Easing optimism fuels ongoing risk revival – time for consolidation

USD: Little to halt current dollar selling momentum?

The US dollar hit a new intra-day low earlier in Asian trading, falling to a level not seen since the first trading day of the year with risk appetite continuing to recover following the turmoil at the start of August. The euro hit a new high for the year as well with a steady stream of rhetoric from central bankers lifting expectations of Fed rate cuts commencing at the next meeting in September.

The latest FOMC member to shift their view is Minneapolis Fed President Kashkari who stated in an interview with the Wall Street Journal that the debate on cutting rates in September was “an appropriate one to have”. In June Kashkari argued a first rate cut might be warranted but only by year-end but has now cited the rise in the unemployment rate as justification for the change. We have also had Chicago Fed President Goolsbee and San Francisco Fed President Daly hint at their support for commencing rate cuts as well and it is clear that the jobs report as well as the financial market reaction has probably convinced the Fed that the restrictiveness of the monetary policy stance is probably now excessive. It is quite remarkable how quickly risk appetite has recovered. The S&P 500 advanced another 1.0% yesterday, advancing through the high on 1st August to mark the full completion of the retracement of the abrupt early August sell-off.

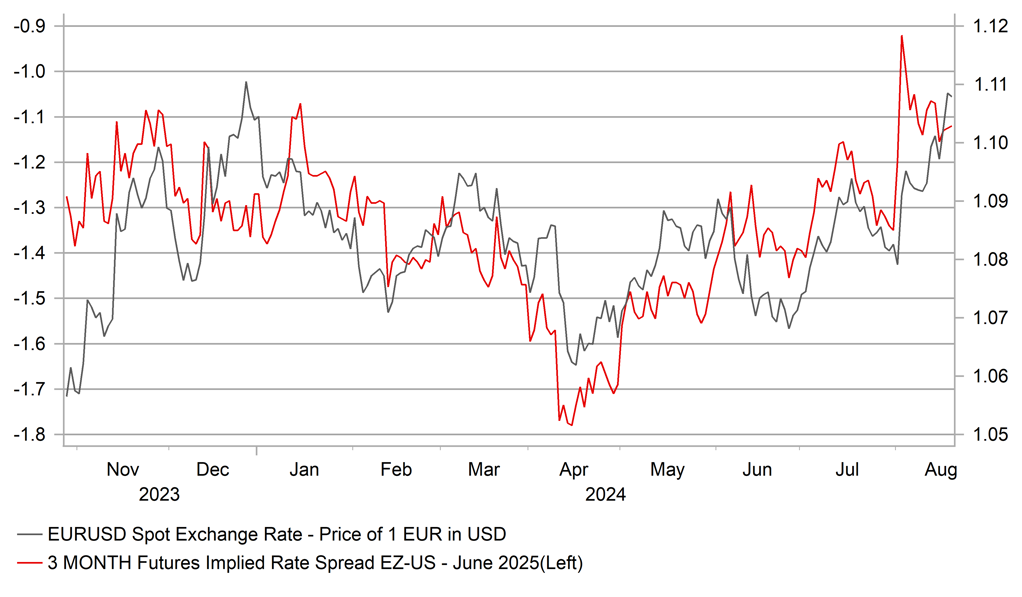

There are two key Fed-related events this week – the FOMC minutes tomorrow from the July meeting and the Jackson Hole speech by Powell on Friday – and there is every reason to believe both will validate or endorse the communications we have had from FOMC members so far this week. But scope for front-end yields to rise in the US could open up if the current risk momentum continues, especially if the US economic data is more like last week’s retail sales and initial claims data and with other central banks set to ease as well, the spread moves favouring dollar selling could pause or start to reverse. ECB Council Member Olli Rehn stated yesterday that he saw scope for the ECB to cut rates at the September meeting given the lack of indications of any pick-up in growth in the manufacturing sector. We would expect EUR/USD momentum to ease notably given the levels we have now achieved in a relatively short period.

EUR/USD VERSUS 3MTH FUTURES IMPLIED YIELD SPREAD

Source: Macrobond & Bloomberg

GBP: BoE caution continues to support the pound

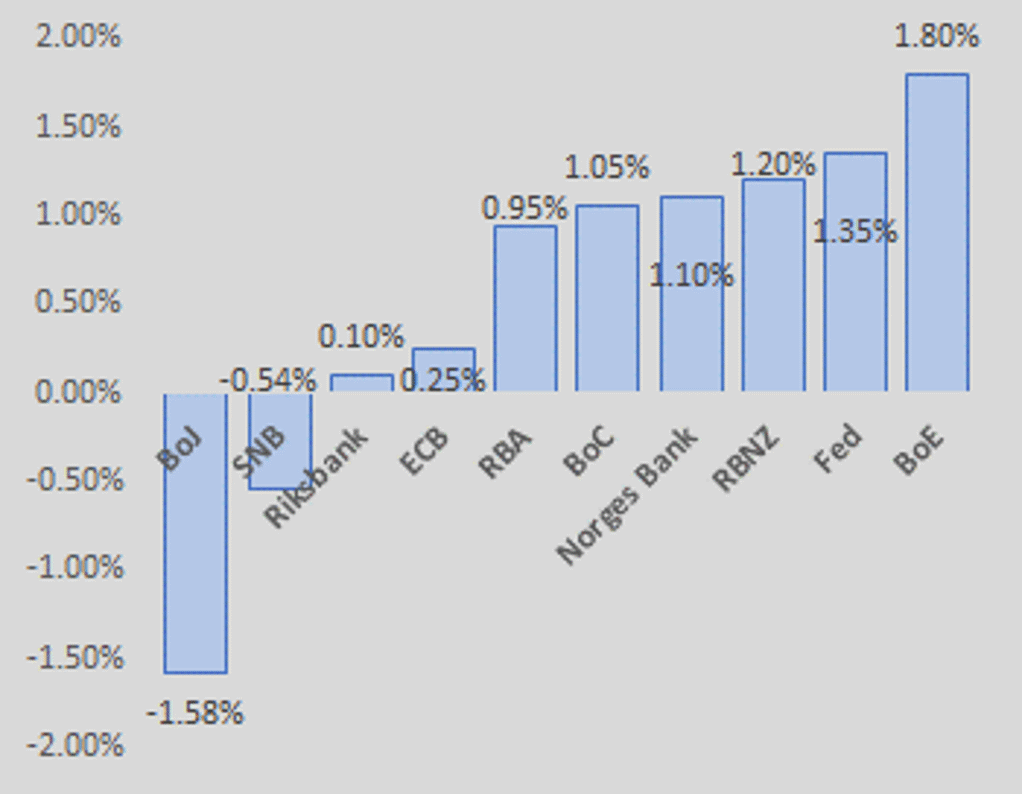

We have updated our projected real policy rate chart which we derive from OIS forward rates for the policy rates across G10 for the middle of 2025 and in order to adjust to a real terms policy rate we take the market consensus for underlying inflation for Q2 2025. There has been a dramatic shift in monetary policy expectations and this shift since the recent turmoil in the financial markets in early August has left the BoE as having by some distance the expected highest monetary policy in real terms by the middle of 2025. This is in contrast to before the turmoil and shift in policy expectations when the BoE’s expected real policy rate was similar to the RBNZ, the Fed and the Bank of Canada and all four central banks had real policy rate over 200bps.

In some ways the UK’s real policy rate falling by notably less is not surprising. Of that group of central banks (Fed; RBNZ; BoC & BoE) that were expected to have the highest real policy rate by mid-2025 the data in the UK is probably most impressive The UK looks to be at different point in the cycle primarily due to the hit to growth from the natural gas price surge hitting growth badly over the 2022-2023 period. The UK economy is now recovering as inflation falls which could limit the scale of slowdown in the jobs market and leave wage risks higher. That is the BoE’s primary concern and given the rate cut was a 5-4 split decision, the BoE’s willingness to cut will be less than in the US and from the RBNZ and BoC which are already cutting. The pound remains the best performing G10 currency on a year-to-date basis, up 2.0% versus the dollar but in August is lagging (worst G10 performer) mainly in circumstances of the risk-off and market volatility. As a high-yielder, the yen carry liquidation is clearly been a drag. If the markets stabilise, there is scope for GBP to outperform.

Two other observations are worth mentioning here. Firstly, the shift in policy expectations has been across the G10 space, but excluding the BoJ. The substantial drop in policy rate levels expected by mid-2025 is in contrast to the modest increase in Japan. That in our view is a clear sign not to expect a sharp revival of the yen carry trade that has begun to unravel.

Secondly, it could be argued that the shift in expectations now looks excessive in the euro-zone. Based on that measure for the real policy rate, for the ECB that is now expected to drop to just 0.25% by the middle of next year. Given domestic demand conditions are improving (like in UK due to falling inflation lifting real incomes) and given the stickiness of underlying inflation and wage risks, we see market expectations of future ECB action as being most at risk of adjusting the other way, which would likely prove EUR supportive.

IMPLIED MARKET EXPECTATIONS OF REAL POLICY RATES ACROSS G10 BY MIDDLE OF 2025 – GBP SUPPORT AHEAD

Source: Forward OIS mid-2025 & consensus inflation forecasts Q2 2025; Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Jun |

37.0B |

36.7B |

! |

|

EC |

10:00 |

Construction Output (MoM) |

Jun |

-- |

-0.90% |

! |

|

EC |

10:00 |

CPI (MoM) |

Jul |

0.0% |

0.2% |

!!!! |

|

EC |

10:00 |

CPI (YoY) |

Jul |

2.6% |

2.5% |

!!! |

|

EC |

10:00 |

Core CPI (YoY) |

Jul |

2.9% |

2.9% |

!!! |

|

EC |

10:00 |

Core CPI (MoM) |

Jul |

-0.2% |

0.4% |

!!!! |

|

SZ |

10:30 |

SNB Chairman Thomas Jordan speaks |

-- |

-- |

-- |

!!! |

|

CA |

13:30 |

Common CPI (YoY) |

Jul |

2.2% |

2.3% |

!! |

|

CA |

13:30 |

Core CPI (YoY) |

Jul |

-- |

1.9% |

!!! |

|

CA |

13:30 |

Core CPI (MoM) |

Jul |

-- |

-0.1% |

!!! |

|

CA |

13:30 |

CPI (YoY) |

Jul |

2.5% |

2.7% |

!! |

|

CA |

13:30 |

CPI (MoM) |

Jul |

0.4% |

-0.1% |

!!! |

|

CA |

13:30 |

Median CPI (YoY) |

Jul |

2.5% |

2.6% |

!!! |

|

CA |

13:30 |

Trimmed CPI (YoY) |

Jul |

2.8% |

2.9% |

!!! |

|

CA |

13:30 |

Common CPI (YoY) |

Jul |

2.2% |

2.3% |

!! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Jul |

0.0% |

-0.2% |

! |

|

US |

18:35 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg