8% |

2.9% |

!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Jan |

75.9 |

67.4 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Jan |

78.8 |

69.7 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Jan |

83.3 |

73.3 |

! |

|

US |

15:00 |

Total Vehicle Sales |

-- |

15.70M |

15.83M |

! |

Source: Bloomberg