Shortened week with US dollar vulnerable to further selling

USD: Looking set for further declines

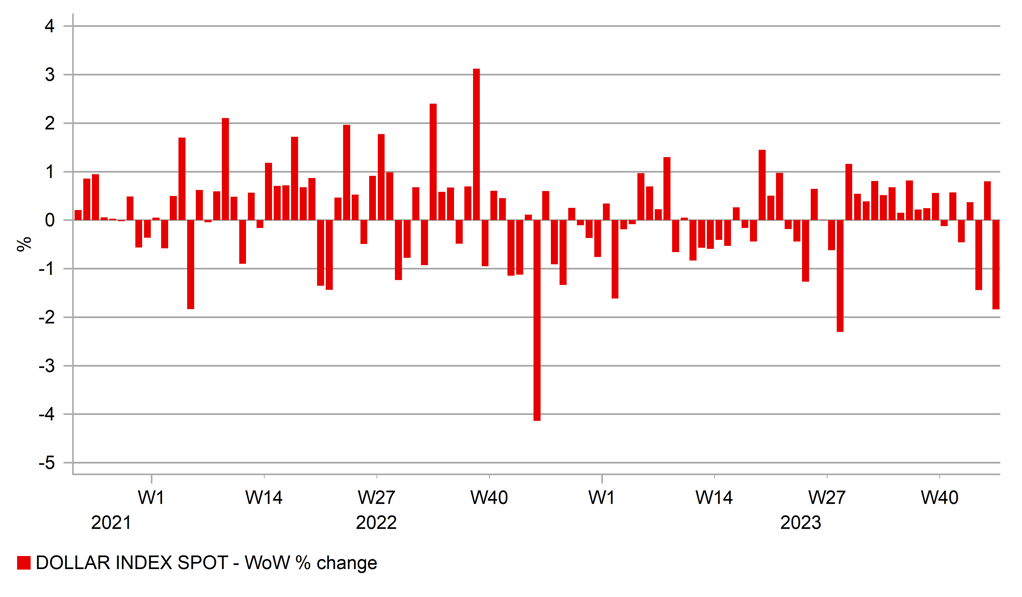

The US dollar weakened by 1.8% (DXY basis) last week, the largest drop since mid-July with the selling intensifying into the close in New York on Friday which has followed through into the start of this week. An indication that this sell-off could be more meaningful is the fact that the weakness of the dollar is more clearly evident in the dollar weakness versus the yen. USD/JPY dropped sharply this morning – by nearly 1.0% with the low earlier (148.70) the lowest since 11th October. The dollar move is broad-based with the MSCI Emerging Markets Currency Index advancing to levels not seen since the start of February.

This week the focus for market participants will be the release of the FOMC minutes tomorrow evening, the minutes from the ECB meeting and the advance PMIs across the major developed economies on Thursday. Given the price action across the financial markets is being dictated by expectations that the Fed’s tightening cycle is over, the minutes of the November FOMC meeting will by key. The meeting in which the FOMC left the key policy rate unchanged for the second consecutive meeting and third meeting in four will likely contain enough evidence to reinforce the prospect of the FOMC’s tightening cycle being complete. While the minutes will certainly emphasise that the inflation battle is not over and that further rate hikes could be required, there is also likely to be a shift in emphasis that reflects the shift in tone amongst Fed speakers and the tone of Powell at the press conference on 1st November. The dollar fell by over 1.0% in response to the November FOMC meeting. The US markets will be closed on Thursday and much of Friday for Thanksgiving.

Hence, the minutes from the ECB meeting in late October will be released into less than normal liquidity on Thursday and may serve as a reminder that it is not just the Fed that may have completed its tightening cycle. Inflation is coming down more sharply than expected and euro-zone economic conditions remain very weak. There was some good news for the euro-zone on Friday when Moody’s raised the outlook on Italy’s sovereign credit rating to stable from negative removing the risk of an imminent downgrade to below investment grade. This will be good news for Italian banks in particular at the start of trading today and should be a factor that helps provide EUR/USD with near-term support.

The US dollar remains vulnerable to further selling, certainly in the earlier part of this week both from a fundamental and technical perspective. DXY broke the 100-day moving average last week and today earlier breached the 200-day moving average.

LARGEST WEEKLY % DROP FOR USD SINCE JULY

Source: Macrobond

GBP: UK budget could see fiscal policy expansion

We have argued in recent writings that the pound could be in for a period of under-performance as the transmission of monetary tightening becomes more and more evident providing scope for the rates market to align with the monetary easing expectations priced for the US and the euro-zone. That under-performance was apparent last week – in a week of sharp depreciation of the dollar, GBP/USD hit a high on Tuesday after the US CPI but failed to advance further after correcting lower on Wednesday. This is in contrast to new highs for EUR/USD on Thursday and Friday. This was reflected in the steady rise in EUR/GBP to hit a high on Thursday not seen since early May.

The UK will be in focus this week with the Autumn Statement by Chancellor Hunt on Wednesday (no official time has been announced yet but it usually takes place at around 12:30 GMT) and over the weekend speculation intensified that Chancellor Hunt may be in a position to loosen the fiscal stance more than expected. The government received the Office of Budget Responsibility (OBR) projections on Friday and it is possible that falling inflation and a better fiscal position will open up scope for more voter-pleasing tax cuts. The Sunday Times reported the fiscal “headroom” for the Chancellor had increased notably from the GBP 6.5bn in March to around GBP 25bn now. This could mean tax cuts for low and middle income earners are part of the Autumn Statement on Wednesday. The Chancellor could save money through using the October inflation reading (4.6%) rather than September (6.7%) to adjust benefit payments. This would be more acceptable if taxes are lowered for low income households than say a cut to inheritance tax which had been reported as a possibility. That plan could now be parked until the Spring Statement update.

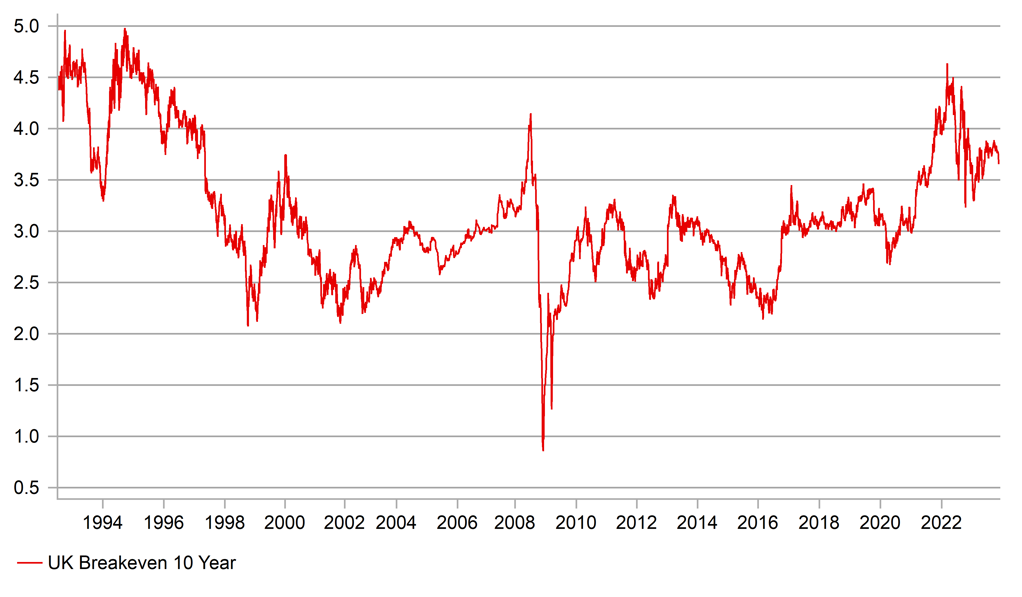

For the financial markets the reaction will be dictated by how balanced any approach is to fiscal expansion. As many will recall, the unbalanced approach to fiscal stimulus by the Liz Truss government ended in disaster with both Gilts and GBP plunging. Of course we will not get anything like that and Chancellor Hunt and PM Sunak do have some credibility with the markets and assuming any tax giveaway is not significantly larger than expected, the Gilt market reaction should be contained.

Better growth projections due to tax cuts are unlikely to be dramatic and the consequences for inflation limited. However, inflation expectations are not as anchored as before and hence there are greater risks of a negative Gilt market reaction. Assuming Chancellor Hunt gets the balance correct, we could see some modest GBP out-performance in the immediate aftermath. However, we doubt it will alter the outlook enough to have any meaningful implications for our more bearish GBP outlook.

UK 10YR BREAKEVEN RATE REMAINS HISTORICALLY HIGH – A BALANCED AUTUMN BUDGET STATEMENT IS REQUIRED

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Construction Output (MoM) |

Sep |

-- |

-1.06% |

! |

|

US |

15:00 |

US Leading Index (MoM) |

Oct |

-0.7% |

-0.7% |

!! |

|

UK |

18:45 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg