Divergence expectations likely to continue helping USD

USD: Trump threatens tariffs, BoE sees more votes for cuts

The prospects certainly remain positive for the US dollar over the short-term as investors continue to view the US economy as best positioned going into 2025 for continued resilient growth. The DXY index earlier hit a new high not seen since November 2022 but has since then turned lower. President-elect Trump has been on Truth Social this morning and has emphasised his stance on scrapping or extending the debt ceiling (see below).

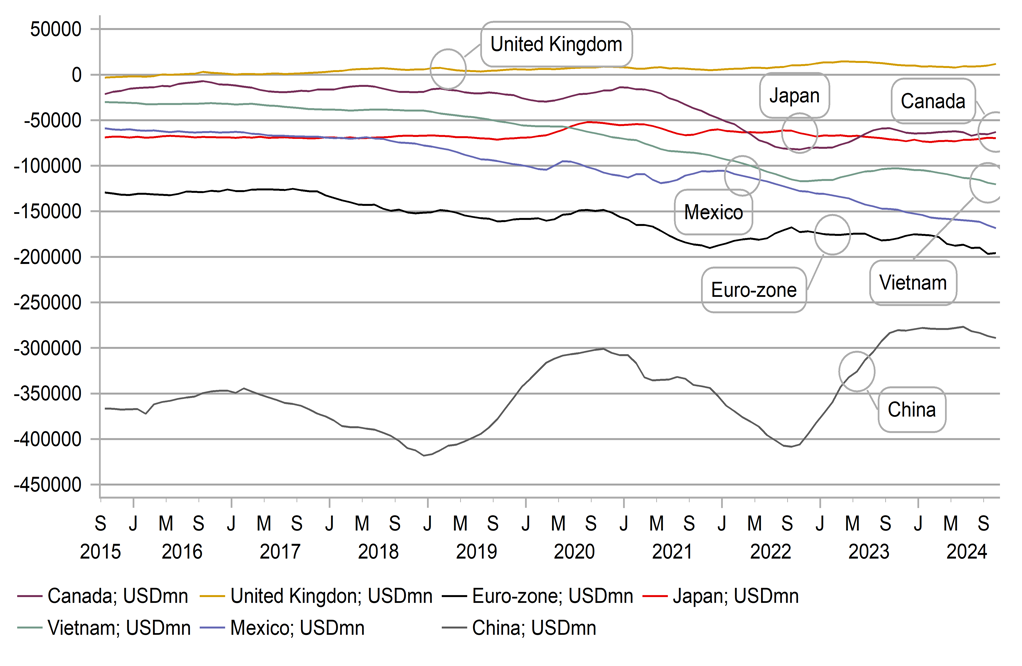

Trump also made further comments on tariff policies threatening the EU with tariffs, demanding that the EU purchases more crude oil and gas in order to reduce the current size of the US trade deficit with Europe, adding that “otherwise it’s tariffs all the way!!!”. The Trump administration is planning to increase LNG exports and is already the largest exporter in the world surpassing Australia and shipping 11.9bn cubic feet per day. Biden halted the licensing of new export terminals in January which is expected to be reversed on day one. The EU already is the largest destination for US exports Of LNG and while this threat underlines the uncertainty for Europe of US trade policy going forward which itself is growth negative, a deal to buy more LNG is something that could be achieved. But the EU and the euro-zone will remain in the firing line of Trump due to the simple fact that the US deficit with the euro-zone is the second largest in the world after China. While China’s deficit has shrunk since Trump’s first term in office, the euro-zone’s has increased by about one-third. Trump seems likely to hit Europe with tariffs and that will weigh on euro-zone economic activity. The ECB looks set to continue cutting over the coming months at a time when the FOMC could well be entering a period of pause.

The divergence with the UK looks less obvious going forward and indeed is one factor why the pound has been the top performing G10 currency after the US dollar this year. But the BoE vote yesterday to hold rates steady (6-3) highlighted a larger number of MPC members who see the need for a rate cut. It certainly keeps a February rate cut as a realistic prospect despite the stronger wage data this week. We expect GBP/USD to decline further over the coming months although from a trade tariff perspective the US trade surplus with the UK could help shelter the UK to a degree.

Finally, the biggest surprise this week for us was the dovishness of the BoJ which has opened up appetite for buying USD/JPY on policy divergence remaining wider than expected next year. We still believe USD upside from here is limited although BoJ Governor Ueda’s comments (lack of signal on a Jan hike) will encourage USD/JPY buying. We doubt there is notable upside scope from here though given we are entering the intervention zone and would expect the MoF to act, possibly even ahead of Trump’s inauguration in January if required. Finance Minister Kato today threatened “appropriate action” on excessive FX moves highlighting increasing cocnerns.

TRUMP FOCUSES ON COUNTRIES WHERE US RUNS A LARGE TRADE DEFICIT – THE EURO-ZONE WILL BE IN FOCUS

Source: Bloomberg, Macrobond & MUFG GMR

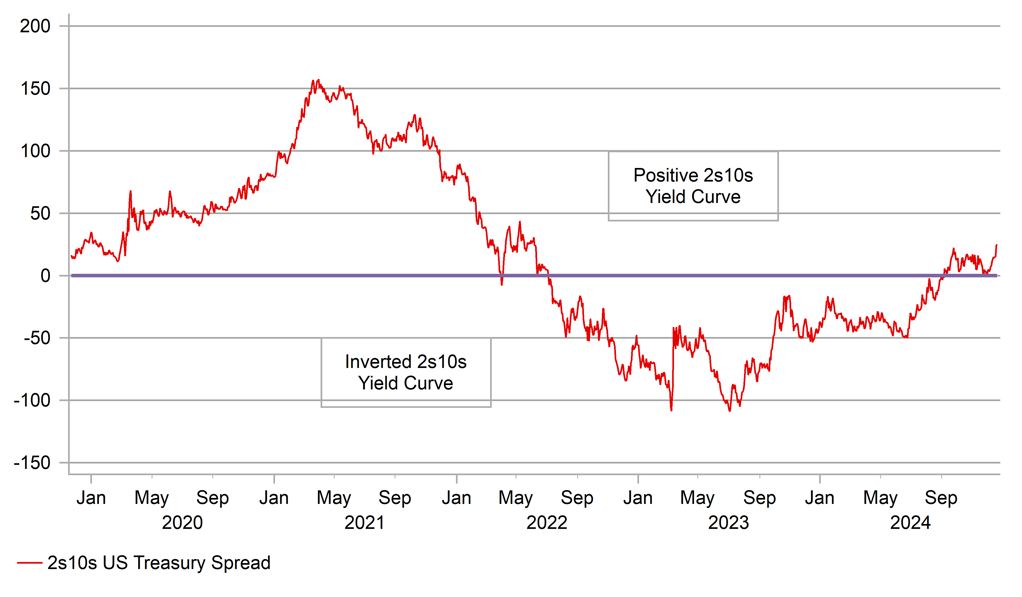

USD: Sharp 2s10s steepening with FX performance mixed

The front-end of the US curve has softened with the 2-year UST bond yield partially reversing the post-FOMC gains, declining by 5bps following an 11bp increase on Wednesday. The 5bp cut in the ON RRP spread over the bottom bound of the federal funds rate may have played a role in this with a possible easing of concerns over tighter front-end conditions going into year-end. SOFR volatility is still likely but the elimination of the spread may mean the USD 130bn of funds sitting in the RRP facility may get drawn out and into the money markets, helping liquidity.

But the longer-end of the curve went the other way with the 10-year yield up 5bps. The concerns of bond investors remain and President-elect Trump’s surprise demand for the spending deal to be renegotiated so that the debt limit issue is included could result in the complete elimination of the debt limit that would free up Trump to move forward without risk of complication with his tax cut, deficit expansion plans.

The call from Trump and Musk for the deal to be scrapped forced House speaker Mike Johnson to pull the deal and restart negotiations. The Democrats are unlikely to have much appetite for agreeing to a new deal that might not include the spending elements it demanded but a deal that removed the debt ceiling – which the Democrats have long called for – could see a deal done. A budget deal was put forward last night that included a provision suspending the debt ceiling for two years. The bill failed by a vote of 235 to 174 with 38 Republicans voting against the bill and defying incoming President-elect Trump. The vote raises the prospect of a government shutdown from this evening. That too could have helped put downward pressure on 2-year yields. The last shutdown under Trump’s presidency in 2018-19 was the longest, lasting 35 days. Trump looks likely to persist with his demand for the debt ceiling to be dealt with now given his comments on Truth Social this morning. Even though he will have a small majority in the House in the new Congress he is likely to need the support of Democrats to lift the debt ceiling so better have the Democrats deal with it now than under his presidency.

A government shutdown is a drag on growth although historically the impact has been limited. The CBO estimated the impact in Q1 2019 was 0.2ppts with that then made up in the subsequent quarters. The S&P 500 did drop sharply in December 2018 and the US dollar weakened through December 2018 into January but the shutdown was not an important factor. Tightening Fed policy concerns and a tech-driven correction were the key factors.

2S10S US TREASURY YIELD SPREAD BREAKING HIGHER

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Business Confidence |

Dec |

86.0 |

86.5 |

! |

|

IT |

09:00 |

Italian Consumer Confidence |

Dec |

97.0 |

96.6 |

! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Dec |

-10 |

-18 |

! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Dec |

-- |

-19 |

!! |

|

US |

12:30 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Nov |

2.9% |

2.8% |

!!!!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Nov |

0.2% |

0.3% |

!!!!! |

|

US |

13:30 |

PCE Price index (YoY) |

Nov |

2.5% |

2.3% |

!!! |

|

US |

13:30 |

PCE price index (MoM) |

Nov |

0.2% |

0.2% |

!!! |

|

US |

13:30 |

Personal Income (MoM) |

Nov |

0.4% |

0.6% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Nov |

0.5% |

0.4% |

!! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Oct |

0.2% |

0.9% |

!!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Oct |

0.7% |

0.4% |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Dec |

2.9% |

2.6% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Dec |

3.1% |

3.2% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Dec |

74.0 |

71.8 |

!! |

|

EC |

15:00 |

Consumer Confidence |

Dec |

-14.0 |

-13.7 |

! |

|

US |

15:30 |

Atlanta Fed GDPNow |

Q4 |

3.2% |

3.2% |

!! |

Source: Bloomberg