Powell signals increased Fed caution prompting USD selling

USD: Powell emphasises need for caution

The communication from Fed Chair Powell through his speech to the Economic Club for New York yesterday certainly gave the impression of a shifting stance within the FOMC triggered by the most recent surge in UST bond yields. We had the obligatory reference to inflation being still too high and that further declines were required and that the path down would be “bumpy”. Nobody expected any victory parade on defeating inflation in Powell’s speech yesterday, but the speech certainly provided more emphasis than in the past on the risks emanating from the tightening already implemented by the Fed. That increased caution first and foremost would have been shaped by the surge in yields and secondly by the recent upturn in geopolitical uncertainties after the Hamas attack on Israel and Israel’s response now unfolding.

Powell was most clear in his view that yields have driven “significant tighter financial conditions” and those financial conditions can affect monetary policy decisions “if persistent”. There was also a hint that as of right now, the FOMC are content with the stance with Powell stating that “additional evidence” of economic strength “may require additional monetary tightening”. So the bar has been set as of now and if the economy continues to indicate strength, we may see a further hike. That you would assume certainly rules out November as it is too close to hike based on today’s comments. December is certainly still in play but we doubt the same degree of economic strength will persist until then. In addition Powell accepted that there was still “meaningful tightening in the pipeline from past hikes” which if correct adds to the chances that by December the impact of Fed tightening will be clearer.

The prospect of a slowdown certainly seems to be the view of Powell based on his comments yesterday. He stated that “many indicators” suggest that the jobs market is cooling. There was also a reference to the strong GDP growth likely in Q3 to be followed by weaker GDP growth in Q4 and into next year.

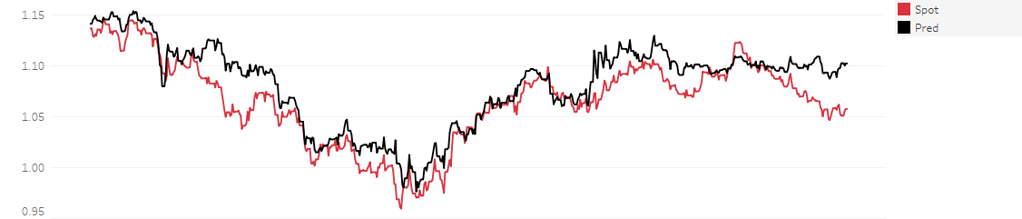

The financial market reaction has been more notable in FX than in rates. The 10-year UST bond yield still finished higher on the day at 4.99% while the 2-year yield dropped 6bps but remains close to the cyclical high. The correlation with FX has been a little weaker of late and EUR/USD did break higher through a downward sloping trend-channel from the high back in July. There is a risk aversion look to G10 performance with CHF, EUR and JPY the top three performing G10 currencies this week. While we think it is premature to call an end to the dollar strength, the price action this week certainly gives us more confidence in our view the scope for dollar appreciation is relatively limited from here with the window set to close once we see further evidence of the cooling jobs market that was referred to yesterday by Powell. Geopolitical risks, and an escalation of the Israel / Hamas conflict that lifts crude oil prices and then the dollar remains the biggest dollar upside risk.

MUFG SHORT-TERM EUR/USD VALUATION IMPLIES SPOT UNDERSHOOT

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Weaker consumer to weigh on the pound

The New Zealand dollar is the worst performing G10 currency so far today but GBP is close behind after data released today underlined the risks of a renewed period of economic contraction in the UK. Retail sales including fuel fell 0.9% m/m in September (ex-fuel -1.0% m/m) which was over twice the drop the market expected. Non-food retail sales fell by a larger 1.9% in September with the ONS citing cost of living pressures and unseasonably warm weather that hit seasonal clothing sales. The inflation impact on the volume of retail sales has been clear. The ONS highlighted the huge divergence between volumes and values of retail sales with the value of sales up 17.1% from pre-pandemic levels while the volume of sales have dropped by 2.5%. The outlook on the consumer side remains fragile and while unseasonably warm weather may be playing a part in weak consumer spending, data earlier today pointed to continued weak consumer confidence as well. The GfK Consumer Confidence Index dropped 9pts to -30 – that was the largest one-month decline since the initial period after the pandemic hit in 2020.

Retail sales now means consumer spending will be a bigger drag on real GDP growth in Q3. The data today confirmed that retail sales dropped 0.8% in the three months to September from the previous three months. Before today’s data, the consensus for Q/Q Q3 real GDP growth was unchanged. A contraction is now a greater prospect.

The UK rates market continues to slowly remove the extent of monetary tightening priced into the OIS market. There remains little priced for November and now only about 9bps for the December meeting. BoE Governor Bailey has just had comments from an interview with the Belfast Telegraph published and he has expressed confidence in a “marked fall inflation” ahead and wasn’t surprised by the stickiness in the CPI data reported this week.

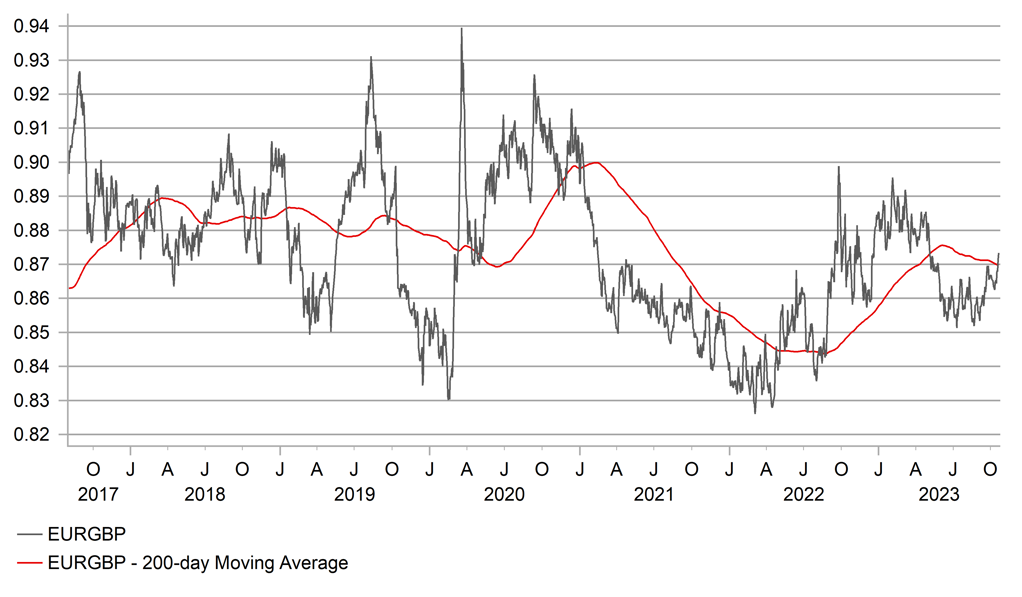

The signs of resilience in EUR/USD of late suggests to us that GBP underperformance may be more evident in a continued move higher in EUR/GBP. Yesterday, EUR/GBP broke through its 200-day moving average and is further higher today suggesting further scope to the upside. The last time EUR/GBP broke to the upside through its 200-day moving average was in August 2022 ahead of a sharp move higher in response to the Liz Truss turmoil.

EUR/GBP BREAKS THROUGH 200-DAY MOVING AVERAGE

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CH |

11:00 |

FDI |

-- |

-- |

-5.10% |

! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Aug |

-0.1% |

1.0% |

!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Aug |

-0.3% |

0.3% |

!! |

|

EC |

13:30 |

ECB McCaul Speaks |

-- |

-- |

-- |

!! |

|

US |

14:00 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

US |

17:15 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg