USD holds up after dovish Fed guidance

USD: Fed signals willingness to look through inflation impact from tariffs

The US dollar has continued to trade at modestly weaker levels following last night’s FOMC meeting. One of the biggest movers has been USD/JPY which has fallen back towards the 148.00-level after briefly rising back above the 150.00-level yesterday. The move lower in USD/JPY has been driven by the sharp adjustment lower in US yields in response to last night’s FOMC meeting. The 2-year and 10-year US Treasury yields have both fallen by around 11bps and 8bps respectively. Market participants have been encouraged to price in more Fed rate cuts. The next rate cut is now fully priced in by July (29bps) and there are around 66bps of cuts priced in total by the end of this year. The dovish market reaction has been driven by a bigger than expected downgrade to the Fed’s outlook for growth. The median projection for growth this year was revised lower by 0.4ppts to 1.7%. At the same time, the Fed raised their outlook for inflation with the median projection for the core PCE inflation in Q4 2025 revised higher by 0.3ppt to 2.8%. The combination of slower growth and higher inflation reflects the adverse impact of President Trump’s economic policies including tariffs. In the press conference, Fed Chair Powell clarified that the hit to growth in the forecasts includes the assumption of full retaliation to tariffs by US trade partners. Despite the bigger downward revision to growth, the median projection for the unemployment rate this year only increased by 0.1ppt to 4.4% suggesting that the Fed is expecting tighter immigration policies to curb labour supply growth and prevent the labour market from loosening even more than expected.

After incorporating the bigger than expected changes to the economic outlook, Fed officials decided to leave their outlook for policy largely unchanged. Fed Chair Powell reiterated that their current policy stance is “well-positioned to deal with the risks and uncertainties we face”. He believes the right thing to do is to wait here for greater clarity about the economy, and repeated guidance that “we’re not going to be in a hurry to move”. The Fed will want to see the release of details in early April of President Trump’s plans for reciprocal tariffs and tariffs on sectors such as autos, semi-conductors and pharmaceuticals before having more clarity on the economic and policy outlook. However, the Fed is still signalling that it has a dovish bias to lower rates further despite the higher inflation forecasts for this year suggesting it is willing to look through a short-term pick-up in inflation. Chair Powell stated that the Fed’s base case is for the tariff lift to inflation to be a one-off as evident by the inflation forecasts for 2026 and 2027 remaining unchanged. He has been reassured recently that longer-run measures on inflation expectations that the Fed regards as the most important “haven’t moved much”. He did emphasize though that the Fed’s willingness to look through higher inflation from tariffs is conditional on inflation expectations remaining anchored. As a result, the median projection for the number of rate cuts for this year remained at 50bps and for a further 50bps for next year. The Fed is waiting to see evidence that the labour market is loosening to justify cutting rates further.

At the same time, the Fed announced that they have decided to slow down the pace of QT so that they can run the program for longer. The Fed has lowered the monthly cap on the Treasury run off from USD25 billion to USD5 billion while the monthly cap on MBS run off remains unchanged at USD35 billion. It highlights that the Fed still has a “really strong desire” to roll off MBS from their balance sheet. Overall, the Fed’s dovish policy reaction function to the impact of tariffs is a negative development for the US dollar. The lack of follow through US dollar selling overnight perhaps is more an indication that it has already weakened sharply recently to better reflect expectations for more active Fed easing as US growth has slowed at the start of this year.

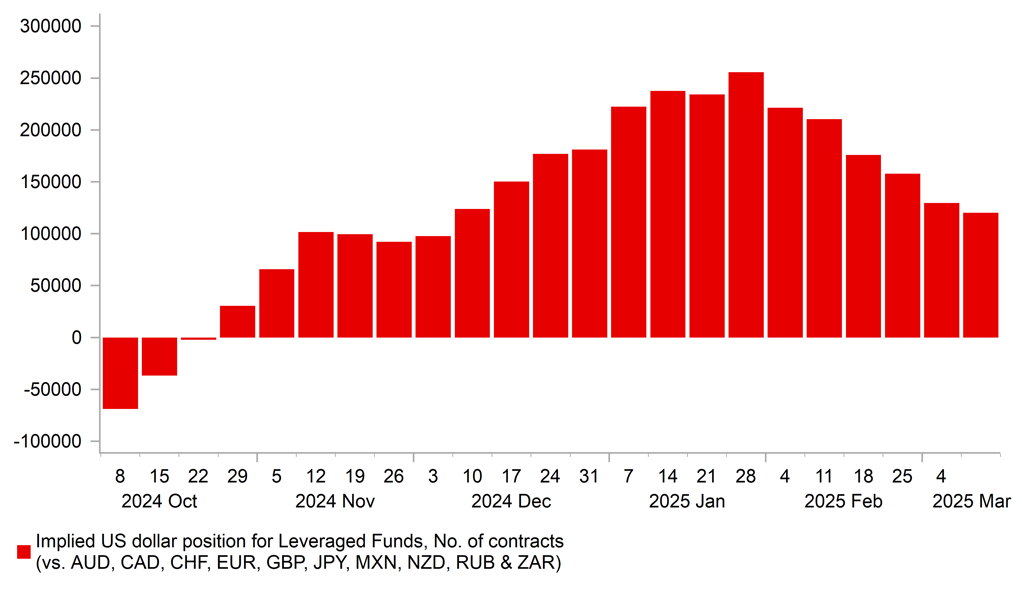

USD LONGS HAVE BEEN SCALED BACK

Source: Bloomberg, Macrobond & MUFG GMR

GBP: BoE to leave door open to cut in May but risk of less dovish signal

The pound has outperformed alongside other European currencies this month benefitting from the significant improvement in investor sentiment towards the region. It has helped to lift cable back up above the 1.3000-level for the first time since last year’s US election. In contrast, the pound has weakened modestly against the euro lifting EUR/GBP back above the 0.8400-level for the second time this year. The euro is expected to benefit more than the pound from Germany’s plans for looser fiscal policy (click here).

Market participants now expect monetary policies between the ECB and BoE to diverge less going forward which has helped to narrow yield spreads in favour of a stronger euro. At the ECB’s last policy meeting (click here) they left the door open for further modest rate cuts with the policy rate now closer to the neutral estimate put forward by President Lagarde between 1.75% and 2.25%. Based on our assumption that legislation is passed tomorrow to boost fiscal policy in Germany, it will ease pressure on the ECB to lower rates below neutral. The main risk to that view would be a much bigger hit to growth in Europe from President Trump’s upcoming plans for trade tariffs in early April. The UK economy is still expected to be less negatively impacted by tariffs than major euro-zone economies boosting the relative appeal of the pound.

Market attention will now shift to the BoE’s updated outlook for policy today. Ahead of today’s MPC meeting, the UK rate market is still expecting the BoE to stick to the current quarterly pace of rate cuts by delivering the next rate cut in May (19bps of cuts priced in) but there is less confidence over a further rate cut in August (37bps of cuts priced in). It is helping to keep yields in the UK at higher levels than on offer in other major economies providing support for the pound. Ahead of today’s MPC meeting, UK economic data has been improving with the exception of Friday’s softer UK GDP report for January. Overall it points to strengthening growth momentum since late year. At the same time the slowdown in services inflation and wage growth remains frustratingly slow. It was revealed this morning that private sector wage growth excluding bonuses remained strong at 6.1% 3Mth/YoY in January. It will become even more uncomfortable for the BoE to keep cutting rates heading into the summer when inflation is expected to temporarily pick up towards 4.0%. Overall, we still believe that the pound remains attractive. Please see our latest FX Weekly (click here) for more details.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:30 |

SNB Interest Rate Decision |

Q1 |

0.25% |

0.50% |

!!! |

|

SZ |

09:00 |

SNB Press Conference |

-- |

-- |

-- |

!!! |

|

EC |

09:00 |

ECB Economic Bulletin |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Construction Output (MoM) |

Jan |

-- |

0.00% |

! |

|

EC |

10:00 |

EU Leaders Summit |

-- |

-- |

-- |

!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Mar |

-30 |

-28 |

!! |

|

GE |

11:00 |

German Buba Monthly Report |

-- |

-- |

-- |

! |

|

EC |

11:00 |

ECB Economic Bulletin |

-- |

-- |

-- |

!! |

|

UK |

12:00 |

BOE Inflation Letter |

-- |

-- |

-- |

!!! |

|

UK |

12:00 |

BoE Interest Rate Decision |

Mar |

4.50% |

4.50% |

!!! |

|

EC |

12:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

UK |

12:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:30 |

Current Account |

Q4 |

-330.0B |

-310.9B |

!! |

|

US |

12:30 |

Initial Jobless Claims |

-- |

224K |

220K |

!!! |

|

US |

14:00 |

Existing Home Sales |

Feb |

3.95M |

4.08M |

!!! |

|

CA |

16:50 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

JP |

23:30 |

National CPI (YoY) |

Feb |

-- |

4.0% |

! |

Source: Bloomberg