USD/JPY is retesting support at the 150.00-level

JPY: Narrowing yield differentials continue to encourage a stronger yen

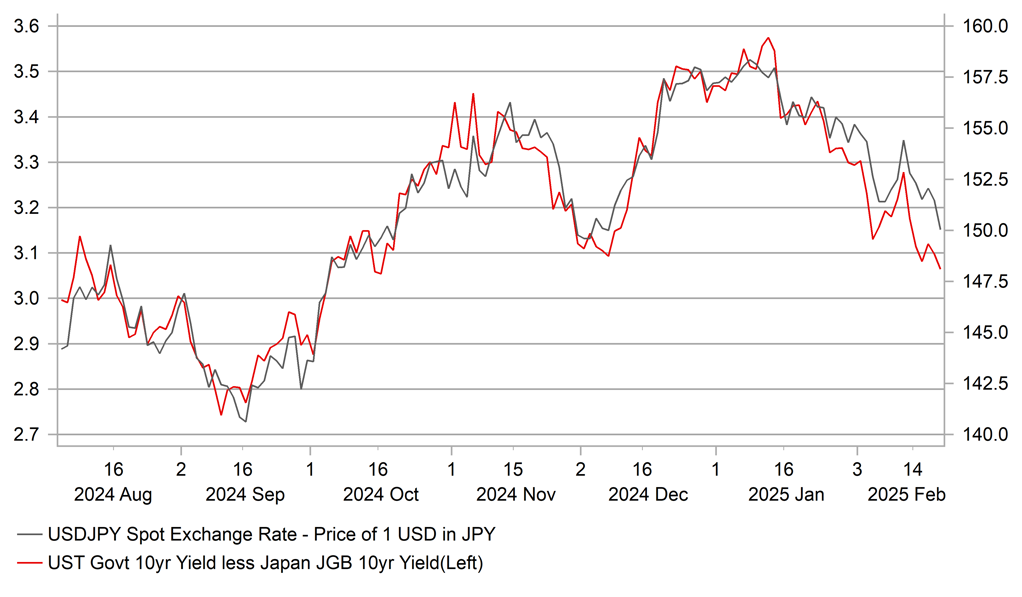

The yen has continued to outperform this week resulting in USD/JPY falling back to within touching distance of the 150.00-level overnight. The pair is moving closer to the lows from in early December when USD/JPY found support between 148.60 and 150.00. The yen has extended its position as the best performing G10 currency so far this year. It has strengthened by around 4.8% against the US dollar and by 4.0% against the euro year to date. The yen is continuing to benefit from the ongoing narrowing of yield differentials between Japan and other major economies. The yield differential between 10-year US Treasury bonds and JGBs has narrowed by around 50bps from a peak of 3.57% in mid-January to the lowest level since prior to the US election. The sell-off in the JGB market has accelerated over the past month resulting in the 10-year JGB yield rising up to a fresh high of 1.45% overnight, and it has now more than doubled over the past year. The ongoing adjustment higher for Japanese yields has been encouraged by hawkish comments from BoJ officials signalling strongly that further rate hikes will be delivered. It follows last month’s decision to raise rates for the third time in the current tightening cycle up to 0.50%. It has been reported overnight BoJ Governor Ueda held a regular meeting with Prime Minister Ishiba to exchange views on financial and economic developments. According to reports, the topic of rising yields in Japan was not discussed. The focus on the sharp rise in yields in Japan may begin to attract more attention if the current pace of pace of sell-off in the JGB market continues. It is one risk alongside the timing the Upper House election which could challenge building market expectations for the BoJ to hike rates again as soon at the July policy meeting. According to Bloomberg, there are currently around 21bps of hikes priced in by the July policy meeting and 15bps by the June meeting.

The case for further rate hikes has been supported by evidence showing that Japan’s economy expanded more strongly than expected during the 2H of last year even after the BoJ started to raise rates. GDP grew by 2.8%Q/Q in Q4 following on from growth of 1.7% in Q3. At the same time, the BoJ has become more confident that stronger wage growth will be sustained in the upcoming fiscal year helping to sustain inflation at their 2.0% target. The BoJ’s preferred measure that excludes distortions from sample changes has shown that full-time base pay was increasing by around 3.0% toward the end of last year which Governor Ueda has indicated is consistent with their inflation target. The next focus points for the BoJ and market participants will be when Rengo (the Japanese Trade Union Confederation) release the 1st tabulation results for the 2025 Shunto (spring wage negotiations) on 14th March. In advance Rengo’s summary result of wage requests is expected to be released on 6th March providing an insight into what the 1st tabulation figures may look like. Overall, the developments are supportive for our short EUR/JPY trade recommendation (click here).

NARROWING YIELD DIFFERENTIALS ARE SUPPORTVE FOR JPY

Source: Bloomberg, Macrobond & MUFG GMR

USD: Hawkish FOMC minutes fail to lift US yields and the US dollar

The US dollar index has been consolidating close to the 107.00-level overnight amidst heightened uncertainty over President Trump’s trade policy plans. Our US dollar momentum indicator still suggests that it is struggling to regain upward momentum even after fresh tariff threats from President Trump. He has threatened to impose tariffs ‘in the neighbourhood of 25%’ on imports of automobiles, semiconductors, and pharmaceuticals from early in April. The prospect of a global trade war has prompted reactions from US trading partners. EU Trade Commissioner Maroš Šefčovič, speaking at a U.S. think tank event in Washington yesterday, expressed a strong willingness to engage in negotiations aimed at reducing or possibly eliminating tariffs on various products traded with the United States. He remarked, "We are interested in doing a deal with the United States that promotes fairness, burden sharing and mutual benefit". At the same time, Šefčovič pledged to respond if Trump follows through on his threats to implement extensive tariffs: “To protect European interests, we will have no choice but to respond firmly and strictly but we do hope to avoid the scenario”.

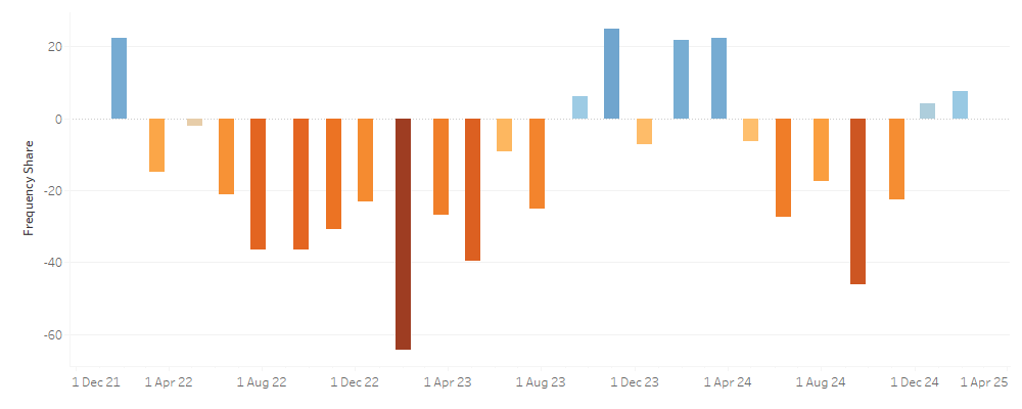

The latest Fed minutes from the January FOMC meeting were also released overnight and shed light on the Fed’s decision to hold interest rates at the previous meeting. Performing a sentiment analysis across FOMC minutes, we note a stronger shift towards positive sentiment, with the latest sentiment score reaching levels not seen since March 2024. In January, Fed officials indicated a stronger willingness to maintain stable interest rates due to persistent inflation and uncertainty in economic policies. “A majority of participants observed that the current high uncertainty made it appropriate for the Committee to take a careful approach in considering additional adjustments to the stance of monetary policy. The minutes noted elevated uncertainty around estimates of the neutral rate and President Trump’s policies. A “few” participants even expressed the view that the policy rate “may not be far above its neutral level”. However, the hawkish minutes have failed to lift US yields and provide a fresh catalyst for an even stronger US dollar.

FOMC SENTIMENT SCORE TURING MORE POSITIVE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Construction Output (MoM) |

Dec |

-- |

1.16% |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

215K |

213K |

!!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Feb |

19.4 |

44.3 |

!!! |

|

US |

14:35 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

15:00 |

US Leading Index (MoM) |

Jan |

-0.1% |

-0.1% |

!! |

|

EC |

15:00 |

Consumer Confidence |

Feb |

-14.0 |

-14.2 |

! |

|

US |

19:30 |

Fed Governor Jefferson Speaks |

-- |

-- |

-- |

! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,814B |

!! |

|

US |

22:00 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

! |

|

AU |

22:30 |

RBA Gov Bullock Speaks |

-- |

-- |

-- |

! |

|

JP |

23:30 |

National CPI (YoY) |

Jan |

-- |

3.6% |

! |

Source: Bloomberg