USD rebounds but scale of tariff actions remains unclear

USD: Trump signals action against Mexico and Canada

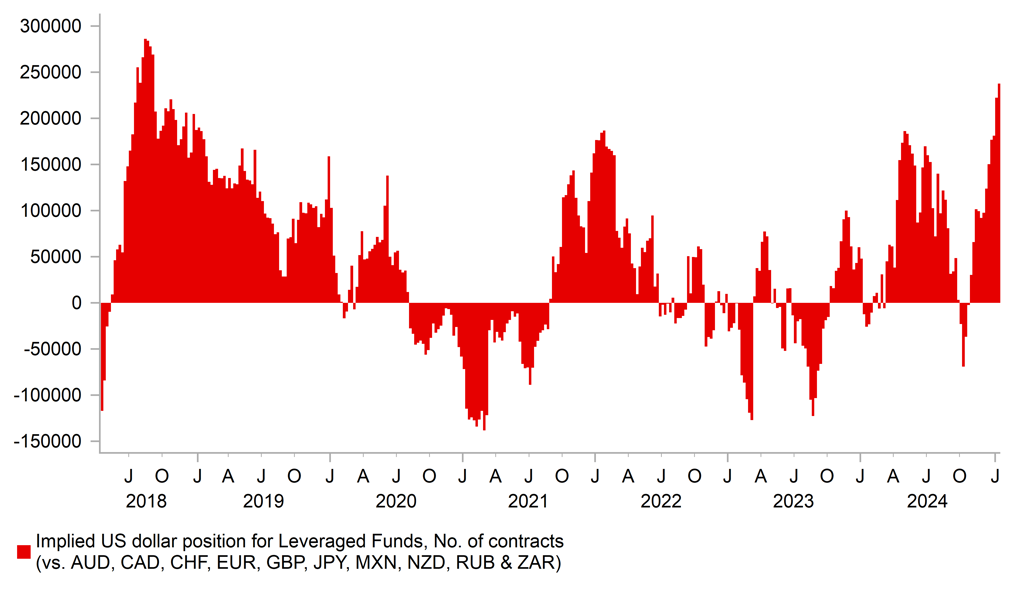

The US dollar fell close to 1.4% (DXY basis) yesterday as media reports suggested President Trump’s first day in office following his inauguration would not entail implementing trade tariffs. Given the scale of US dollar appreciation in advance of inauguration on expectations of widespread tariffs being implemented it was no surprise to see the dollar decline. CFTC positioning data has highlighted the extent of long USD positioning with Leveraged Funds increasing long dollar positions to the largest total since September 2018 when Trump was last in office.

But it would be very surprising for President Trump to have left it too long before announcing something given the explicit nature of his rhetoric suggesting action and sure enough in the Oval Office last night Trump stated his plans to implement a 25% tariff on Canada and Mexico, possibly effective 1st February. Trump cited “the vast numbers of people” being allowed to cross the borders as reason for the action. He threatened Mexico with widespread tariffs in his first term in office for the same reason but a deal was quickly done and the tariffs were never implemented. There will be many hoping that like then, a deal will be quickly done with Canada and Mexico in order to avoid the implementation of a 25% tariff on all imports to the US.

Such action would have a considerable economic impact on not just Canada and Mexico but on the US as well. 28% of total merchandise US imports came from Canada and Mexico and would therefore have a notable impact on lifting inflation in the US quite quickly. Canada sends between 75% and 80% of its exports to the US and in GDP terms US exports account for over 20% of Canada’s GDP. Over 80% of Mexico’s exports head to the US but accounts for a smaller 7% of GDP. In any case, there is a big incentive for negotiations to commence quickly before these tariffs are implemented. There must be a reasonable chance these negotiations are successful in at least watering down the extent of the tariffs. Goods cross the border multiple times in intertwined supply chains that could be hugely damaging, especially for the euro and food sectors. But in the meantime there is certainly scope for both CAD and MXN to weaken further beyond the 1.0% and 1.3% drop we are witnessing today.

Trump’s inauguration speech was much more focused on immigration than it was on trade. In that sense, the focus on tariffs on Canada and Mexico makes sense. On trade, there is clearly a longer timescale for the markets to wait. As expected, Trump confirmed a review of the Phase 1 trade deal with China, but also set out plans to review the Permanent Normal Trade Relations with China, the USMCA deal, and the adoption of export controls. These reviews are scheduled to report by 1st April. Europe was also threatened with tariffs if it did not purchase more natural gas from the US.

All told, the actions taken are certainly considerably less than what could have happened and indeed what many market participants were expecting. The US dollar gains and positioning certainly suggest to us that the FX markets were expecting more too. But it is still highly likely that considerable tariff actions are coming but in what way and exactly when remain unclear. The review date of 1st April could see this become a Q2 risk although with President Trump market participants will be fully aware of the threat of a tariff announcement at any point in time. That will limit further dollar selling from here but certainly at this juncture, the risks of EUR/USD dropping below the parity level this quarter has come down somewhat.

LARGEST IMPLIED USD LONG POSITION AMONGST LEVERAGED FUNDS SINCE 2018 WHEN TRUMP WAS LAST IN OFFICE

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Wage growth stronger but labour demand stays weak

The UK employment data released this morning indicated a common mix in showing strong wage growth but signs of a weakening in labour demand. Excluding bonuses, the 3mth annual increase in wages accelerated from 5.2% to 5.6% in November, a touch stronger than expected. The ILO employment data increased 36k after a 173k gain the previous month but this data remains under serious questions related to reliability. The PAYE employment figures however, which are deemed more reliable, recorded a 47k drop in jobs with the previous month showing a 32k drop. The size of the consecutive months of decline was the largest since 2020 when the labour market was suffering widespread furloughs and job losses due to covid. Based on that data, clearly the UK jobs market is weakening and this should translate into slower wage growth ahead. There is a degree of stickiness of course that remains evident in the wage data which will be a concern to the BoE but we suspect this wage data will not deter the MPC from cutting the key policy rate at the next meeting in February.

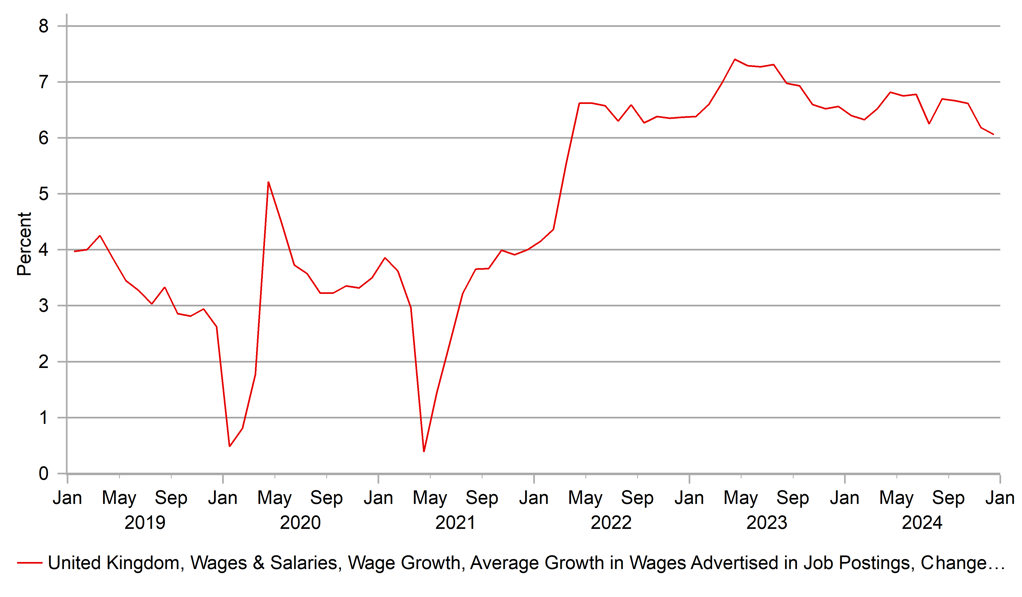

The MPC will possibly point to survey data that suggests a slowing in wage growth. The Indeed Wage Tracker has slowed to the lowest level since mid-2022 while the KPMG/REC jobs survey data shows full-time and part-time pay also slowing notably. The less aggressive than expected start to US trade tariff policies could also ease BoE concerns over the threat to global inflation and further underlines the prospect of a cut. GBP has weakened only very slightly versus EUR with a BoE cut in February nearly fully priced and given the ECB is set to ease over coming policy meetings as well.

INDEED UK WAGE TRACKER SHOWS A CONTINUED GRADUAL EASING IN WAGE GROWTH

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Current Conditions |

Jan |

-93.1 |

-93.1 |

!! |

|

GE |

10:00 |

German ZEW Economic Sentiment |

Jan |

15.2 |

15.7 |

!! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Jan |

16.9 |

17.0 |

!! |

|

EC |

11:00 |

ECB's Centeno speaks |

!! |

|||

|

CA |

13:30 |

Common CPI (YoY) |

Dec |

1.9% |

2.0% |

! |

|

CA |

13:30 |

CPI (MoM) |

Dec |

-0.7% |

0.0% |

!!! |

|

CA |

13:30 |

CPI (YoY) |

Dec |

1.8% |

1.9% |

!!! |

|

CA |

13:30 |

Median CPI (YoY) |

Dec |

2.5% |

2.6% |

!!! |

|

CA |

13:30 |

Trimmed CPI (YoY) |

Dec |

2.5% |

2.7% |

!!! |

Source: Bloomberg