BoJ on hold but signals more hikes to come as inflation moves higher again

JPY: BOJ outlook little changed helping support yen

The yen is moderately stronger this morning with G10 FX moves generally modest underlined by the fact that JPY is the biggest mover, up a mere 0.3%. From the low after the FOMC announcement on Wednesday, USD/JPY advanced close to 3.5 big figures but failed to break above the 144.00-level which has led to a retracement of some of those gains. In fact USD/JPY is now close to the levels prevailing when the FOMC announcement was made.

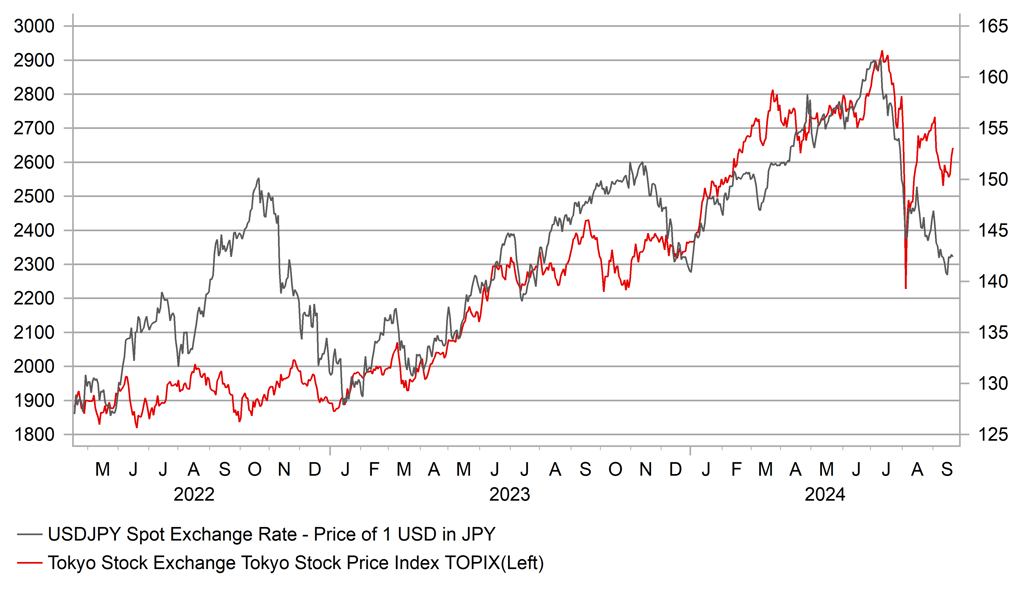

The statement from the BoJ was very telling in lacking any sign of reduced conviction over the favourable outlook ahead from when the BoJ raised the policy rate 15bps to 0.25% in July. The BoJ still now believes that the economy will continue to grow at a rate above potential as “a virtuous cycle from income to spending gradually intensifies against a backdrop of factors such as accommodative financial conditions”. Given the turmoil in the financial markets in the immediate aftermath of the rate hike when Japanese equities plunged on 5th August, the reference to “accommodative financial conditions” is a strong indication of continued confidence in the conditions being consistent with further rate hikes going forward. Governor Ueda is speaking now and has repeated the key message that the level of real rates in Japan are “very low” and that if the economy unfolds in line with forecasts then the BoJ will raise rates further. Still, given the scale of yen appreciation and the drop in Japanese equities since the last meeting Governor Ueda did acknowledge that the upside risks to inflation had receded. This was an inevitable comment and the fact that there is little shift in the overall guidance on future rate hikes to us underlines the determination of the BoJ to hike. But October certainly seems too early given Governor Ueda believes the BoJ now “has room to mull policy given the receded inflation risks”.

The inflation data released today also backed up the BoJ’s intent to raise rates further. The nationwide core CPI YoY rate accelerated from 2.7% to 2.8% in August, the fourth consecutive pick-up in the annual rate. The BoJ has argued that the inflation pressures are now building due to domestic factors that means there is a much better prospect of a sustained positive inflation rate around target going forward. The larger than expected Fed rate cut that is seen as pre-emptive and has therefore helped fuel a strong rally in US equities to new record highs increases the prospect of the BoJ taking action. We currently expect the BoJ to hike by 25bps in December.

The reduced inflation risks comment may fuel some renewed near-term yen selling. But we would argue today shows a level of determination to stay on course despite the substantial strengthening of the yen. Previously we sensed a strong view amongst clients that if the Fed was cutting aggressively then the BoJ would be reluctant to hike again. But the BoJ’s key message is unchanged and that will limit the scope for yen selling.

JPY GAINS AND EQUITY MARKET DECLINE HAVE HELPED EASE UPSIDE INFLATION RISKS

Source: Bloomberg, Macrobond & MUFG GMR

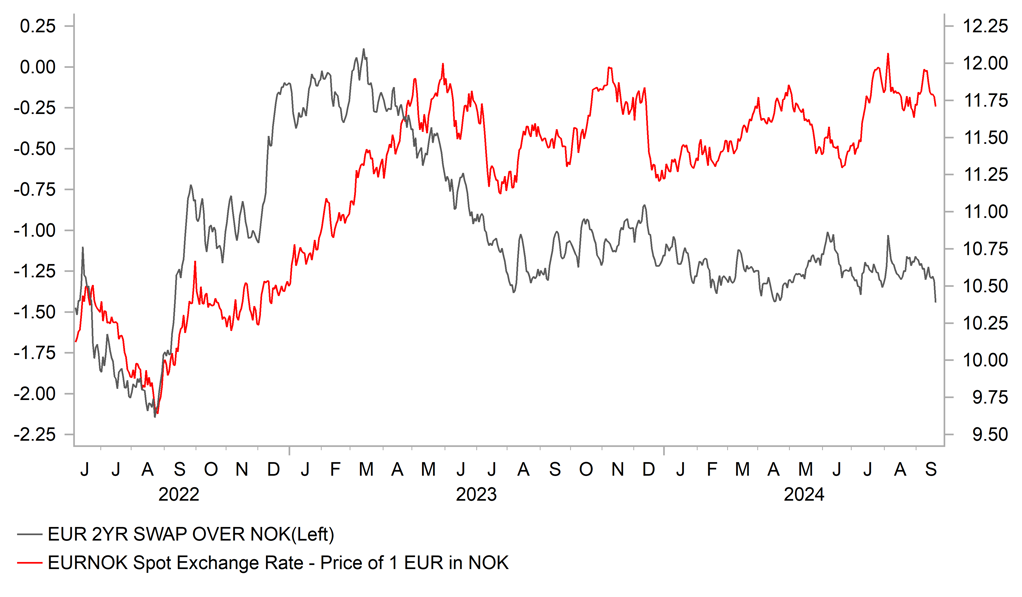

NOK: Norges bank boost for krone

The Norwegian krone was the top performing G10 currency yesterday after Norges bank kept its monetary policy stance unchanged with the policy rate at 4.50%. Prio to the meeting, the financial markets were fully priced for the first 25bp cut coming by year-end. However, the OIS market has now removed 10bps of that easing with the probability of a cut now at about 60%. Norges bank’s projections for the policy rate were tweaked lower over the forecast period out to Q4 2027 but by small amounts. The Q4 2024 projection was put at 4.49%, down just 2bps from the June projection which prompted the reappraisal of a cut by year-end.

Governor Ida Wolden Bache justified the continued caution given the Norges bank view that the recent rapid decline in inflation was not expected to continue. The underlying annual CPI rate fell to 3.2% in August, down from a peak of 7.0% in June 2023 but the pace of decline has slowed noticeably in recent months. The drop in the annual rate in July and August was just 0.1ppt. Governor Bache stated that the “there is a need to keep the policy rate at today’s level for a period ahead” but added that “the time to ease monetary policy is approaching”. Governor Bache was then more explicit in stating that the Norges bank policy rate kept at 4.50% “to the end of the year”.

Given the Fed is likely to cut by 100bps by year-end and the ECB and BoE will also cut further after already cutting, the rate spread favouring Norway should become more favourable in supporting NOK. The 2-year EZ-NO spread today widened in favour of NOK to a level not seen since September 2022 when EUR/NOK was trading at around 10.000. The spread has not been a particularly reliable driver of EUR/NOK but if Norges bank continues to be cautious in cutting rates we would expect NOK to gain traction from a spread perspective. Furthermore, if the Fed’s larger than expected rate cut this week proves successful in engineering a soft landing that too will prove supportive for high-beta G10 currencies like NOK. But given our higher EUR/USD forecast we expect more NOK appreciation versus the US dollar with a 5.5% appreciation implies in our forecast by June 2025.

EUR/NOK VERSUS 2-YEAR SWAP SPREAD – DOWNSIDE POTENTIAL BUILDING

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

10:30 |

BoE MPC Member Mann |

-- |

-- |

-- |

!!! |

|

CA |

13:15 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!!! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Jul |

0.2% |

0.3% |

!! |

|

CA |

13:30 |

IPPI (MoM) |

Aug |

-0.3% |

0.0% |

! |

|

CA |

13:30 |

IPPI (YoY) |

Aug |

-- |

2.9% |

! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Aug |

-- |

0.2% |

!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Jul |

0.5% |

-0.3% |

!! |

|

CA |

13:30 |

RMPI (YoY) |

Aug |

-- |

4.1% |

! |

|

CA |

13:30 |

RMPI (MoM) |

Aug |

-2.0% |

0.7% |

!! |

|

EC |

15:00 |

Consumer Confidence |

Sep |

-13.0 |

-13.5 |

! |

|

EC |

16:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg