Decline in US yields keeps the negative dollar momentum going

USD: Jobs revision and FOMC minutes in focus

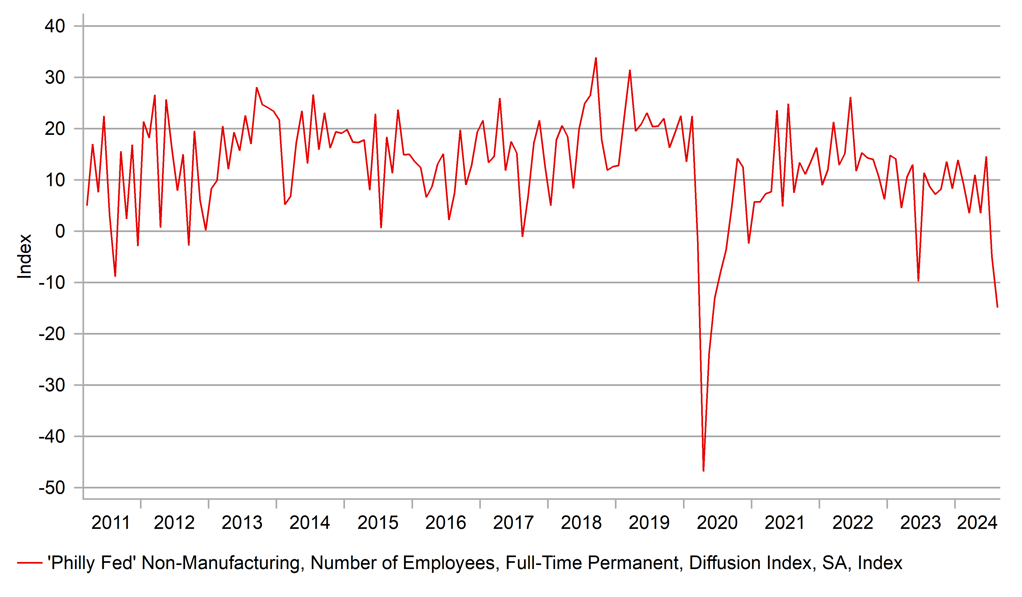

US yields were down across all tenors yesterday with a modest curve steepening at play with the 2-year yield falling more as investors looked ahead to factors that could determine market expectations of the FOMC’s action in September. It was a largely event-free day yesterday although the ‘Philly Fed’ non-manufacturing index came in weaker than expected – indeed, the drop to -25.1 in August was the lowest reading since December 2020 during covid. Excluding covid, the reading was the worst since September 2011 which followed the equity market turmoil due to the debt-ceiling crisis and the downgrade of the sovereign rating of the US. In addition, the breakdown of the data indicated the full-time employment index plunged from -4.9 to -14.6 – the 6mth average stands at +2.1, highlighting worsening labour market conditions.

The focus on the US jobs market will be elevated today by the release of the Bureau of Labor Statistics of the preliminary annual benchmark revisions for the non-farm payrolls data in the year to March 2024. In June, the BLS released the Quarterly Census of Employment and Wages that indicated the probable downward revision to the data. Each monthly NFP print is derived in part from the birth-death model that is basically a prediction of the pace of new companies started and existing companies folding. Only with more accurate tax data at a later date can the BLS provide a more accurate reading.

Today we get the initial revision to the data with the final revision in February 2025. The pattern of the data often suggests that going into a downturn when interest rates tend to be high, the failures of small and medium sized companies is underestimated and equally in economic upturns, the start-up pace of new companies can be under-estimated. The look at the recent cycle shows a benchmark downward revision of 501k in 2019 when rates were relatively high and an upward revision of 462k in 2022 when rates were still relatively low although had started to rise.

While the revisions can be substantial – there is market speculation of potentially -600k to -1mn today – it is important to remember that the Fed measures the inflation risks stemming from the labour market in many ways beyond the NFP print itself. Firstly, the unemployment rate is key and this derived from a completely different employment report. Secondly, the average hourly earnings data is a key measure of inflation risks and doesn’t change because of the NFP revision and then finally we have all of the other labour market data and separate wage data that are all assessed by the Fed.

So of course we may see some dollar selling today if this revision is bigger than expected but the Fed will be looking at the “totality” of the data (as Powell might say) and in that regard it is unlikely to alter the reaction function of the Fed and hence any initial market response is unlikely to be sustained.

‘PHILLY FED’ NON-MANUFACTURING EMPLOYMENT WORST SINCE COVID

Source: Macrobond & Bloomberg

SEK: Riksbank acts again with more to come

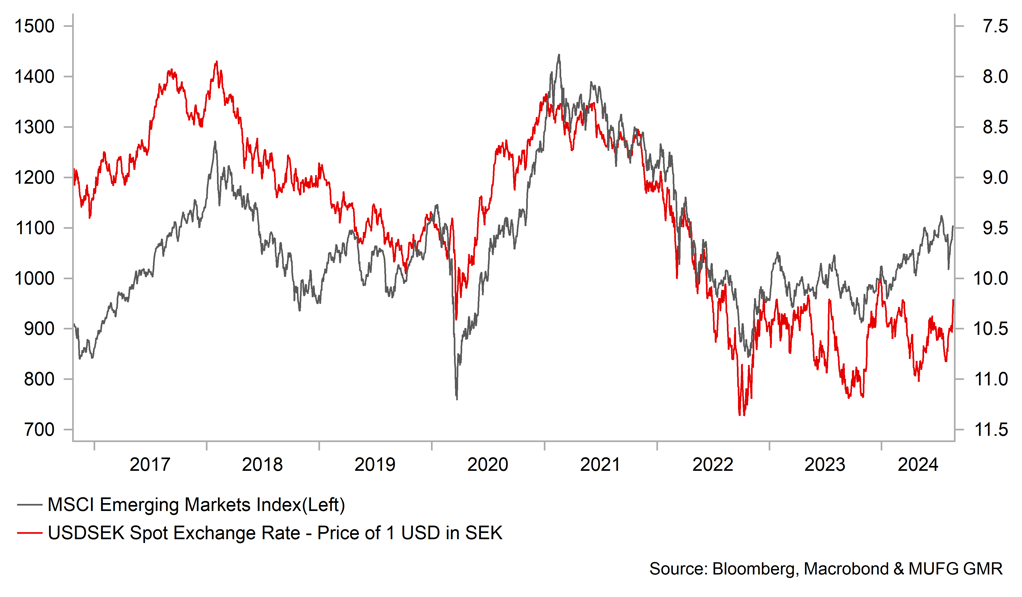

The Riksbank took the ideal opportunity yesterday to ease its monetary stance and signal to the financial markets the intention to do more than it previously had been signalling. A key variable for the Riksbank is the currency and SEK is currently the best performing G10 currency so far in August, up 4.8%. The cut yesterday was welcomed by the markets and SEK advanced notably, by 0.6% versus the euro and by 1.7% over three days. The FX performance is an example of how investors’ fears of a central bank being behind the curve in cutting rates can weigh on FX performance and equally if a central bank responds by cutting it can be currency supportive. Essentially the Riksbank signalled to the markets the intention to meet market expectations of cutting on three more occasions by year-end. The 25bp cut yesterday was the second cut meaning the Riksbank is set to lower the key policy rate by 125bps in total this year by December. With the underlying annual CPI rate (CPIF ex-energy) currently at 2.2%, this would still imply a positive real policy rate in Sweden of around 50bps. Including energy, the annual CPIF is at just 1.7%.

The danger is though that inflation keeps declining and then the Riksbank is playing catch-up to get the monetary stance in real terms to a level that is supporting economic activity. Data at the end of July signalled that the economy may have contracted in Q2 with other data showing weak consumer spending and still mixed conditions in the residential construction sector. The Swedish krona has outperformed our expectations given the much more powerful risk-on move in August after the volatile start. We will be lifting our SEK forecasts in the September Foreign Exchange Outlook although we would still expect volatility and bouts of SEK depreciation given the uncertainty over the type of landing for the US economy and whether the Riksbank’s action will be quick enough to alleviate downside growth risks in Sweden.

SEK REBOUND HELPED BY BROADER RECOVERY IN RISK APPETITE

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:30 |

German 10-Year Bund Auction |

-- |

-- |

2.430% |

!! |

|

EC |

12:00 |

ECB's Panetta speaks |

!! |

|||

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

16.8% |

! |

|

CA |

13:30 |

IPPI (MoM) |

Jul |

-0.5% |

0.0% |

! |

|

CA |

13:30 |

IPPI (YoY) |

Jul |

-- |

2.8% |

! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Jul |

0.0% |

-0.2% |

!! |

|

CA |

13:30 |

RMPI (MoM) |

Jul |

-0.9% |

-1.4% |

!! |

|

CA |

13:30 |

RMPI (YoY) |

Jul |

-- |

7.5% |

! |

|

US |

15:00 |

Payrolls Benchmark, n.s.a. |

-- |

-- |

-187.00K |

!!! |

|

US |

18:00 |

20-Year Bond Auction |

-- |

-- |

4.466% |

!! |

|

US |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

-- |

!!! |

Source: Bloomberg