An important week for testing early Fed rate cut expectations

USD: Will Fed rate cut expectations intensify further?

The US dollar has staged a modest rebound since the end of last year. After hitting an intra-day low of 100.62 on 28th December, the dollar index has risen back up to an intra-day high overnight of 101.59. Despite the pick-up in year end demand for the US dollar, it still closed lower for the calendar year as a whole. The dollar index declined by -2.1% in 2023 which marks a modest reversal lower after strong gains of 6.4% and 8.2% in 2021 and 2022 respectively. The main trigger for the US dollar sell-off late last year was intensified speculation over earlier and deeper Fed rate cuts. The US rate market is currently pricing in around 24bps of cuts from the Fed by 20th March FOMC meeting, and a cumulative total of around 155bps of cuts for this year as a whole. The recent dovish repricing of Fed rate hike expectations sets a higher bar for further US dollar weakness at the start of this year. Market participants will now require the release of weak US economic data regarding both activity and inflation to support expectations for the Fed to begin cutting rates as soon as in March. Those expectations will be tested in the week ahead by the release tomorrow of the latest FOMC minutes from 13th December meeting and the latest nonfarm payrolls report for December on Friday.

The dollar index stands around -2.5% lower than prior to the last FOMC meeting on 13th December. The meeting triggered a heavy sell-off for the US dollar after Fed Chair Powell indicated that policymakers had a preliminary discussion about how long to hold rates before cutting and expect to discuss further, while acknowledging the risk of keeping rates too tight for too long. The updated dot plot also included an additional planned rate cut to show that the majority of FOMC participants favoured at least three rate cuts by the end of this year. However, there has been some pushback from Fed speakers since the last FOMC meeting in which they attempted to dampen speculation over a rate cut as soon as March. The release tomorrow of the minutes from the December FOMC meeting will be scrutinized closely to see if the Fed attempts to further dampen speculation over earlier rate cuts. Fed officials have found it difficult to discourage market expectations for earlier rate cuts while US economic data has been supporting those expectations. Most importantly the further slowdown in the core PCE deflator in November has given market participants more confidence that inflation will return towards the Fed’s 2.0% target and open the door for the Fed to lower rates to less restrictive levels this year. The dollar index is now approaching important technical support levels at just above the 100.00-level. It hasn’t closed below the 100.00-level on a monthly closing price basis since March 2022. While we expect the US dollar to weaken further in 2024, we see room for a temporary bounce at the start of this year following the heavy sell-off in recent months.

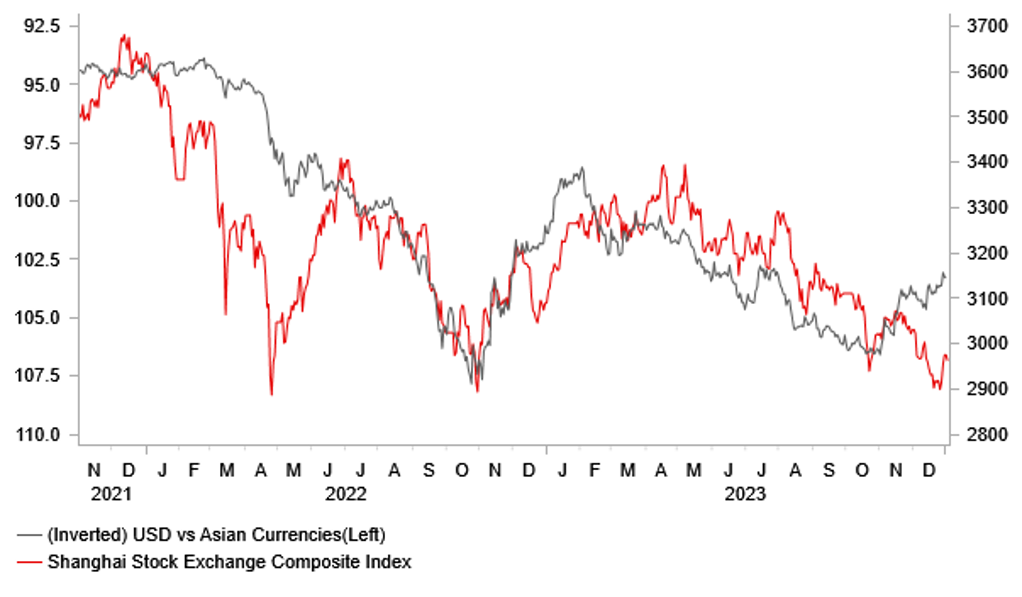

ASIA FX PERFORMANCE VS. CHINA EQUITY MARKET

Source: Bloomberg, Macrobond & MUFG GMR

CNY: Investor concerns continue over China growth outlook

The main economic data releases over the year end period have been latest PMI surveys from China. The official PMI surveys revealed that business confidence both in the manufacturing and non-manufacturing sectors was weaker than expected in December. The manufacturing PMI unexpectedly fell by 0.4 point to 49.0 in December. It was the third consecutive month that business confidence in the manufacturing sector had declined after putting in place a peak of 50.2 in September. It compares to last year’s average of 49.9. Business confidence in the non-manufacturing sector is not much better either. The non-manufacturing PMI increased only marginally by 0.2 point to 50.4 in December after hitting its lowest level in November since December 2022. Overall, the official PMI surveys continue to send a cautionary signal over the health of China’s economy. After growth picked up in Q3, it appears that China’s economy slowed heading into the end of last year. The weak cyclical performance of China’s economy will keep pressure on domestic policymakers to provide further stimulus to support growth in 2024. Bloomberg has noted that China’s government is likely to front-load fiscal spending in 2024 with unused funds from last year likely to be spent. In October of last year, the government made the unusual announcement that it was adding USD1 trillion to its annual budget. Ongoing investor concerns over weak cyclical momentum in China remain a headwind for the renminbi and Asian currencies at the start of this year. China’s equity market finished close to year date lows in 2023.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Nov |

-1.0% |

-1.0% |

! |

|

EC |

09:00 |

Manufacturing PMI |

Dec |

44.2 |

44.2 |

!! |

|

CA |

14:30 |

Manufacturing PMI |

Dec |

-- |

47.7 |

! |

|

US |

14:45 |

Manufacturing PMI |

Dec |

48.2 |

49.4 |

!!! |

|

US |

15:00 |

Construction Spending (MoM) |

Nov |

0.5% |

0.6% |

! |

Source: Bloomberg